Energeios Review: Is This Platform a Safe Choice for Investors?

In this Energeios review, we look at key aspects like legitimacy, features, and risks. The platform focuses on EV charging investments. It promises steady returns. But questions about sustainability arise. We combine details from various sources to give a clear picture. This helps users decide on Energeios’ legitimacy and safety. Now visit Scams Radar.

Table of Contents

Part 1: Understanding the Energeios Platform

Energeios offers a way to invest in EV charging stations. Users start with $50 in USDT. The main draw is 1% daily ROI for 200 days. This adds up to 200% total return. The system uses blockchain for tracking. It claims to blend clean energy with passive income.

Key Energeios features include daily earnings and team-based rewards. Investors get income from referrals, too. The setup resembles MLM structures. This raises concerns about long-term viability. Energeios markets itself as a tool for wealth creation in the EV sector.

1.1 Energeios Ownership and Leadership Profiles

Ownership details point to Energeios Financial LTD. The listed address is 80 George Street, Edinburgh, Scotland. Contact includes email and phone. The CEO is Rhona Lennox. She is described as a visionary from Scotland. The platform says she leads expansion to over 50 countries.

But background checks show limited info on Rhona Lennox. A LinkedIn profile links to a student in Ireland with no business ties. Mentions appear in promo materials for other projects like SAFIR International Zeniq. This is an MLM-linked crypto scheme. No verifiable corporate registration exists. Domain records hide owners via privacy services. The domain started in August 2025. It uses NameCheap, often tied to low-trust sites.

This lack of clear profiles raises questions. In an Energeios review, transparent leadership matters for trust. Without solid backgrounds, investors may doubt Energeios’ safety.

Part 2: Detailed Energeios Compensation Plan Explained

The plan has several parts. It starts with the investment. Minimum is $50 USDT on the BEP20 network. Daily ROI is 1% for 200 days. For $50, that’s $0.50 per day. Total payout reaches $100.

Direct income gives 10% from referrals. No cap applies. Binary matching income ranges from 7% to 15%. It depends on team volume and rank. Daily caps go from $500 to $5,000.

Ranks form a big part. There are 12 levels from Prime to Luminary. Weekly income lasts 100 weeks. Earnings start at $50 and hit $2,500 at the top ranks. Qualification updates daily at 11:30 PM UK time.

Rank | Weekly Income | Duration | Daily Cap |

Prime | $50 | 100 weeks | $500 |

Luminary | $2,500 | 100 weeks | $5,000 |

Reinvestment lets users create new packages. All works on weekends and holidays. This Energeios compensation plan explained shows a heavy focus on recruitment. It boosts Energeios’ benefits like higher earnings. But it also highlights risks if new members are slow.

2.1 Energeios ROI Claims and Sustainability Analysis

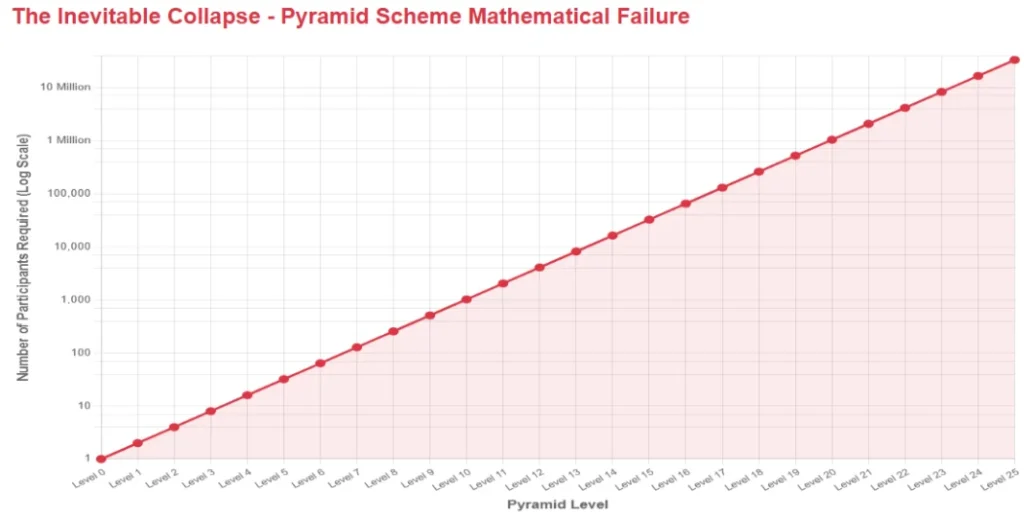

Energeios promises 365% annual ROI. To check, consider math. For $50, daily $0.50 over 200 days equals $100 total. The platform must generate $50 profit per investor.

Real EV charging yields 5-15% yearly after costs. Formula: FV = P × (1 + r)^t. For compounded: $50 × (1.01)^200 ≈ $369. But payouts are linear.

Without new investments, it fails. Example: 100 investors at $5,000 total. Daily outflow $50. Needs constant inflows. This pyramid, when growth stops.

2.2 Energeios vs Competitors Comparison

Compare to real options. Bank ROI: Safe at 4.5% APY. Real estate ROI: 7-13% yearly. Crypto exchange APY: 3-10% for staking.

Energeios’ assets focus on EV stations. But no proof of operations. Competitors like ChargePoint give 10-15%. Energeios claims 37x higher. This gap questions viability.

Part 3: Energeios Risks and Security Measures

Energeios security includes SSL and blockchain tracking. But no audits or smart contract details. Energeios risks involve crypto-only payments. Withdrawals are available only with a 10% fee.

Red flags:

- Hidden ownership and a young domain.

- Unrealistic returns without revenue proof.

- MLM focuses on recruitment.

- No regulations or licenses.

- Placeholder content like “0+ customers”.

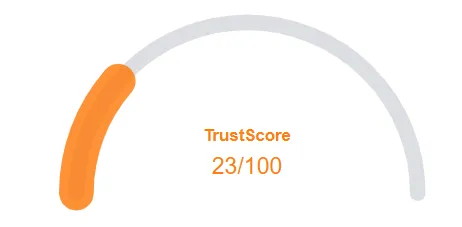

Energeios scam check and trust rating: Low score on ScamAdviser due to hidden owner and HYIP traits. No reviews on Trustpilot or Sitejabber.

3.1 Energeios Customer Support Review

Support via email (support@energeios.io) and phone (+44 7414 217868). No live chat. Response times unverified. Limited options raise concerns for Energeios customer support.

3.2 Energeios User Reviews and Public Perception

Few independent Energeios user reviews exist. Site novelty means low traffic. X posts from @Energeios hype returns but show zero engagement. No major promoters. Past links to similar schemes like Forsage.

3.3 Energeios Deposit and Withdrawal Options

Uses USDT BEP20 only. Minimum withdrawal $5. Fee 10%. Processed in 30 minutes on Sundays. No fiat. This limits traceability.

Future Predictions for Energeios Platform

The model suggests early payouts from new funds. By Q1 2026, stalls are likely to lead to delays. Collapse is common in 3-6 months for HYIPs. Regulatory risks are high.

Recommendations for Energeios Account Setup

Avoid investing due to red flags. Choose regulated options. For the Energeios sign-up or account, verify all claims first.

In conclusion, this Energeios review highlights key concerns. While features appeal, risks outweigh benefits. Always check Energeios’ safety and do thorough research.

Energeios Review Trust Score

A website’s trust score is an important indicator of its reliability. Energeios currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Energeios or similar platforms.

Positive Highlights

- SSL certificate verified as valid.

- DNSFilter marks the website as safe

Negative Highlights

- Website has low visitor traffic.

- Several low-rated sites share the same server.

- Several spammers and scammers use the same registrar

Frequently Asked Questions About Energeios Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Energeios allows investment in EV charging stations, offering 1% daily ROI for 200 days, tracked via blockchain. Sustainability is uncertain.

Energeios lacks transparency, with hidden ownership and an MLM structure, raising doubts about its legitimacy.

It offers daily returns, referral bonuses, and binary matching, but relies on recruitment to maintain payouts.

Unlike stocks or crypto, which offer stable returns, Energeios promises high returns with no proven revenue generation.

Compared to Everstead, Energeios has more red flags, making Everstead a potentially safer passive income option.

Other Infromation:

Website: energeios.io

Reviews:

There are no reviews yet. Be the first one to write one.