Fleet Mining Review: Is This Cloud Mining Platform Legit or a Risky Scheme?

In this Fleet Mining review, Scams Radar examines fleetmining.com closely. Launched in mid-2025, it promises easy earnings through cloud mining. But questions arise about its claims. We look at ownership, compensation plans, and returns. This helps investors decide wisely.

Table of Contents

Part 1: Understanding Fleet Mining Basics

Fleet mining involves managing digital assets without hardware. The platform says it uses AI for hashrate allocation. It claims 97 mining farms and 150,000 rigs. These run on clean energy. It serves millions of users worldwide.

The site started on June 16, 2025. Its domain renewal is set for 2026. WHOIS data hides the owner. This raises concerns. Legitimate sites often share clear details.

Fleet Asset Management Group (FLAMGP) is linked to it. It says founded in 2020 in the US. But checks show no SEC filings for FLAMGP. No license numbers appear on the site. The address is 1225 17th St, Denver, CO 80202. This is a shared office space. It does not prove real mining operations.

No named executives show up in searches. A contact name, Mina Hayes, appears in some press. But no background details exist. No profiles on LinkedIn or elsewhere. This lack of transparency is a key issue in any Fleet Mining review.

1.1 Compensation Plan Details

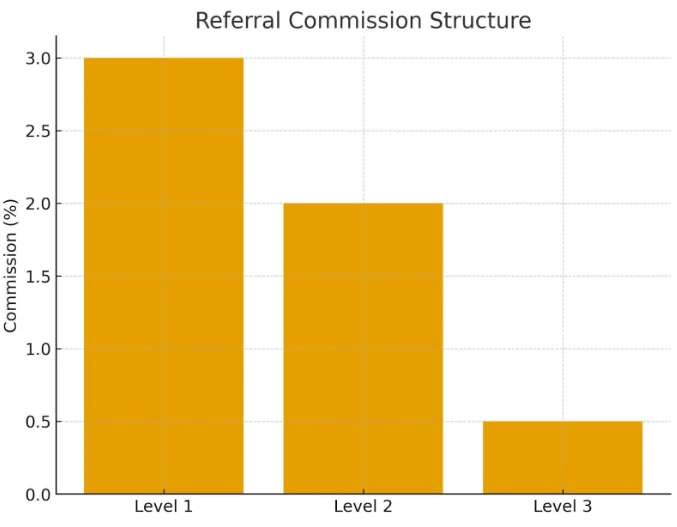

The compensation plan focuses on affiliates. It uses a multi-level structure. Users earn from referrals.

- Level 1: 3% commission on direct referrals.

- Level 2: 2% on second-level invites.

- Level 3: 0.5% on the third level.

This setup rewards recruitment. It offers sign-up bonuses from $15 to $100. Free mining trials lure new users. Higher deposits unlock better hashrate tiers.

Contracts vary. Some promise daily payouts. No fees for beginners. But this depends on constant new funds. It mirrors schemes where inflows pay old users.

In mining fleet management, real systems track equipment. Here, it’s about digital referrals. No proof of actual mining ties to earnings.

Part 2: ROI Promises and Why They Fall Short

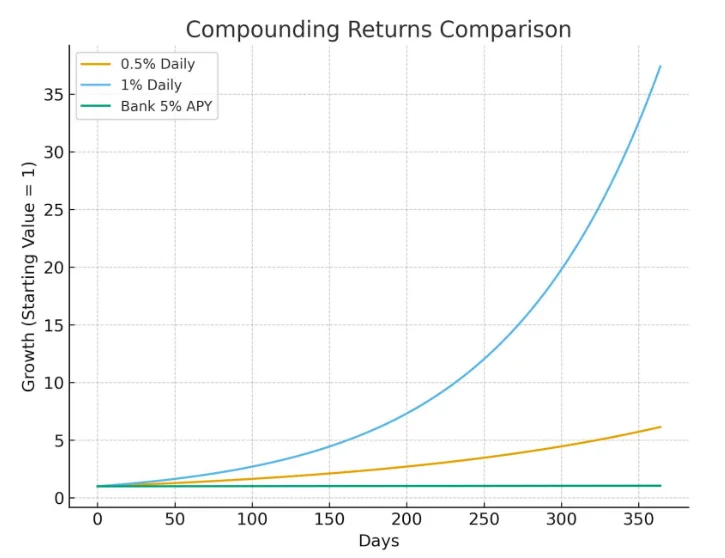

Fleet mining claims stable daily returns. Often 0.5% to 1% or more. This sounds appealing. But math shows issues.

Consider a $1,000 investment.

At 0.5% daily, compounded yearly, Growth reaches about $6,175.

At 1% daily, it jumps to around $37,783.

These are huge. Annual yields hit 584% and 3,778%.

Real options differ.

Investment Type | Typical Annual Yield (%) |

Bank Savings | 4-5 |

Real Estate | 8-12 |

Crypto Staking | 5-15 |

Fleet mining vastly exceeds these. Bitcoin mining faces volatility. Network difficulty rises 10% monthly. Costs for rigs and energy cut profits. Sustainable yields stay at 10-20% yearly.

No stable daily gains exist in real mining fleet optimization. Claims ignore market swings.

Part 3: Traffic Trends and Public Views

Traffic is low. Tools like SimilarWeb show little activity. This contrasts with claims of millions of users.

Public views are mixed. Trustpilot rates 3.9/5 from 11 reviews. Positive note: easy use. Negatives cite frozen accounts.

Forums like Bitcointalk warn of fakes. Sites like Kripto Haberim call it a scam. ScamAdviser scores it low. ScamDoc gives 25% trust.

Press is mostly paid releases. No real news coverage.

In mining fleet analytics, legit firms have strong data. Here, no audits or telemetry.

3.1 Security and Payment Methods

Security uses basic SSL. Cloudflare protects against attacks. But no 2FA details. No blockchain proofs for payouts.

Payments use crypto: BTC, ETH, SOL, DOGE, XRP, USDT, LTC. Daily settlements promised. Reviews report freezes.

Support is an AI chat. Users say it’s unhelpful. No phone or live help.

For mining vehicle tracking, real tools offer real-time data. This lacks it.

Red Flags in Fleet Mining

Several signs point to risks.

- Hidden owners and no executive backgrounds.

- Unproven claims on farms and rigs.

- MLM focuses on real mining.

- High returns that math disproves.

- Low traffic vs big user claims.

- Mixed reviews with scam alerts.

- No real regulation proof.

These match FBI warnings on crypto schemes.

Social promotion comes from low-follower accounts. Like @aixterminal_ sharing links. Past posts hype similar tokens. Others like @johnmorganFL push BTC trends.

No ties to autonomous mining vehicles or telematics. It’s all digital claims.

Future Outlook for Fleet Mining

Schemes like this often collapse. Withdrawals stop in 6-12 months. BTC swings could speed it up. Regulators may step in.

For mining fleet safety systems, focus on proven tools. Avoid unverified promises.

Recommendations

Skip deposits on https://fleetmining.com/. If invested, withdraw small amounts first. Document all. Report issues to IC3.gov.

Choose platforms with audits and real data. Like Bitdeer for verified mining.

This Fleet Mining review uses public facts. Crypto carries risks. Research fully.

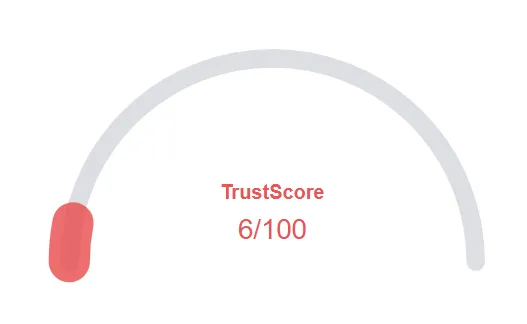

Fleet Mining Review Trust Score

A website’s trust score is an important indicator of its reliability. Fleet Mining currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Fleet Mining or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About Fleet Mining Review

This section answers key questions about the Fleet Mining, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Fleet Mining shows hidden ownership and unverified mining operations, which raises concerns. Always research deeply before depositing.

The platform claims AI-based mining, but no real mining proof or audited earnings data is shown. Returns appear to rely on new user deposits, not mining.

Key risks include unregulated operations, high ROI claims, referral-based earnings, and potential withdrawal freezes reported by users.

Beginners should be cautious. The “easy earnings” model can be misleading. Only invest what you can afford to lose.

The Everstead Review shows a similar pattern: high returns, hidden owners, and referral-driven growth. Always compare platforms for transparency and regulation before investing.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.