This FilanTrading review examines the legitimacy and risks of filantrading.com, a platform promising high-yield returns. We analyze its ownership, compensation plan, traffic trends, security, payment methods, customer support, and ROI claims. Using clear data, charts, and comparisons with real estate, bank, and crypto returns, we highlight red flags and offer practical advice for investors seeking safe opportunities.

Filantrading.com claims to offer high returns through investments in forex, commodities, and cryptocurrencies. However, its lack of transparency raises concerns. This FilanTrading review dives into key aspects to help you decide if it’s a safe investment platform.

The platform’s ownership is unclear, a major concern for investors. WHOIS lookup shows the domain, registered on March 3, 2024, with GoDaddy.com, uses privacy protection to hide owner details. No information about founders, executives, or a physical address is provided. Legitimate platforms like Fidelity or Coinbase openly share their leadership and regulatory licenses from bodies like the SEC or FCA.

The platform uses a multi-level marketing (MLM) structure, promising 5-10% daily returns on investment packages. It heavily emphasizes referral bonuses, where users earn commissions for recruiting others. This setup resembles a Ponzi scheme, where returns depend on new investor funds rather than legitimate profits.

Investment Tier | Daily Return | Referral Bonus |

Basic Plan | 5% | 3% per referral |

Premium Plan | 7% | 5% per referral |

Elite Plan | 10% | 7% per referral |

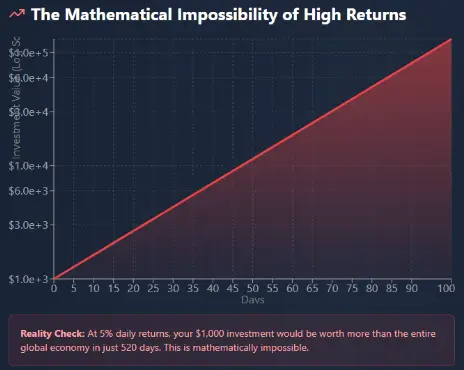

Filan trading claims daily returns of 5-10%, equating to 1,825-3,650% annually. Let’s break it down with math:

Comparison with Legitimate Investments:

Investment Type | Average Annual Return |

Real Estate | 8-12% |

Bank Savings | 4-5% |

Crypto Staking | 5-15% |

FilanTrading.com | 1,825-3,650% (Claimed) |

Red Flag: Such high returns are mathematically unsustainable without a Ponzi structure.

The platform has low traffic, with no significant ranking on tools like SimilarWeb or Tranco. This suggests limited user engagement, unlike established platforms like Robinhood, which have millions of monthly visitors. No credible reviews or discussions appear on X, Reddit, or financial forums, indicating the platform is either new or avoiding scrutiny.

The website uses a basic domain-validated SSL certificate, offering minimal security. It lacks advanced features like two-factor authentication or fund insurance, standard in platforms like Kraken. Payments are primarily in cryptocurrencies (e.g., Bitcoin), which are hard to trace and prevent chargebacks.

Customer support is limited to a generic email or contact form, with no phone or live chat options. Tools like GTmetrix report slow load times and a recent 503 error, indicating poor reliability. In contrast, platforms like eToro provide 24/7 support and fast websites.

Future Outlook: Without transparency, filantrading.com may collapse if new investments slow, as seen in past Ponzi schemes. Regulatory crackdowns, like Robinhood’s $26M fine, show increasing scrutiny of such platforms.

This FilanTrading review is for informational purposes only, not financial advice. Always conduct your own research, verify claims, and consult a financial advisor before investing.

The answers to frequently asked questions about the validity Filan Trading Networks report can be found here. To address your concerns, we have provided the following questions and answers:

Based on our FilanTrading review, the platform raises concerns due to hidden ownership, unrealistic 5-10% daily returns, and lack of regulatory licenses. Investors should verify legitimacy with tools like WHOIS or ScamAdviser before committing funds.

Risks include potential Ponzi scheme structure, reliance on cryptocurrency payments, and no regulatory oversight. The platform’s high-yield claims and MLM-style referral bonuses suggest significant financial risk.

FilanTrading offers 5-10% daily returns and referral bonuses (3-7%) for recruiting others. This MLM structure, as noted in our FilanTrading review, resembles a Ponzi scheme, relying on new investor funds rather than legitimate profits.

No, the claimed 5-10% daily returns (1,825-3,650% annually) are unsustainable. For comparison, legitimate investments like real estate yield 8-12% annually, and crypto staking offers 5-15% APY with clear risks disclosed.

Check for regulatory licenses with the SEC or FCA, use ScamAdviser for trust scores, and review WHOIS for ownership details. The absence of public reviews or social media presence further questions its credibility.

Title: Filan Trading

There are no reviews yet. Be the first one to write one.