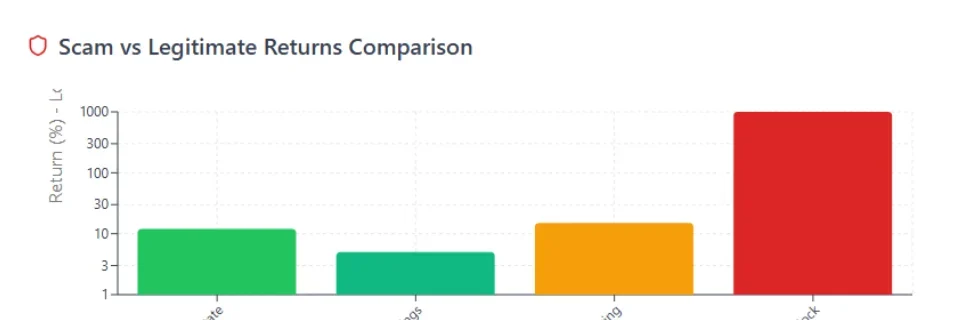

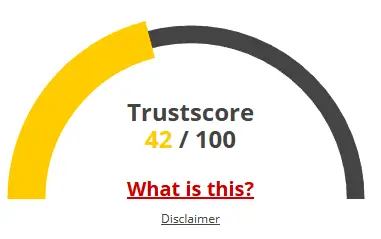

A website’s trust score is a vital indicator of its credibility. H5Fivex has raised multiple red flags due to its alarmingly low score, warning users to proceed with extreme caution.

Key concerns include low traffic, negative user feedback, suspected phishing behavior, anonymous ownership, vague hosting data, and weak SSL security.

Such a low trust score significantly increases the risk of scams, data breaches, or other malicious activity. It’s essential to evaluate these warning signs thoroughly before engaging with H5Fivex or any similar platform. For a complete risk breakdown, view the ScamMinder trust report.