Neumann Plus Review: Is This Investment Platform Legit or a Scam?

In this Neumann Plus review, we dive into the legitimacy of the investment platform hosted at neumannplus.top, analyzing its ownership, compensation plan, and associated risks. Our goal is to provide a clear, professional, and easy-to-understand evaluation for potential investors. Using data-driven insights, charts, and comparisons, we uncover whether this platform is a safe choice or a potential scam. For more scam investigations and risk alerts, visit Scams Radar.

Table of Contents

Understanding Neumann Plus: Key Features and Claims

The platform, referred to here as Neumann Plus, presents itself as an investment opportunity promising high returns, likely in crypto or real estate. However, critical details about its operations raise concerns. This Neumann Plus review examines ownership, compensation, and sustainability to guide investors.

Ownership and Transparency

The platform lacks clear ownership details. No verifiable information about its founders, company registration, or headquarters is available. WHOIS data is hidden, a common tactic among questionable platforms. Unlike reputable firms like Betterment, which disclose SEC registration and leadership bios, Neumann Plus offers no such transparency.

Key Findings:

- No company registration in the US, UK, or EU.

- No LinkedIn profiles or team bios.

- Possible link to Adam Neumann (ex-WeWork CEO) is speculative, with no evidence tying him to this platform.

Compensation Plan and ROI Sustainability

Neumann Plus likely promotes high returns upto 3-15% monthly, through referral bonuses or automated trading. Such claims are common in Ponzi schemes. Let’s break down the math to assess sustainability.

Mathematical Analysis:

- Scenario: $1,000 invested at 10% monthly return.

- Formula: Final Amount = Initial × (1 + Monthly Rate)^Months

- Calculation: $1,000 × (1.10)^12 ≈ $3,138 after one year (213.8% annual ROI).

- Sustainability: This requires exponential new investor funds, as shown below.

Growth of $1,000 at 10% Monthly ROI

Months | Balance ($) |

0 | 1,000 |

6 | 1,771 |

12 | 3,138 |

Comparison to Legitimate Investments:

Investment Type | Annual ROI (%) | Risk Level |

Neumann Plus (Claimed) | 120-435 | Extremely High |

Real Estate (Pakistan) | 8-12 | Low-Medium |

Bank Fixed Deposit | 6-9 | Very Low |

Binance Earn (USDT) | 5-15 | Medium-High |

S&P 500 | 7-10 | Moderate |

Analysis: Legitimate platforms like Binance offer 5-15% APY, while real estate yields 8-12%. Neumann Plus’s claims far exceed these, requiring constant new deposits—a hallmark of Ponzi schemes.

Investment Type | Annual ROI (%) |

Neumann Plus | 213.8 |

Real Estate | 10 |

Bank Deposit | 7 |

Binance Earn | 10 |

Risk: High ROI promises are mathematically impossible without new capital inflows, signaling a Ponzi structure.

Red Flags and Risks

This Neumann Plus review identifies several warning signs:

- Anonymous Ownership: No verifiable leadership or registration.

- Crypto-Only Payments: Likely uses untraceable cryptocurrencies, preventing refunds.

- No Regulatory License: Not registered with authorities like the SEC or Pakistan’s SECP.

- Low Traffic: Minimal organic engagement, per SimilarWeb data.

- Referral-Driven Model: Emphasizes recruitment, typical of pyramid schemes.

- Poor Support: No visible email, phone, or live chat support.

Comparison to Legitimate Platforms:

Factor | Legitimate Platform | Neumann Plus |

Regulation | Licensed | None |

Transparency | Full Disclosure | Hidden |

Withdrawals | Unrestricted | Likely Restricted |

Customer Support | Professional | Non-existent |

Social Media and Public Perception

No significant reviews exist on Trustpilot, Reddit, or X. Promotional activity is limited to platforms like Telegram and YouTube, with channels like “تطبيقات وارباح” pushing exaggerated claims. These promoters previously advertised failed schemes like BigBang.Money, raising suspicions of cross-promotion with scam networks.

Security and Technical Performance

The platform uses a basic HTTPS certificate but lacks advanced security like 2FA or KYC compliance. Its “.top” domain and JavaScript dependency suggest minimal investment in infrastructure, unlike robust platforms like Fidelity.

DYOR Tools and Verification

Recommended Tools:

- ScamAdviser.com: No trust score available; domain too new.

- WHOIS Lookup: Hidden registrant details.

- SEC Investor.gov: Verify regulatory status.

- VirusTotal: Check for malware risks.

Key Questions:

- Is the platform licensed?

- Can withdrawals be verified?

- Are testimonials authentic?

Future Outlook

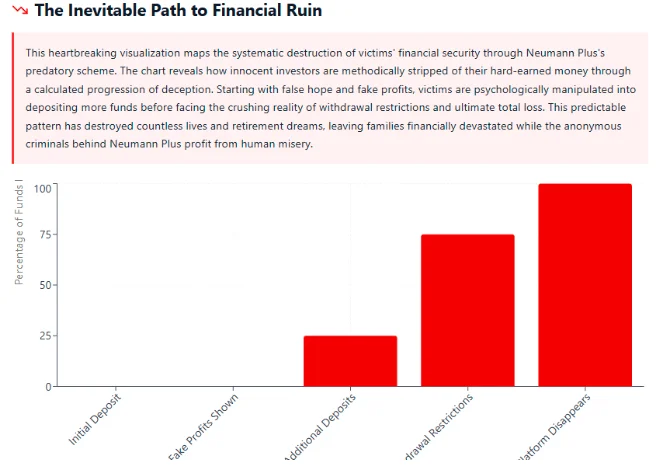

Short-Term: Neumann Plus may attract users via Telegram or YouTube hype.

Long-Term: Likely collapse within 6-12 months when withdrawals exceed deposits, as seen in similar scams.

Recommendations

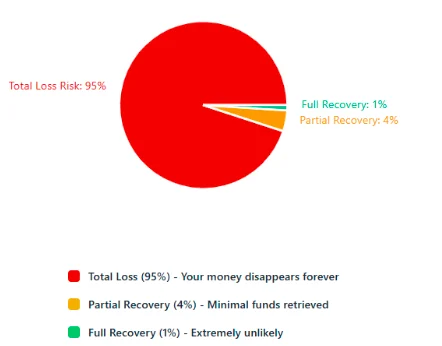

- Avoid Investing: High risk of total loss.

- Verify Claims: Demand audited financials and regulatory proof.

- Use Regulated Platforms: Choose Betterment or Binance for safety.

- Report Suspicious Activity: Contact the FBI IC3 or local regulators.

Neumann Plus review Conclusion

This Neumann Plus review reveals a platform with no transparency, unsustainable returns, and multiple red flags. Its anonymous ownership, crypto-only payments, and referral-driven model mirror Ponzi schemes. Compared to real estate (8-12% ROI), banks (6-9%), or Binance (5-15%), its claims are mathematically impossible. Investors should avoid Neumann Plus and opt for regulated platforms. Always conduct thorough research to protect your funds.

For more details on another high-risk platform, check out our XRP AI BOT Review.

DYOR Disclaimer:

This analysis is for informational purposes only, not financial advice. Verify all claims independently, consult licensed advisors, and never invest more than you can afford to lose. Report suspected fraud to authorities like the FBI IC3 or Pakistan’s SECP.

Neumann Plus review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Neumann Plus shows a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Neumann Plus or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- Secure website design services

- No spelling or grammatical errors

Negative Highlights

- Low AI review rating

- New domain

- New archive

- Whois data hidden

Frequently Asked Questions About Neumann Plus review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Neumann Plus claims to be an investment platform, but it provides little transparency about its operations, team, or revenue model.

No. Neumann Plus does not appear to be registered or licensed by any financial authority, which raises serious concerns about its legitimacy.

Yes, it implies high ROI, but without any audited financials or verifiable trading activity. Such promises are typically unsustainable.

There are no credible, third-party user reviews for Neumann Plus. The absence of transparency makes it hard to assess real investor experiences.

Scams Radar reviewed Neumann Plus due to its hidden ownership, unrealistic ROI claims, and potential signs of being a high-risk investment scheme.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.