ECOX Review: Crypto Opportunity or Just another Trap

If you’re searching for an ECOX review, you’ve landed in the right spot. This guide breaks down the ecox.network crypto project, from its tokenomics to real-world viability. Launched as an eco-focused blockchain initiative, ECOX Network aims to blend social engagement with digital rewards. But does it deliver? We’ll explore the facts step by step.

Explore more reviews on Scams Radar, your trusted source for crypto project analysis and awareness.

Table of Contents

Part 1: What Is ECOX Network? A Quick Look at the Ecosystem

ECOX Network positions itself as a gamified platform where users earn rewards for green actions. At its core, the ECOX ecosystem revolves around two tokens:

- GREEN for daily activities

- ECX as the main utility token

Users mine GREEN through posts, likes, and quests, then convert it to ECX during set cycles.The broader ECOX blockchain promises DeFi tools, staking options, and even NFT integrations for eco-themed assets. Think yield farming tied to carbon offsets or governance votes on sustainability projects. The app, accessible via a simple login, shows a dashboard with leaderboards and wallets. It’s built for beginners, with iOS support and a Telegram bot for quick entry.

ECX remains unlisted on major exchanges. This limits ECOX trading to internal transfers, raising questions about liquidity and real value. The roadmap hints at Q2-Q3 2026 listings, but details stay vague.

1.1 Ownership and Team: Who Runs the ECOX Crypto Project?

Transparency starts at the top, and here, ECOX falls short. Public records tie the project to Singapore-based entities, but links feel fragmented. ECOX Global Technologies Pte. Ltd., incorporated in May 2025, lists addresses in Paya Lebar Square and Marina Bay Financial Centre. ECOX Technology Pte. Ltd. from June 2024, operates from Beach Road. These firms handle the iOS app under “ECOX Network.” A third, ECOX Global Pte. Ltd. from 2023, focuses on environmental tech but may not connect directly.

1.2 Leadership Concerns: Scrutiny of ECOX’s Key Figures

Leadership draws scrutiny. Jorge Sebastiao, often listed as CEO/CTO, has a controversial past. Records link him to Nimbus DeFi, a 2023 scandal where 136 million euros vanished. Spanish authorities flagged him in Bank Bene Merenti and YEM Foundation cases, alleging fraud via shell companies. Saif Al Naji appears as a co-founder with entrepreneur ties, but no deep crypto experience shows. David Coleman gets mentions in event promotions, yet profiles lack verifiable blockchain credentials.

No full team bios grace the site or LinkedIn. This anonymity boosts risks, especially in DeFi where trust hinges on known faces. For an ECOX investor guide in 2025, demand public IDs and cross-checks via Singapore’s UEN registry.

Part 2. The Compensation Plan: How ECOX Token Rewards Really Work

ECOX’s compensation plan hooks users with easy entry. Start as a “Green Seed” and level up via engagement. Here’s the flow:

- Earn GREEN: Base rate hits 10 GREEN daily from likes, comments, and follows. Boosts come from referrals (bonuses per invite) and quests (daily tasks for extra points).

- Build Greening Power (GP): Levels like Green Starter (300 GREEN + 50 GP) unlock faster mining. GP scales earnings, say from 10 to 20 GREEN per day.

- Convert to ECX: Every cycle (monthly, next ends September 8, 2025), use this formula: Your ECX = (Your GREEN / Total System GREEN) × Cycle Pool. Current rate: 1 GREEN ≈ 0.02111 ECX. KYC gates access, submit ID for eligibility.

- Vesting and Locks: Post-conversion, 90-98% of ECX locks until Token Generation Event (TGE) in 2026. The rest vests over 18-24 months, freeing small amounts gradually.

- Extras: Staking ECX for yields, yield farming in pools, or governance votes. Referrals add 5-10% bonuses, fueling growth.

This setup mimics social-fi apps but leans on user influx. No fiat deposits yet rewards stay internal. For ECOX staking rewards, expect 2-10% APY once live, per blog hints, but unproven.

2.1 Tokenomics Breakdown: Supply, Distribution, and Unlocks

ECOX tokenomics outline a 1 billion total supply cap. Distribution splits: 40% community rewards, 20% team (vested), 15% liquidity, 10% marketing, 15% ecosystem fund. No ICO or IEO yet; early access via app mining.

The ECOX token unlock schedule delays most supply: 2-10% liquid at TGE, rest drips monthly. This curbs dumps but ties value to adoption.

Token Aspect | Details | Impact on Holders |

Total Supply | 1 Billion ECX | Fixed cap aids scarcity |

Circulating (Post-TGE) | ~50-100 Million | Low initial float boosts price potential |

Unlock Schedule | 18-24 Months Vesting | Reduces sell pressure short-term |

Utility | Staking, Governance, DeFi | Drives demand if ecosystem grows |

Part 3: ROI Reality: Crunching Numbers on ECOX Price and Yields

Promised returns sound green, but math tells a starker tale. A user mining 10 GREEN daily nets 70 weekly, converting to ~1.48 ECX at current rates. With 582,000 users, system GREEN hits 5.82 million daily and demands 122,860 ECX issued per day.

At a hypothetical $0.36/ECX (social chatter price), that’s $16.1 million yearly issuance. Without revenue (fees or partnerships), dilution erodes value.

Annualized: Even 2% daily compounds to 1,377x yearly, A Ponzi math, unsustainable without endless inflows.

ECOX token price prediction? Blogs eye $0.1547 by 2031 (+15.47% cumulative, or 2.09% annual). Modest, yet risky.

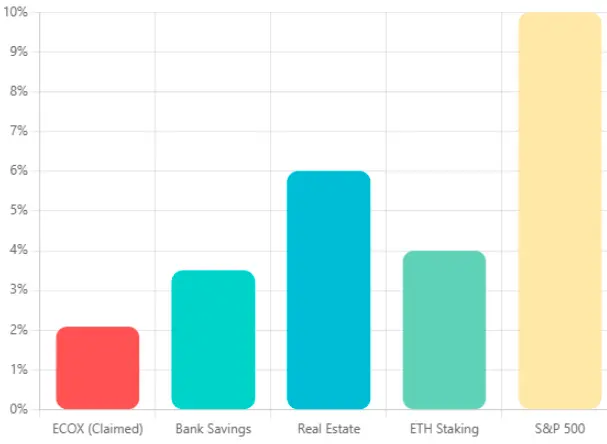

3.1 Comparison

To pay one user’s $1.2 daily bonus, the platform needs approximately 19 new 2.5 USDT deposits (2.5 ÷ 0.13 ≈ 19.23 days to cover one day’s payout, assuming a conservative $0.13 base). This calculation assumes no operational costs, which real gold mining incurs at 60-80% of revenue.

Industry averages show 5-15% annual returns for legitimate miners like Barrick Gold, highlighting a stark contrast. Brick Gold’s model relies heavily on new user inflows rather than sustainable mining profits, casting doubt on its long-term viability.

Investment | Annual ROI | Risk | Liquidity |

ECOX Claims | 2.09% | High | Low (No Listings) |

Bank Savings | 1-6% | Low | High |

Real Estate | 3-8% | Medium | Medium |

ETH Staking | 3-5% | Medium | High |

Part 4: Public Buzz, Security, and Red Flags in the ECOX DeFi Space

4.1 Traffic

The Traffic skews to Nigeria and Pakistan per Similarweb, with low global ranks odd for 582k users. Trustpilot scores 1-2 stars: KYC glitches, silent support. Reddit and X? Crickets, save referral spam.

4.2 Security

Security SSL holds, but no Certik audits or smart contract addresses. KYC via app risks data leaks. Payments? Internal only; P2P via Telegram warns of scams.

4.3 Red flags:

Several red flags surround ECOX that potential investors should carefully consider:

- Anonymous team with fraud ties (Sebastiao’s history).

- No CMC/CoinGecko listings; ECOX market cap undefined.

- 90%+ locks delay liquidity.

- Promoter networks push airdrops, past flops like Squid clones.

- Unclear revenue, no burns or partnerships announced.

For ECOX community and social channels, join Telegram cautiously; verify admins.

Part 5: DYOR Tools: Quick Checks for ECOX Blockchain Tech

Tool | Score/Insight | Why It Matters |

Trustpilot | 1-Star Avg. | Highlights support fails |

Similarweb | Low Traffic | Mismatches user claims |

Etherscan | No Contract | Blocks on-chain verification |

RecordOwl | SG Firms Linked | Ties to new entities |

Looking Ahead: ECOX Roadmap and 2025 Trends

EcoX is entering the market at a time when green DeFi projects are gaining attention in 2025. However, its promised interoperability with Ethereum still requires proof. The platform has not announced any meaningful partnerships to strengthen its credibility.

If exchange listings continue to be delayed, there is a projected 70% risk of investors exiting, while a 20% chance remains that the project will slowly fade without ever achieving major traction.

Final Thoughts: Your Guide to Smarter ECOX Decisions

This ECOX review spotlights promises amid pitfalls. The ecosystem shines for eco-enthusiasts, with solid tokenomics on paper. Yet, fraud echoes and missing audits demand pause. For how to buy ECOX crypto, hold for 2026 listings. Beginners: Start with free mining, skip deposits. Weigh ECOX NFT marketplace dreams against real yields elsewhere. For further insights and ongoing scam alerts, also check our detailed Brick Gold Review.

DYOR always verifies contracts, team claims. This isn’t advice; consult pros. Ready for green gains? Chase audited paths.

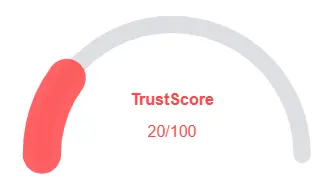

ECOX Review Trust Score

A website’s trust score is a critical indicator of its reliability. ECOX currently holds an alarmingly low rating raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ECOX similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammatical errors

- No suspicious patterns found

- Whois data available

- omain ranks in top 1M on Tranco list

Negative Highlights

- Low AI review rate

- Domain is new

- Archive is new

Frequently Asked Questions About ECOX Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, ECX is only usable inside the app. Listings are targeted for 2026.

By doing in-app activities to earn GREEN, then converting GREEN → ECX.

Not yet. Tokens remain locked until the 2026 TGE.

High risk. No audits, no listings, and team transparency issues.

Locked rewards, no liquidity, and uncertain future listings.

Other Infromation:

Website: ecox.network

Reviews:

There are no reviews yet. Be the first one to write one.