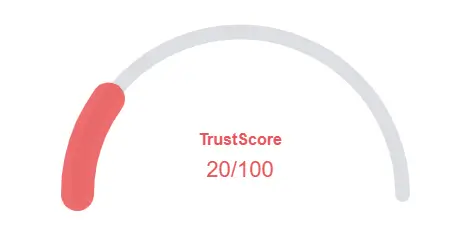

This IconX review highlights significant risks, including anonymous ownership, ties to past scams, and unsustainable 1,929% annual returns. Compared to real estate (8-12%), bank savings (4-5%), or crypto staking (4-15%), IconX’s claims are unrealistic. Investors should avoid this platform and prioritize regulated alternatives. Conduct thorough research before investing.

Disclaimer: This IconX review is for informational purposes only. Always perform your own research (DYOR) and consult financial advisors. Cryptocurrency investments carry high risks, and losses may occur.