Grass.io Review: Is It a Legit Way to Earn Passive Income in 2025?

This Grass.io review on Scams Radar examines the legitimacy of a platform that lets users earn rewards by sharing unused internet bandwidth. Grass.io (app.grass.io) has gained attention with over 3 million users and a $300 million token airdrop, but questions remain about its safety, sustainability, and earning potential. This review dives into ownership, compensation plans, security measures, performance, and more, providing clear charts and comparisons to help everyday users decide whether Grass.io is worth their time.

Table of Contents

What Is Grass.io and How Does It Work?

Grass.io allows users to share idle internet bandwidth through a desktop or mobile app. This bandwidth helps AI companies collect public web data for training models. Users earn Grass Points, which convert to GRASS tokens during airdrops. These tokens, built on the Solana blockchain, can be traded on exchanges like Bitget or Gate.io. The platform, operated by Wynd Labs, aims to create a decentralized network for AI data collection.

Key Features

- Bandwidth Sharing: Share unused internet via a lightweight app.

- Grass Points: Earn points based on uptime, bandwidth, and location.

- GRASS Tokens: Points convert to tokens during airdrops.

- Referral Program: Earn extra points by inviting others.

Ownership and Team Background

Grass.io, developed by Wynd Labs in Toronto, Canada, was founded in 2023 by CEO Andrej Radonjic. The company raised $4.5 million from investors like Polychain Capital and Tribe Capital, showing some credibility. However, the team’s full details are unclear. A related entity, Lower Tribeca Corp., registered in the Bahamas, lists Christopher Nguyen as its director and CTO of Wynd Labs. The lack of public team profiles raises transparency concerns, as trust is vital in crypto projects.

Ownership Concerns

- Limited Team Disclosure: Only the CEO and CTO are named publicly.

- Corporate Structure: Lower Tribeca Corp. may be a shell company, per SEC filings.

- Transparency Risk: Hidden details could signal accountability issues.

Grass.io Compensation Plan Explained

The grass.io rewards system is based on earning points by sharing bandwidth. Points depend on your internet speed, uptime, and location. The referral program offers 20% of direct referrals’ points, 10% from second-level, and 5% from third-level referrals. Points convert to GRASS tokens during airdrops, like the October 2024 event, where 100 million tokens ($300 million) were distributed to 2.8 million users.

Compensation Breakdown

- Point Earning: Average 20–30 points/hour, or ~1,000 points/day with 24/7 uptime.

- Token Conversion: 20,000 points ≈ $14 (based on user reports, $0.007/point).

- Airdrop Value: Average user received 35.71 tokens ($26.95 at $0.7554/token).

- Referral System: Multi-level structure resembles MLM, raising sustainability concerns.

- Payouts: Tokens withdrawable to Solana wallets, with small network fees.

Earning Method | Points/Hour | Monthly Value (USD) |

Bandwidth Sharing | 20–30 | $3–5 |

Referral Bonuses | 5–15/referral | Variable |

Geographical Bonus | Up to 50% boost | $4.50–7.50 |

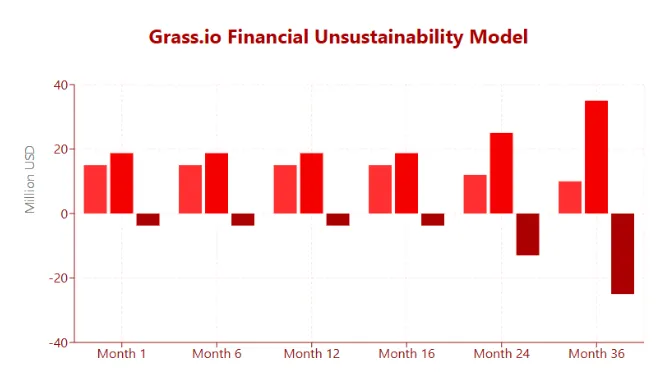

ROI Calculation

Assume a user earns 1,000 points daily (24/7 uptime):

- Points to Tokens: 1,000 points ≈ 0.1 tokens ($0.07554 at $0.7554/token).

- Monthly Earnings: $2.27 (0.1 tokens × 30 days).

- Electricity Cost: 72 kWh/month (100W PC) at $0.17/kWh (Pakistan avg) = $12.24.

- Net ROI: $2.27 – $12.24 = -$9.97/month (loss).

This negative ROI shows Grass.io earnings may not cover costs for average users, especially with high electricity prices.

Comparing Grass.io to Traditional Investments

Investment Type | Annual ROI | Risk Level | Liquidity |

Grass.io | ~3–5% (variable) | High | Low |

Real Estate (PK) | 8–12% | Moderate | Low |

Bank Savings | 4–5% | Very Low | High |

Crypto Staking | 5–20% | High | Medium |

Security and Privacy Policies

Grass.io emphasizes user privacy:

- No Personal Data: Only public web data is collected, not browsing history.

- Encryption: Uses Fully Encrypted Transactions (FETs).

- Audits: Certified by AppEsteem, compatible with antivirus tools.

- Phishing Warnings: Alerts against fake sites.

However, sharing IP addresses for web scraping raises risks. Unknown data buyers and potential legal liabilities if IPs are misused are concerns. Fake “Grass Foundation” phishing sites also threaten users.

Technical Performance and User Experience

The Grass.io app runs lightly, using 20–30 MB of memory and throttling during high usage. It’s available on Windows, Mac, Linux, and Android (iOS pending). However, users report issues:

- Syncing Problems: Points not accruing or showing 0% network quality.

- App Crashes: Connectivity and installation issues.

- Support Delays: Slow responses via chatbot or Discord (470,000+ members).

Public Perception and Trust

Trustpilot reviews (3.2/5 from 319 users) show mixed sentiment:

- Positive: Users like the passive income concept and community support.

- Negative: Complaints about unclaimable tokens and poor support. Social media (e.g., @grass_io on X, 98K followers) shows enthusiasm from early adopters but warnings about fees and scams.

Red Flags in Grass.io Usage

- MLM-Like Referrals: Heavy focus on recruitment raises pyramid scheme concerns.

- No Cash Payouts: Tokens only, limiting accessibility.

- Transparency Issues: Unclear team details and data buyers.

- Technical Glitches: Syncing and payout issues frustrate users.

- Regulatory Risks: Possible securities law violations.

DYOR Tools and Social Media Promotion

- VirusTotal: No malicious activity (0/90 scanners).

- Scamadviser: Moderate trust (60/100) due to hidden domain details.

- CoinGecko: GRASS token at $0.7554, $234M market cap.

Promoters

- @Lamboland_: Promotes Grass.io, Ether.fi, Zeus Network.

- @Crypto_Pranjal: Focuses on airdrops, including Bless Network.

- @CoinMarketCap: Covers Grass.io and many crypto projects.

Recommendations for Grass.io Users

- Test Cautiously: Use one device to limit electricity costs.

- Monitor Earnings: Track points and token conversions.

- Secure Wallets: Use official links to avoid phishing.

- Diversify: Combine with stable investments like savings accounts.

- Check Terms: Understand BVI-based legal recourse limitations.

Grass.io Review Conclusion

This Grass.io review finds a legitimate platform with innovative AI data-sharing potential, backed by real investors. However, its speculative returns, transparency gaps, and technical issues make it risky. Compared to real estate (8–12% ROI) or bank savings (4–5%), Grass.io’s earnings (~3–5%) are low and uncertain. For risk-tolerant users, it’s a speculative experiment, not a reliable income source. Always verify details on official channels and diversify investments.

If you’re exploring similar earning opportunities, check out our detailed EarnApp Review to compare another passive income platform.

DYOR Disclaimer

This Grass.io review is for information only, not financial advice. Cryptocurrency is volatile, and Grass.io carries risks like token price swings and regulatory issues. Do your own research using tools like CoinGecko, Trustpilot, and official Grass.io docs. Consult advisors before participating.

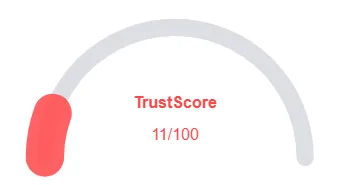

Grass.io Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Grass.io currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Grass.io similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rating

- New archive

- Whois data concealed

Frequently Asked Questions About Grass.io Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Grass.io is a platform that lets users earn rewards by sharing unused internet bandwidth. But is it a legitimate way to make passive income? Our review reveals the truth.

While Grass.io has over 3 million users and offers a $300 million token airdrop, our Grass.io Review on Scams Radar uncovers concerns about its sustainability and security risks.

Grass.io rewards users for sharing bandwidth, but unclear payout structures and low rates raise questions about how sustainable and profitable the platform really is.

Risks include privacy concerns, security vulnerabilities, potential misuse of shared bandwidth, and the platform’s reliance on a volatile token for rewards.

Our review advises caution. While Grass.io offers a tempting way to earn passive income, the risks and unverified claims make it essential to thoroughly research before joining.

Other Infromation:

Website: app.grass.io

Reviews:

There are no reviews yet. Be the first one to write one.