GROKRX3WF Review: Is This Platform Legitimate or a Risky Scheme?

This GROKRX3WF review on Scams Radar examines the legitimacy, ownership, compensation plan, and risks of GROKRX3WF (grokrx3wf.com), a platform claiming to offer cryptocurrency trading. Concerns arise due to its opaque operations and unrealistic promises. Our analysis, designed for everyday investors, uses clear data, charts, and comparisons to highlight red flags and help you make informed decisions before engaging with the platform.

Table of Contents

What Is GROKRX3WF?

GROKRX3WF presents itself as a crypto trading platform linked to GROKR Exchange Ltd. and Wealth Win-Win Fund (3WF). It promises high returns, like 1-4% daily, through AI-powered trading signals. However, its lack of transparency and regulatory warnings suggest it may be a high-risk scheme.

Ownership: Who Runs GROKRX3WF?

The platform’s ownership is unclear, a major concern. GROKR Exchange Ltd. filed an SEC Form D in June 2025, listing Ernest Dewey May Jr. as a director at a Denver co-working space. However, no Colorado business registration exists, and the address is not a permanent office. WHOIS data shows the domain, registered in August 2025 via Namecheap, uses privacy protection, hiding the owner’s identity. Regulators like Austria’s FMA and Germany’s BaFin have flagged related GROKR sites for operating without licenses, indicating no verifiable corporate footprint.

- Key Issues:

- No business registration found.

- Privacy-protected domain.

- Unverified SEC filing claims.

- No business registration found.

Compensation Plan: How Does It Work?

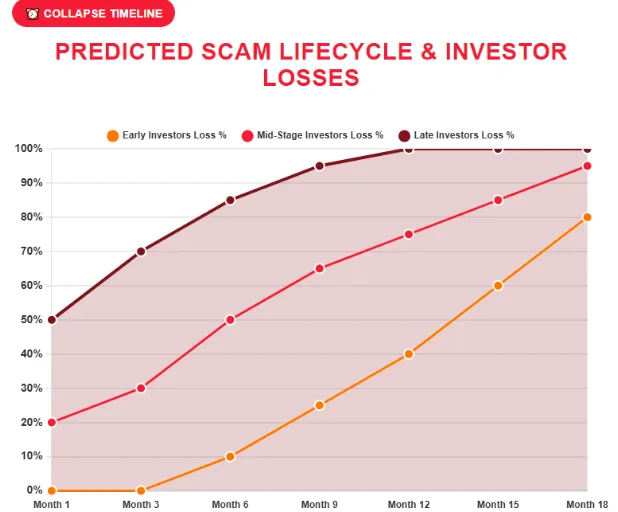

The GROKRX3WF compensation plan mirrors a Ponzi scheme, offering 1-4% daily returns and multi-level referral bonuses. Investors earn $25-$37.50 monthly per referral with a $1,000+ deposit, plus 1-5% of team trading volume. Additional rewards include shareholder bonuses, salaries, and trading signals claiming a 96.8% win rate.

Why It’s Unsustainable

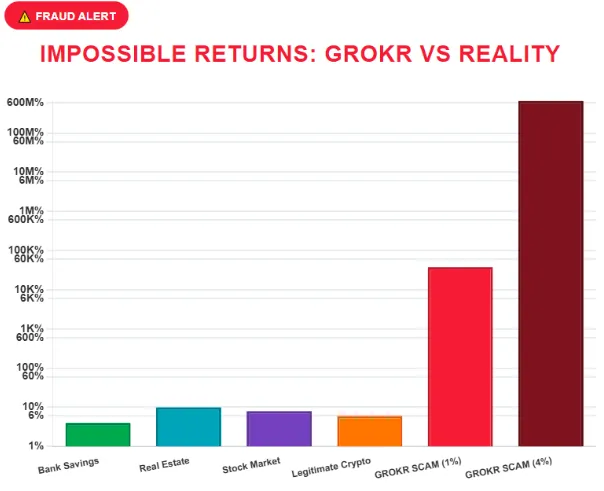

High returns rely on new investor funds, not trading profits. A $1,000 investment at 1.2% daily grows to $37,783 in one year, requiring exponential recruitment. The table below compares GROKRX3WF’s claims to legitimate options:

Investment Type | Annual Return | Risk Level |

GROKRX3WF | 438% (claimed) | Extremely High |

Real Estate (Pakistan) | 8-12% | Moderate |

Bank Savings (PK) | 9-13% | Low |

Coinbase Staking | 4-8% | Moderate |

Public Perception and Social Media

Community feedback on platforms like Trustpilot and Reddit labels GROKRX3WF and related sites (e.g., grokrcoin.com) as scams. Users report blocked withdrawals and demands for extra deposits. Social media accounts like @Grokr_080 on Telegram and “Ron Rogers” on Bonchat promote the site, often using fake testimonials. These accounts also pushed now-defunct scams like Bitrofx.com and Ethgain.io.

- Promoter Patterns:

- Fake profiles with high followers, low engagement.

- Cross-promotion of other scams.

- Use of deepfake endorsements.

- Fake profiles with high followers, low engagement.

Security and Technical Setup

The platform uses a basic SSL certificate but lacks advanced security like 2FA or cold storage policies. Hosted on Hostinger with a recent domain, it shows low traffic (under 5,000 monthly visits) and a high bounce rate (78%). Legitimate platforms like Binance invest in robust infrastructure, unlike GROKRX3WF’s low-cost setup.

Payment Methods and Support

GROKRX3WF accepts only crypto (e.g., USDT, BTC), which is irreversible, a common scam trait. Customer support is limited to Telegram and Bonchat, with reports of unresponsiveness or pressure to deposit more. Legitimate platforms offer 24/7 support and diverse payment options.

ROI Math: Why It Fails

A 1.2% daily return on $1,000 yields $432 million annually for a $100 million offering, per SEC filings. This requires 4,320 new $1,000 investors yearly, ignoring costs. No market supports such growth, confirming the Ponzi structure.

Red Flags Summary

- No regulatory approval (FMA, BaFin warnings).

- Hidden ownership and fake credentials.

- Unsustainable returns (1-4% daily).

- Crypto-only payments.

- Poor customer support and withdrawal issues.

Comparison to Legitimate Alternatives

Unlike GROKRX3WF, platforms like Coinbase and Binance are regulated, offering 4-8% staking APY. Pakistan’s bank deposits yield 9-13% APY, and real estate averages 8-12%. These options are transparent and sustainable, unlike GROKRX3WF’s risky promises.

Recommendations

- Avoid Investment: Do not deposit funds due to scam risks.

- Withdraw Funds: If invested, try small withdrawals and document attempts.

- Report Issues: File complaints with regulators like the SEC or FMA.

- Use Trusted Platforms: Choose regulated exchanges like Kraken or Gemini.

- Research Thoroughly: Check ScamAdviser, SEC EDGAR, and FinCEN for legitimacy.

DYOR Tools

- ScamAdviser: Check domain trust scores.

- SEC EDGAR: Verify filings.

- URLVoid: Scan for blocklist hits.

- Trustpilot: Read user reviews.

GROKRX3WF Review Conclusion

This GROKRX3WF review reveals a high-risk platform with no regulatory backing, unsustainable returns, and questionable ownership. Its Ponzi-like structure and negative public perception make it untrustworthy. Investors should prioritize regulated alternatives and conduct thorough research. For more insights on similar projects, check our detailed Grass.io Review to compare risks and legitimacy. Always verify claims independently to protect your funds.

DYOR Disclaimer: This review is for information only, not financial advice. Conduct your own research using official sources and consult experts before investing. Cryptocurrency carries high risks, and past performance does not guarantee future results.

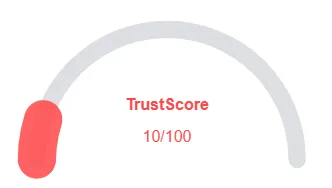

GROKRX3WF Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 GROKRX3WF currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with GROKRX3WF similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rating

- New domain

- Hidden WHOIS data

Frequently Asked Questions About GROKRX3WF Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

GROKRX3WF is a cryptocurrency trading platform, but our GROKRX3WF Review on Scams Radar investigates whether its promises are legitimate or misleading.

While GROKRX3WF claims high crypto returns, our review uncovers opaque ownership, questionable payouts, and operational risks that raise red flags.

GROKRX3WF promises profits from trading, but unclear payout structures and unrealistic ROI claims make it crucial to understand how returns are calculated.

Risks include potential security vulnerabilities, lack of transparency, unverified trading algorithms, and unsustainable crypto earning promises.

Our GROKRX3WF Review recommends caution. Always verify claims, assess risks, and consider safer alternatives before engaging with grokrx3wf.com.

Other Infromation:

Website: GROKRX3WF.COM

Reviews:

Grokr exchange

All are truthfully… thank you…

My amount 5000$ how to withdrawal any option?