Honeygain Review: Is This Passive Income App Worth Your Time in 2025?

Honeygain promises easy money by sharing your unused internet bandwidth. That’s why we’ve created this Honeygain review on Scams Radar to evaluate its legitimacy, earnings, and risks. Honeygain (honeygain.com) claims to provide passive income opportunities, but questions about ownership, compensation plans, and sustainability remain. In this review, we explore its payment structure, security measures, and public perception, supported by clear charts and bullet points to help you decide whether Honeygain is truly worth trying.

Table of Contents

What Is Honeygain? A Quick Overview

Honeygain is an app that lets users earn money by sharing their internet connection. Businesses use this bandwidth for tasks like market research or ad verification. Operated by Honeygain UAB, a registered company in Lithuania, it has paid users since 2019. But is Honeygain legit and safe to use? Let’s dive in.

Honeygain Ownership and Background

Honeygain operates under Honeygain UAB, a company registered in Lithuania (company code 306103177, address: Antakalnio g. 17, Vilnius). Established in 2018 and publicly launched in 2020, it partners with Oxylabs, a major proxy service provider. However, details about the leadership team, including CEO Kaiden Holmes, are scarce, raising transparency concerns.

- Key Facts:

- Registered in Lithuania, under EU jurisdiction.

- Member of Amtso (Anti-Malware Testing Standards Organization) in 2025.

- Limited public info on ownership or executives.

- Registered in Lithuania, under EU jurisdiction.

Concern: The lack of clear leadership details may worry users seeking accountability.

Honeygain Compensation Plan Explained

Honeygain offers multiple ways to earn, but earnings vary by location and demand. Below is a breakdown of the earning methods:

Earning Method | Rate | Notes |

Default Network Sharing | $0.003 per 10 MB ($1 per 10 GB) | Depends on client demand and location. |

Content Delivery | $0.006 per hour | Limited to specific regions and devices. |

Referral Program | $5 per referral + 10% of their earnings | Referred user must reach $20 payout threshold. |

Lucky Pot | Up to $10 daily | Sweepstakes, requires daily engagement. |

JumpTask Mode | 10% earnings boost | Instant crypto payouts, no minimum threshold. |

How to Increase Honeygain Earnings Faster

- Use multiple devices (up to 10, one per IP).

- Enable Content Delivery in high-demand regions.

- Share referral codes to earn bonuses.

Payout Details

- Minimum Payout: $20 via PayPal (fees: $1 + 2%, capped at $2 for U.S., $21 for others).

- Crypto Option: JumpTask (JMPT) offers instant payouts with no minimum, but Bitcoin payments are paused.

- Processing Time: PayPal takes 2-3 days; JumpTask is faster but involves crypto volatility.

Concern: The $20 threshold can take months to reach in low-demand areas, delaying payouts.

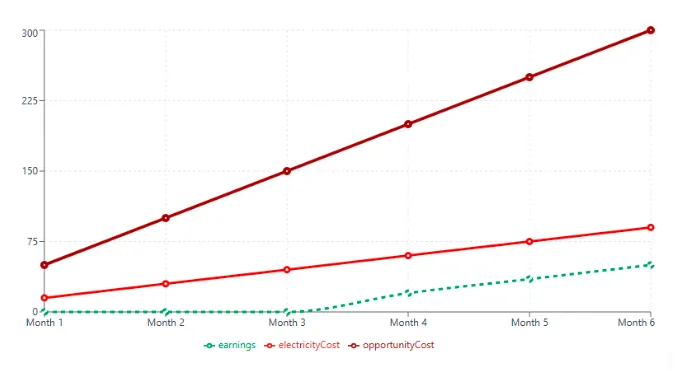

Earnings and ROI: The Math

Honeygain claims users can earn up to $55/month with three devices sharing 6 GB daily and 3 hours of Content Delivery. Let’s verify:

- Default Sharing: 6 GB/day = 180 GB/month. At $1 per 10 GB, that’s $18/month.

- Content Delivery: 3 hours/day = 90 hours/month. At $0.006/hour, that’s $0.54/month.

- Total: $18 + $0.54 = $18.54/month, far below $55 unless in a high-demand region.

For one device sharing 10 GB/day (300 GB/month):

- Earnings = $30/month or $360/year.

- With three devices: Up to $90/month or $1,080/year (assuming no IP overlap).

Cost Considerations

- Electricity: A PC running 24/7 (120W) at $0.10/kWh costs $8.64/month. Four PCs cost $34.56/month, often exceeding earnings.

- Data Plans: Limited plans may incur overage fees, reducing profitability.

ROI Comparison

Investment Type | Annual ROI | Risk Level |

Honeygain | -82% to 10% | High |

High-Yield Savings | 4-5% | Very Low |

Real Estate (REITs) | 8-12% | Medium |

Crypto Staking | 5-10% | High |

Honeygain Security and Privacy Concerns

Honeygain claims robust security:

- Encrypted connections for data protection.

- GDPR/CCPA compliance with minimal data collection (email, IP).

- Vetted clients for legitimate use cases.

Risks:

- IP Blacklisting: Users report more CAPTCHAs or bans from sites mistaking traffic for bots.

- Third-Party Access: Lack of transparency about client activities raises concerns.

- Proxy Misuse: Security reports note potential for proxyware abuse, though not specific to Honeygain.

Recommendation: Avoid using Honeygain on devices accessing sensitive accounts.

Public Perception and User Experience

- Trustpilot: 4.6/5 stars (21,689 reviews), praising ease but noting slow earnings.

- Sitejabber: 1.7/5 stars (18 reviews), citing account closures and low payouts.

- Reddit (r/Honeygain): Mixed feedback; earnings range from $1-$25/month.

Technical Performance

- Platforms: Windows, macOS, Linux, Android, iOS.

- Issues: Android APK requirement, battery drain on mobile, and occasional connection errors.

- Limit: One device per IP, up to 10 per account.

Customer Support and Payment Methods

- Support: Email-based Help Desk; mixed reviews on response quality.

- Payments: PayPal ($20 minimum, high fees) or JumpTask (crypto, volatile but no minimum).

Red Flags to Watch

- Anonymous leadership team.

- High payout threshold delays earnings.

- Variable earnings based on location.

- Potential IP reputation issues.

- Credit forfeiture after six months of inactivity.

Social Media and Promotions

Honeygain’s official accounts (@honeygain on Twitter/X, r/Honeygain on Reddit) promote updates and referrals. Influencers like Passive Income Geek (YouTube) and The Flying Gibbon (Medium) also push Honeygain, often alongside PacketStream, Pawns.app, and Swagbucks, raising bias concerns due to referral incentives.

Future Outlook

Competition from platforms like Pawns.app may lower earnings. Privacy regulations could tighten, impacting operations. Expansion to new markets may boost growth if transparency improves.

Honeygain Review Conclusion

This Honeygain review shows it’s a legitimate platform but not a reliable income source. Earnings are low ($1-$25/month), often offset by electricity and data costs. Privacy risks and lack of ownership transparency are concerns. For better returns, consider high-yield savings or real estate crowdfunding. If you try Honeygain, use a dedicated device, monitor costs, and set realistic expectations.

If you’re exploring alternative income platforms, check out our detailed Pawns.app Review for insights into another passive income opportunity.

DYOR Disclaimer: This analysis is for informational purposes only. Conduct your own research before using Honeygain. Verify claims, assess risks, and consult financial advisors. Visit the official site or support channels for updates.

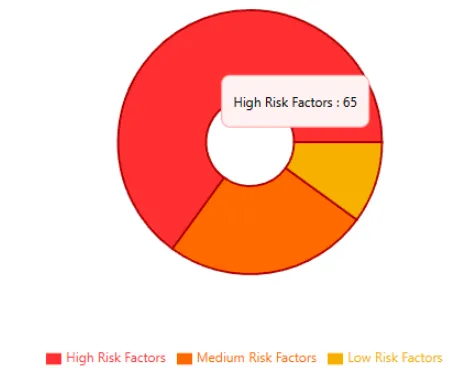

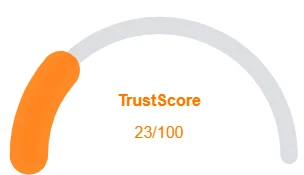

Honeygain Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Honeygain currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Honeygain similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

- Domain is well-established

- Domain ranks in the top 1M on Tranco list

Negative Highlights

- Low AI review rating

- New archive

- Whois data concealed

Frequently Asked Questions About Honeygain Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Honeygain is a passive income app that pays users for sharing unused internet bandwidth, claiming to offer easy extra money.

While Honeygain is widely used, our Honeygain Review on Scams Radar highlights concerns about data privacy, low payouts, and long-term sustainability.

Users earn credits for every MB of data shared, which can be converted into cash or gift cards. However, payout minimums and low earnings make it less attractive.

Risks include potential misuse of bandwidth, security vulnerabilities, slow earnings, and lack of clarity on how shared data is used.

Our review advises caution. While Honeygain (honeygain.com) may provide small earnings, privacy risks and low ROI make it less reliable than safer alternatives.

Other Infromation:

Website: honeygain.com

Reviews:

There are no reviews yet. Be the first one to write one.