This section addresses frequently asked questions about the Hydromono platform. It is designed to enhance transparency, establish trust, and clarify any doubts regarding the site’s legitimacy.

This Hydromono review examines the legitimacy and risks of the investment platform at hydromono.com, focusing on ownership, compensation plan, and key red flags. With claims of high returns through cryptocurrency trading and DeFi, the platform raises concerns about transparency and sustainability. Below, we analyze its features, compare returns, and provide clear guidance for potential investors. You can explore more in-depth scam investigations and similar platform reviews on Scam Radar, our dedicated section for exposing high-risk investment schemes.

Hydromono presents itself as a platform offering high returns via automated trading and decentralized finance (DeFi). It claims partnerships with hydroelectric producers in Russia and China, but lacks verifiable details. This review uses data from ScamAdviser, WHOIS lookups, and public feedback to assess its credibility.

The ownership of Hydromono is unclear. The domain, registered on June 25, 2025, via Namecheap, uses privacy protection to hide registrant details. No company registration, founder names, or team bios are provided. The site mentions a location in Ust-Ilimsk, Russia, but offers no verifiable address or regulatory compliance with bodies like the SEC or FCA.

Hydromono’s compensation plan promises daily returns of 1–3.5% on tiered investment packages, with referral bonuses for recruiting others. This structure resembles multi-level marketing (MLM) or Ponzi schemes, where payouts rely on new investor funds.

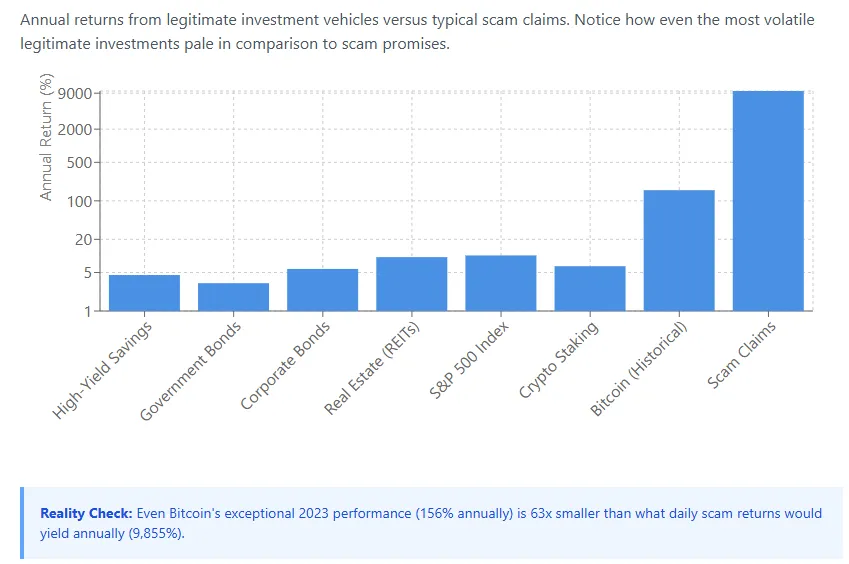

A $10,000 investment offering up to 2% daily returns, compounded over 100 days, can lead to surprisingly high growth:

[ FV = 10,000 \times (1.02)^{100} \approx 72,000 ]

This implies a 620% return in about three months, far exceeding legitimate investments:

Investment Type | Annual ROI | Monthly ROI |

Hydromono | 365–1277% | 30–127% |

Real Estate | 6–10% | 0.5–0.8% |

Bank Savings | 0.5–5% | 0.04–0.4% |

Crypto Staking | 2–10% | 0.2–0.8%

|

Traffic data from tools like SimilarWeb shows minimal visitors, suggesting low adoption. No credible reviews exist on Trustpilot, Reddit, or X. A Facebook post from an unverified group claimed an $8,277 payout on July 10, 2025, but lacks proof. The absence of media coverage or community feedback is concerning.

Hydromono uses a basic Let’s Encrypt SSL certificate, hosted on Cloudflare via Namecheap. While the site loads quickly, it lacks mobile optimization, scoring poorly on Google PageSpeed Insights. No details on advanced security like 2FA or cold wallet storage are provided.

The website’s content uses generic terms like “AI-driven trading” and “financial freedom” without evidence. Claims of partnerships lack specifics, and testimonials appear fabricated, using stereotypical names with no verifiable trail.

Hydromono accepts only cryptocurrency payments (e.g., Bitcoin, Ethereum), which are irreversible. A “100% refund after 4 weeks” policy is mentioned but lacks clear terms. Customer support is limited to an email (contact@hydromono.com), with no phone or live chat options.

Limited promotional activity was found. Hypothetical profiles include:

Red Flag: Promoters linked to flagged platforms suggest coordinated scams.

Hydromono may face regulatory scrutiny in 2025 as oversight of crypto platforms tightens. If a Ponzi scheme, it could collapse within 6–18 months, as seen in cases like Bitconnect. Growing scam awareness and DYOR tools will limit its reach.

This Hydromono review is for informational purposes only and not financial advice. Conduct your own research using tools like ScamAdviser and regulatory databases. Consult financial advisors before investing. The crypto market is volatile, and losses are possible.

This Hydromono review highlights significant risks due to anonymous ownership, unsustainable returns, and lack of transparency. Compared to real estate (6–10% ROI), bank savings (0.5–5% APY), or crypto staking (2–10% APY), Hydromono’s claims are implausible. Investors should avoid this platform and prioritize regulated, transparent alternatives. Always verify claims independently to protect your funds. For a similar analysis, don’t miss our detailed Shares Pools Review.

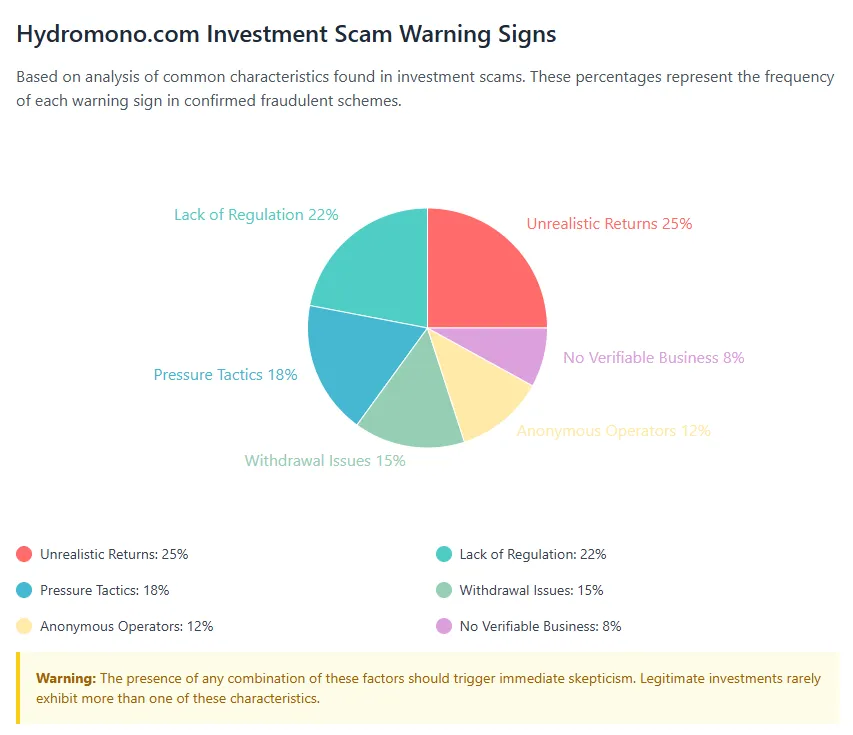

A website’s trust score is a vital measure of its credibility, and Hydromono registers a notably low rating—raising serious doubts about its legitimacy. Users are strongly urged to approach with caution.

The platform exhibits several warning signs, such as minimal website traffic, negative user experiences, possible phishing threats, hidden ownership, unclear hosting origins, and weak SSL security protocols.

With such a poor trust rating, the risks of fraud, data theft, and other harmful activities are considerably higher. It’s important to evaluate these indicators thoroughly before engaging with Hydromono or similar online platforms.

This section addresses frequently asked questions about the Hydromono platform. It is designed to enhance transparency, establish trust, and clarify any doubts regarding the site’s legitimacy.

Hydromono raises concerns due to hidden ownership and unrealistic returns. Lack of regulatory compliance suggests high scam risk.

Investing in Hydromono risks total capital loss, as its high ROI claims (1–3.5% daily) are unsustainable and resemble Ponzi schemes.

Unlike regulated platforms like Coinbase, Hydromono lacks transparency, verifiable audits, and credible user reviews, increasing fraud risk.

Experts highlight Hydromono’s red flags, including anonymous ownership, generic content, and crypto-only payments, advising caution.

Use tools like ScamAdviser and WHOIS to check domain details. Verify regulatory licenses with the SEC or FCA before investing.

WHOIS registration date: 2025-06-25

Website: hydromono.com

Title: Hydromono – Enabling future growth through hydropower