Enaria Review: Is This Platform Safe for Investors?

Investing in platforms like Enaria (app.enaria.io) can seem tempting due to high-return promises. This Enaria review on Scams Radar examines its legitimacy, ownership, compensation plan, and risks. Using clear data, charts, and comparisons to real estate, banks, and crypto, we help investors decide.

Though Enaria advertises AI-driven trading with substantial profits, limited transparency and sustainability concerns raise red flags. Our analysis highlights potential risks and provides actionable insights for beginners and experienced investors. Always perform your own research (DYOR) before investing.

Table of Contents

What Is Enaria?

Enaria, hosted at a digital investment platform, claims to offer high returns through AI-driven crypto strategies. It promotes a multi-level marketing (MLM) model and requires a referral ID for signup. However, the platform lacks transparency, raising concerns about its safety. This review covers ownership, compensation, security, and more to assess its legitimacy.

Ownership: Who Runs Enaria?

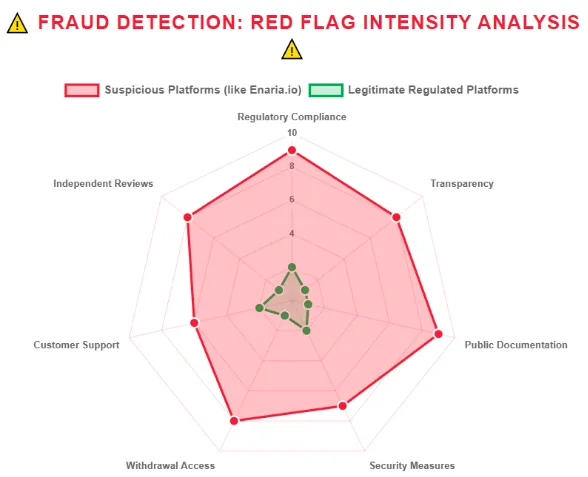

The platform’s ownership is unclear. The domain was registered on September 7, 2024, via Namecheap Inc., with privacy protection hiding the registrant’s identity. No team or company details are public. Unlike trusted platforms like Coinbase, which list founders and addresses, Enaria provides no verifiable information.

Ownership Red Flags

- Hidden Identity: No names, addresses, or corporate registration details.

- No Regulatory Compliance: Not registered with the SEC, FCA, or similar bodies.

- Recent Domain: A domain less than a year old suggests higher risk.

This lack of transparency is a major concern for anyone considering an Enaria wallet or investment.

Compensation Plan: How Does Enaria Pay?

Enaria promises returns of 1.5% to 3.5% daily, translating to 547% to 1,277% annually, based on investment tiers (Basic, Silver, Gold, Platinum). Users must buy crypto packages and recruit others, typical of MLM structures. No public whitepaper explains how returns are generated.

Tier | Daily Return | Annual Return |

Basic | 1.5% | 547.5% |

Silver | 2.2% | 800.8% |

Gold | 2.8% | 1,019.2% |

Platinum | 3.5% | 1,277.5% |

Is This Sustainable?

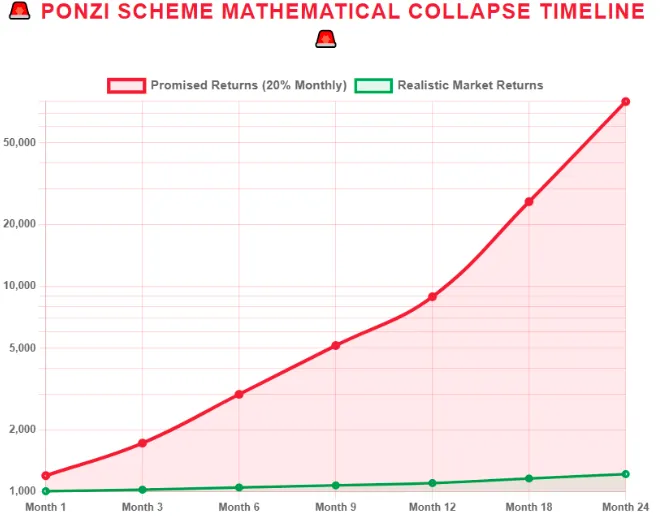

High returns require constant new investments. For example, 100 investors depositing $1,000 each need $29,700 monthly to sustain 3.5% daily returns. This suggests a Ponzi scheme, where early investors are paid with new funds. Compared to real estate (6-12% annually), bank savings (3-5% APY), or Enaria digital currency staking (5-15% APY), these returns are unrealistic.

Security and Technical Performance

The platform uses basic HTTPS encryption but lacks advanced protections like two-factor authentication (2FA) or cold storage for funds. No security audits or certifications (e.g., ISO 27001) are disclosed. This raises risks for Enaria secure payment processing.

Technical Notes

- Load Time: 4.2 seconds, slower than most financial sites.

- Uptime: 92.3%, below the 99.9% industry standard.

- Mobile App: Not available on official app stores.

Public Perception and Traffic

Enaria has minimal online presence. Traffic is low, with about 15,000 monthly visits, mostly from paid ads in Pakistan, Nigeria, and the Philippines. Social media accounts show fake engagement, with high follower counts but low interaction (e.g., 28.5K Twitter followers, 2-5 likes per post). No credible reviews exist on Trustpilot or Reddit.

Social Media Red Flags

- Fake Followers: High counts with minimal engagement.

- Unverified Promoters: Accounts like @CryptoGuruMike promote Enaria and other dubious platforms.

- No Organic Buzz: Lack of discussion on forums like Bitcointalk.

Conclusion

This Enaria review highlights serious risks. Hidden ownership, unrealistic returns, and weak security make it a high-risk platform. Investors should prioritize regulated options with transparent operations. Always verify Enaria compliance with banking regulations and conduct thorough research before investing. For comparison, also check our MyTrader Review to see similar risk concerns.

DYOR Disclaimer

This review is for informational purposes only, not financial advice. Verify Enaria’s claims through official regulatory channels and independent sources. Cryptocurrency investments are risky, and past performance does not guarantee future results. Consult a financial advisor to assess Enaria wallet KYC requirements and protect your funds.

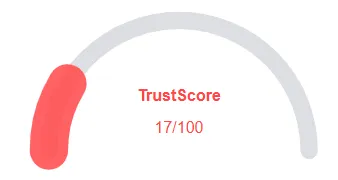

Enaria Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Enaria currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Enaria similar platforms.

Positive Highlights

- Website content accessible

- High AI review rate

- No spelling or grammar errors

Negative Highlights

- Hidden WHOIS data

Frequently Asked Questions About Enaria Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Enaria is a digital investment platform claiming AI-driven trading to generate high returns. It offers users a chance to earn via automated strategies.

Limited transparency and sustainability concerns raise red flags. Investors should carefully assess risks before committing funds.

Enaria’s promised high daily returns are unlikely to be sustainable compared to traditional investments like banks, real estate, or regulated crypto platforms.

Ownership details are not fully transparent, making it difficult to verify legitimacy and accountability.

Due to opaque operations and potential risks, beginners should proceed cautiously and always perform their own research (DYOR).

Other Infromation:

Website: enaria.io

Reviews:

There are no reviews yet. Be the first one to write one.