EZ Invest Review: A Close Look at This CFD Trading Platform

In this EZ Invest review, Scams Radar explores the platform’s features for online trading. Many search for an EZ Invest review to check if it’s safe. We cover regulation, fees, and risks. EZ Invest offers CFDs on forex, stocks, and more. But past issues raise questions. Read on for details.

Table of Contents

Part 1: What Is EZ Invest and How Does It Work?

EZ Invest is a broker for CFD and forex trading. It runs through two main companies. One serves EU users. The other handles global clients. The platform lets you trade assets like currencies and indices. You use leverage to boost positions. But this adds risk.

The EU part uses WGM Services Ltd. This firm started in Cyprus in 2009. Its license number is 203/13 from CySEC. The address is in Nicosia. WGM has ties to old brands like EZTrader. That was for binary options. In 2015, CySEC fined WGM €10,000 and €340,000. Reasons included poor AML checks and bad marketing. These fines show past compliance problems.

The global side is Sanus Financial Services Pty Ltd. It began in South Africa in 2020. The FSCA license is 51523. The office is in Pretoria. Sanus says it lacks EU protections. No clear owner names stand out. One LinkedIn profile links to a CEO with a health sciences background. But details stay thin. Both firms keep ownership private. This makes full checks hard.

1.1 EZ Invest Regulation: Is It Safe?

Regulation matters in any EZ Invest review. CySEC oversees the EU entity. This means MiFID rules apply. Funds stay separate in banks. There’s negative balance protection. EU clients get up to €20,000 from the Investor Compensation Fund if issues arise.

For non-EU users, FSCA rules kick in. No EU fund covers losses. FSCA offers mediation. But it’s less than CySEC. Past fines on WGM hurt trust. SEC in the US probed related firms for binary options. EZ Invest claims strong security. Sites use SSL. But no 2FA details show up. Data stays safe via encryption. Still, hidden owners raise flags.

Ask: Is EZ Invest regulated and safe? Yes, but history suggests caution. Check CySEC and FSCA sites yourself.

1.2 EZ Invest Account Types and Minimum Deposit

EZ Invest has several account types. Options range from Bronze to Diamond. Each fits different traders.

- Bronze: Basic setup. Higher spreads at 3 pips.

- Silver: Better tools. Mid-level spreads.

- Gold: Lower fees. More support.

- Platinum: Advanced features.

- Diamond: Tight spreads at 0.5 pips. VIP perks.

The EZ Invest minimum deposit starts at $100 for some. Others say $1,000. Check current terms. Islamic accounts exist. These avoid swaps for faith-based rules. The EZ Invest demo account lets you practice. Set it up for free. It helps beginners learn without risk.

How to open an account on EZ Invest? Sign up online. Pick your type. Verify ID. Fund it.

Part 2: EZ Invest Trading Fees, Spreads, and How the Broker Earns

Fees shape your costs. In this EZ Invest review, we break them down. The broker earns from spreads, swaps, and fees.

Spreads: From 0.5 to 3 pips. Variable on ECN accounts. Fixed on others. EZ Invest spreads and trading fees detailed review shows currency pairs at low costs. But check real-time.

Swaps: Charged for overnight holds. Formula: Pip value × Lots × Swap rate × Nights. Discounts up to 80% on high tiers.

Commissions: $0 to $7 per lot on currencies. No hidden costs claimed. But reviews note surprises.

Understanding EZ Invest fee structure and hidden costs: Transparent on-site. Yet, some users report extra charges. Compare to others. EZ Invest trading fees suit active users. But high for starters.

Fee Type | Details | Example |

Spreads | 0.5-3 pips | EUR/USD at 1 pip |

Swaps | Variable, nightly | $5 on 1 lot hold |

Commissions | Up to $7/lot | None on basic |

EZ Invest withdrawal process: 1-5 days. Use cards or wires. Fees may apply, like $25 for wires. How to withdraw money from the EZ Invest platform? Log in, request, and wait for approval.

2.1 EZ Invest Trading Instruments and Platforms

EZ Invest trading instruments cover 300+ assets. Forex pairs, indices, commodities, stocks, crypto CFDs.

- Forex: Major pairs like EUR/USD.

- Stocks: CFDs on big names.

- Crypto: Bitcoin, Ethereum trading.

EZ Invest cryptocurrency trading features leverage. But no real coins.

Platforms: MT4 and SIRIX. EZ Invest MT4 is popular. It has charts and bots. Web and mobile versions work anywhere. EZ Invest trading platform comparison: MT4 for pros. SIRIX for social trades. EZ Invest mobile app features for trading on the go include news and alerts.

Trade execution on EZ Invest is fast, under 100ms. But reviews note glitches in busy times.

Part 3: EZ Invest Customer Support and Educational Tools

Support is key. EZ Invest customer support options and responsiveness: 24/5 chat, email, phone. EU line in Cyprus. Global in South Africa. Users say replies vary. Some fast, others slow.

Educational tools offered by EZ Invest for beginner traders: Calculators, guides. A step-by-step guide to trading Forex on EZ Invest helps new users. But depth is lacking compared to big brokers.

EZ Invest platform user interface and experience review: Simple. EZ Invest’s advanced trading tools and charting options include indicators.

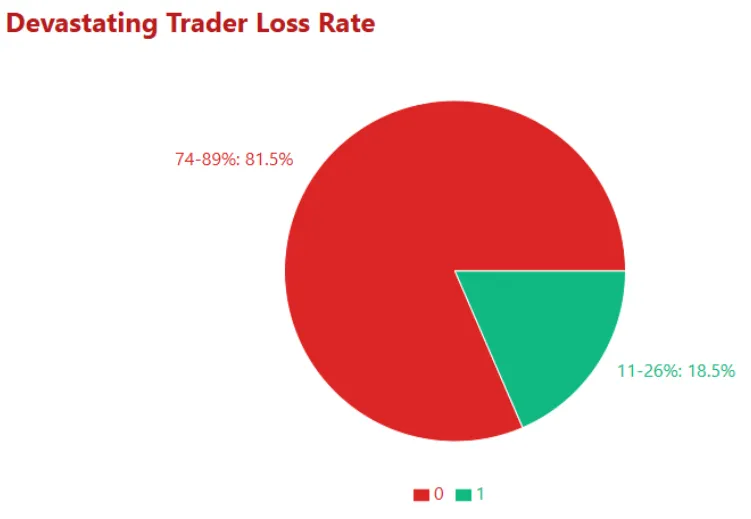

3.1 Risks of Trading CFDs on the EZ Invest Platform

CFDs carry high risk. 74-89% lose money. Leverage magnifies losses. EZ Invest warns this. How to manage risks when trading with EZ Invest? Use stops. Learn first.

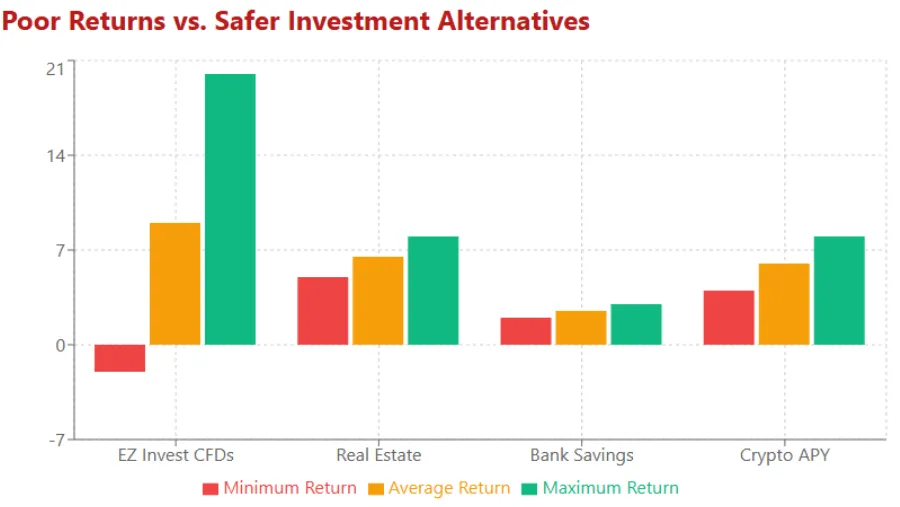

ROI claims: None direct. But math shows hype is unsustainable. Assume 5% monthly: $1,000 grows to $1,795 in a year. Real? No. Compare:

Investment | Avg Annual Return | Risk Level |

EZ Invest CFDs | -2% to 20% | High |

Real Estate | 5-8% | Medium |

Bank Savings | 2-3% | Low |

Crypto APY | 4-8% | High |

Graph insight: High returns link to high volatility. Banks offer safety. CFDs are like gambling.

EZ Invest review from real users and traders: Mixed. Trustpilot at 2.5/5. Complaints about withdrawals. Positives on spreads.

Tips for using EZ Invest for Forex and CFD trading: Start small. Test demo. Skip bonuses with terms.

EZ Invest pros and cons for new traders: Pros – Regulated, MT4. Cons: Past fines, poor reviews.

3.2 EZ Invest Withdrawal Timeframes and Process Explained

Requests processed in 1-5 days. Delays are common in complaints. EZ Invest security: Segregated funds. How secure is your data on EZ Invest? SSL protects.

Trading commodities on the EZ Invest platform overview: Gold, oil, and CFDs.

Conclusion: Should You Choose EZ Invest?

This EZ Invest review shows a regulated broker with tools like MT4 and diverse instruments. But fines, reviews, and risks stand out. For safe trading, check all. Online trading with EZ Invest suits pros. Beginners, look elsewhere. Always DYOR. Past issues don’t predict the future.

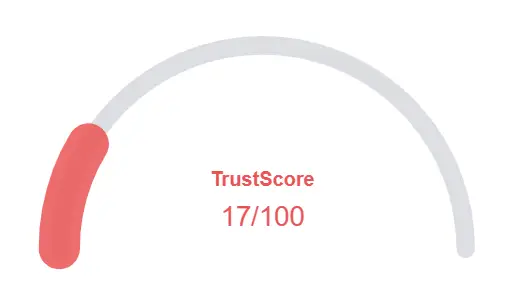

EZ Invest Review Trust Score

A website’s trust score is an important indicator of its reliability. EZ Invest currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with EZ Invest or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- Online shopping features were detected (use our shopping scam checklist)

- v DNSFilter labels this site as safe

- We found a valid SSL certificate

Negative Highlights

- High risk financial services or content seems to be offered

- A risk/high return financial services are offered

- An internal review system is used by this site

- The references on Social Media were negative

- Words were found often used by scammers

Frequently Asked Questions About EZ Invest Review

This section answers key questions about EZ Invest , providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Yes, EZ Invest operates under CySEC (EU license 203/13) and FSCA (51523 South Africa). Both ensure compliance, though past fines suggest investors should stay cautious.

The EZ Invest minimum deposit typically starts at $100, depending on account type and region. Always verify the latest terms before funding.

Withdrawal requests are processed within 1 to 5 business days. Bank wires may incur additional fees and longer approval times.

Yes. EZ Invest provides both demo and Islamic (swap-free) accounts, letting traders practice risk-free or trade per faith-based principles.

While both claim strong CFD tools, EZ Invest Review highlights CySEC regulation, whereas Everstead Review often focuses on user experience and global access. Always research each platform’s license and track record before investing.

Other Infromation:

Website: ezinvest.com

Reviews:

There are no reviews yet. Be the first one to write one.