This I3Q review examines the legitimacy of i3q.com, an AI-driven trading platform promising high returns. Scams Radar analyze ownership, compensation plans, traffic trends, public perception, security, payment methods, customer support, technical performance, and ROI claims. Using clear language, charts, and bullet points, we highlight risks for investors.

The platform I3Q markets itself as an AI-powered trading system using quantum analytics to deliver up to 25% monthly returns. However, multiple concerns suggest it may not be a safe investment. This I3Q (https://i3q.com/) review dives into key aspects to uncover potential risks.

The platform claims operations in London, Arkansas, Gibraltar, and Hong Kong. Investigations reveal these are virtual office addresses, not physical offices. For example, the London address at the Leadenhall Building shows no record of “I3Q LTD.” The Arkansas address links to a real estate fund, SFR3-020 LLC, not I3Q. The company is registered as “I3Q GLOBAL LLC” in Arkansas (filed oddly on December 25, 2024) and “I3Q LTD” in the UK. No regulatory licenses from the FCA or SEC are evident, and no founder or leadership details are disclosed.

Red Flags:

Ownership Concern Chart

Aspect | Details | Risk Level |

Address Verification | Virtual offices, no physical presence | High |

Regulatory Licensing | No FCA/SEC registration | High |

Management Transparency | No founder details | High |

The compensation structure offers a 5% commission on profits from referred users, resembling multi-level marketing (MLM). Influencers, especially in Latin America, promote “funded accounts” claiming 25% monthly returns. This focuses on recruitment over trading, a common Ponzi scheme trait. There’s no clear explanation of how profits are generated or distributed.

Key Features:

Red Flags:

Compensation Structure Graph

Month | Payout Needed | New Investors Required |

1 | $30,000 (25% return + 5% commission) | 30 |

6 | $2.19M | 2,187 |

This exponential growth is unsustainable, as new investor pools dwindle.

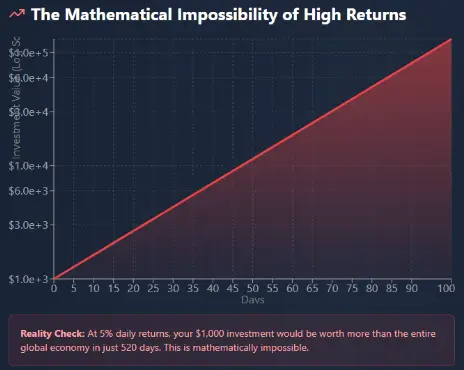

The platform promises 25% monthly returns, equating to 1465% annually. This is mathematically unsustainable:

Calculation:

( (1 + 0.25)^{12} – 1 \approx 1465% )

For 100 investors with $1,000 each, $30,000 is needed monthly (returns + commissions). By month 6, ~7,290 new investors are required, an impossible growth rate.

Comparisons:

ROI Comparison Chart

Investment Type | Annual Return | Risk Level |

i3q.com | 1465% | Extreme |

Real Estate | 8–12% | Low |

Bank Savings | 5–7% | Very Low |

Crypto Staking | 5–15% | Moderate |

Traffic data from tools like SimilarWeb shows moderate visits, mainly from Latin America, driven by influencer promotions. The domain, registered in 2003, was recently repurposed for AI trading, raising questions about its history. Public perception is negative, with Reddit threads (e.g., u/DannydeHek) and ScamMinder labeling it a potential scam due to fake trades and unresponsive support. Some positive user claims lack evidence.

Red Flags:

The site uses an SSL certificate from Google Trust Services and Cloudflare hosting, ensuring basic security. However, there’s no information on fund storage or compliance with FDIC/SIPC standards. Reports of trades using delayed data (e.g., outdated Tesla prices) suggest manipulation, not real-time AI trading.

Red Flags:

Payment methods are not disclosed, and users report withdrawal issues. Customer support is limited to a generic email (support@i3q.com), with no phone or live chat. Responses are often vague, unlike regulated platforms like IQ Option, which offer robust support.

Red Flags:

Spanish-speaking YouTubers promote the platform, often showcasing unverified “funded accounts.” Some previously endorsed dubious platforms like QubiQuant Infinity. Reddit and X show minimal credible promotion, with warnings dominating discussions.

This I3Q review finds significant risks, suggesting a Ponzi-like structure. Investors should:

Future Outlook: The platform may face collapse by mid-2026 if new investor inflows slow, as seen in similar schemes.

This I3Q review is for informational purposes only, not financial advice. Conduct your own research, verify regulatory compliance, and consult financial advisors before investing. High-return platforms carry significant risks, and you may lose your entire investment.

The answers to frequently asked questions about the validity I3Q Networks report can be found here. To address your concerns, we have provided the following questions and answers:

i3q.com is an AI-driven trading platform claiming to use quantum analytics for up to 25% monthly returns. It offers automated trading but lacks transparency on profit generation, raising concerns about legitimacy.

This platform shows red flags like unverifiable addresses, no regulatory licenses, and an MLM-like referral system. Investors should approach with caution and verify claims independently.

An I3Q review reveals risks including unsustainable 25% monthly returns, manipulated trade data, unresponsive support, and lack of regulatory oversight, suggesting a potential Ponzi scheme.

The platform offers a 5% commission on referred users’ profits, resembling multi-level marketing. This focus on recruitment over trading raises concerns about sustainability.

Regulated platforms like IQ Option or 3iQ offer transparent crypto and stock trading with lower risks, providing 5–15% annual returns compared to i3q.com’s unrealistic claims.

Title: I3Q – Intelligence Trading & Quantum Analytic

There are no reviews yet. Be the first one to write one.