FXCentrumIndia Review: Is It a Safe Investment Platform?

This FXCentrumIndia review examines the legitimacy, compensation plan, ownership, and risks of the platform associated with its CRM portal. For an in-depth scam analysis, visit Scams Radar for a detailed review. Launched recently, it claims to offer forex trading opportunities but raises concerns due to regulatory gaps, unrealistic promises, and user complaints. This analysis provides clear insights for potential investors seeking safe trading platforms like fxcentrumindia.com in India.

Table of Contents

What Is FXCentrumIndia?

FXCentrumIndia operates as a forex trading platform, with its CRM portal serving as a login and signup interface for Indian users. It is linked to FXCentrum, a Seychelles-based broker, but lacks clear ties to Indian regulators like SEBI. The platform promotes high-leverage trading and affiliate programs, which may appeal to beginners but carry significant risks.

Key Features and Claims

- Trading Options: Forex, commodities, and indices.

- Leverage: Up to 1:1000, which is highly risky.

- Bonuses: Up to 100% deposit bonuses, often tied to recruitment.

- Accessibility: Simple login portal, but limited public information.

Ownership and Regulatory Transparency

The platform’s ownership raises red flags. The parent domain, fxcentrumindia.com, was registered on February 27, 2025, via GoDaddy, with ownership hidden through Domains By Proxy. FXCentrum, the global entity, operates under FXC Ltd. in Seychelles, regulated by the Seychelles Financial Services Authority (FSA), a Tier-3 regulator with minimal investor protections compared to FCA or SEBI.

- No SEBI License: Unregulated in India, violating RBI guidelines for forex brokers.

- Anonymous Owners: No verifiable details about founders or management.

- Impersonation Risk: The platform may falsely associate with the global FXCentrum brand.

This lack of transparency undermines trust, as legitimate brokers disclose ownership and comply with local regulations.

Compensation Plan and ROI Promises

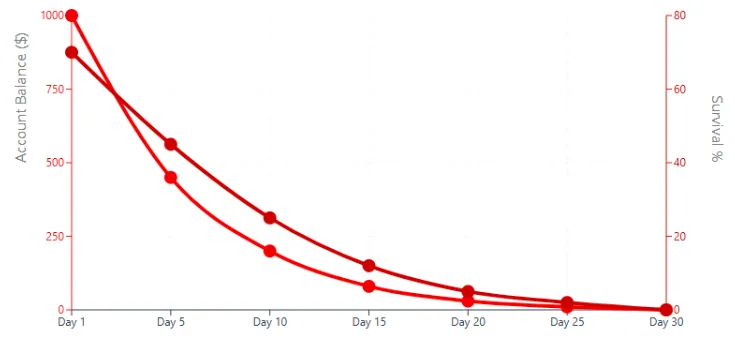

The platform’s compensation structure relies heavily on affiliate programs and high-leverage trading. While specific ROI figures are not publicly detailed on the CRM portal, related reviews suggest promises of 2-10% monthly returns, common in high-risk forex schemes. The affiliate model rewards users for recruiting others, resembling multi-level marketing (MLM).

ROI Sustainability Analysis

Let’s break down the math for a hypothetical 5% monthly return:

Time Period | Initial Investment ($1,000) | Return at 5% Monthly |

1 Year | $1,000 × (1.05)¹² | $1,795.86 |

2 Years | $1,000 × (1.05)²⁴ | $3,225.10 |

Compare this to legitimate investments

Investment Type | Typical Annual ROI |

Indian Bank FD | 6-7% |

Real Estate (India) | 8-12% |

Regulated Forex | 10-30% (high risk) |

FXCentrumIndia Claim | 60-120%+ (unsustainable) |

Such high returns are mathematically unsustainable without new investor funds, a hallmark of Ponzi schemes. The 1:1000 leverage amplifies risks, where a 0.1% market drop could wipe out an entire account.

Affiliate Program Concerns

- MLM Structure: Earnings tied to recruiting new users, not trading success.

- High Bonuses: 100% deposit bonuses encourage over-leveraging.

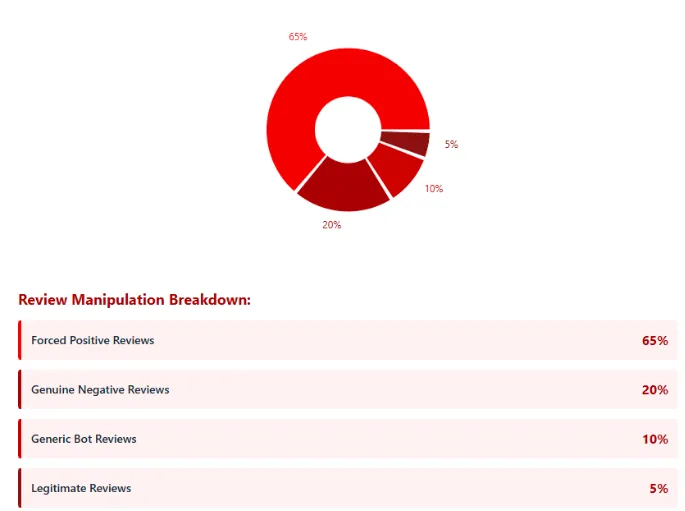

- Withdrawal Issues: Users report 10% fees and delays, with some citing forced positive reviews on Trustpilot to process withdrawals.

Public Perception and User Complaints

User reviews paint a troubling picture. On Trustpilot, fxcentrumindia.com scores 2.9/5 from limited reviews, with users calling it a “crypto MLM scam.” The global FXCentrum site has a 4.1/5 rating, but recent complaints highlight:

- Forced Reviews: Users claim they were pressured to post positive reviews before withdrawals.

- Withdrawal Delays: Reports of 10-day delays and unexpected fees.

- Non-Functional Platform: Claims of MT5 support are unverified, with users noting platform glitches.

Social media presence is minimal, with no verified accounts. Promotions occur via WhatsApp and Telegram groups, often by unverified affiliates pushing referral links, a tactic common in fraudulent schemes.

Security and Technical Performance

The platform uses basic SSL encryption, but lacks advanced security like two-factor authentication (2FA) or data protection policies. Traffic data from SimilarWeb shows negligible organic visits, suggesting reliance on paid ads or referrals. The CRM portal’s simple design and lack of public content raise concerns about its authenticity.

Security Gaps

- No 2FA: Weak account protection.

- No Compliance: No mention of GDPR or Indian DPDP Act adherence.

- Payment Risks: Supports crypto and bank transfers, which are hard to reverse if fraud occurs.

Comparison with Legitimate Alternatives

Platform Type | Regulation | Annual ROI | Risk Level |

SEBI-Regulated Brokers | SEBI, RBI | 10-30% | Moderate |

Bank Fixed Deposits | RBI | 6-7% | Low |

FXCentrumIndia | Seychelles FSA | 60-120%+ | Very High |

Regulated brokers like Zerodha or ICICI Bank offer safer, transparent trading with lower leverage (1:30 max in EU/UK). Bank FDs provide guaranteed returns, while real estate offers steady growth with moderate risk.

Recommendations for Investors

- Avoid Investment: The platform’s lack of regulation, hidden ownership, and user complaints make it a risky venture.

- Choose Regulated Alternatives: Opt for SEBI-registered brokers or bank-backed investments.

- Protect Yourself: Enable 2FA on all financial platforms and avoid crypto deposits.

- Report Issues: Contact SEBI or RBI if you encounter suspicious activity.

FX CentrumIndia review Conclusion

This FXCentrumIndia review reveals significant concerns about its legitimacy. With no SEBI regulation, hidden ownership, unsustainable ROI claims, and user-reported withdrawal issues, the platform poses high risks. For another example of similar risks, see our detailed Laventinemarketsystem Review. Investors should prioritize regulated alternatives for safety and transparency. Always conduct thorough research before investing in any online trading platform.

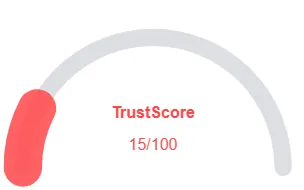

FXCentrumIndia Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and FX Centrum India a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with FX Centrum India or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- Whois hidden

Frequently Asked Questions About FX CentrumIndia Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. FXCentrumIndia shows red flags such as regulatory gaps, unrealistic ROI promises, and negative user feedback.

Risks include potential fund loss, lack of regulatory protection, unrealistic profit claims, and unresolved customer complaints.

No. FXCentrumIndia is not licensed by any recognized financial regulator in India or abroad, making it a high-risk option for traders.

It claims to offer forex trading opportunities with appealing returns, but there is no verifiable evidence of consistent or safe performance.

It’s not recommended. The lack of transparency, regulatory oversight, and numerous complaints suggest avoiding this platform for safety.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.