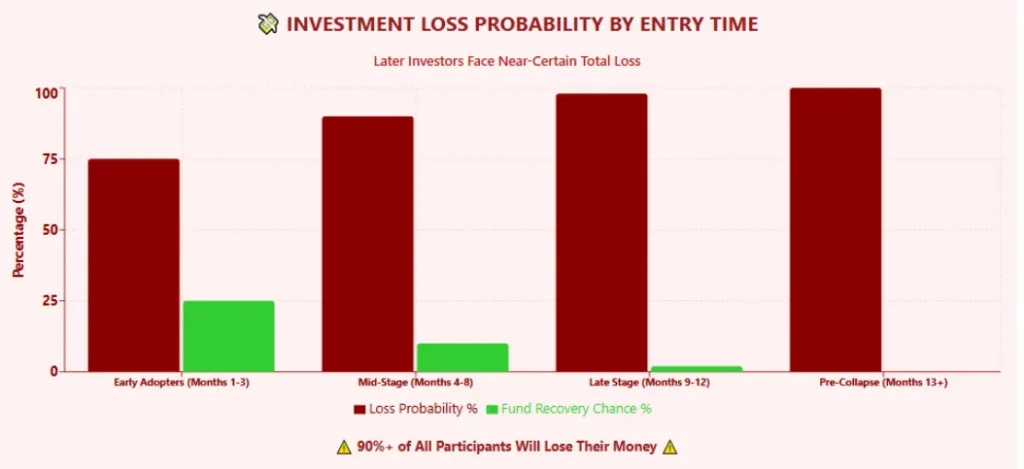

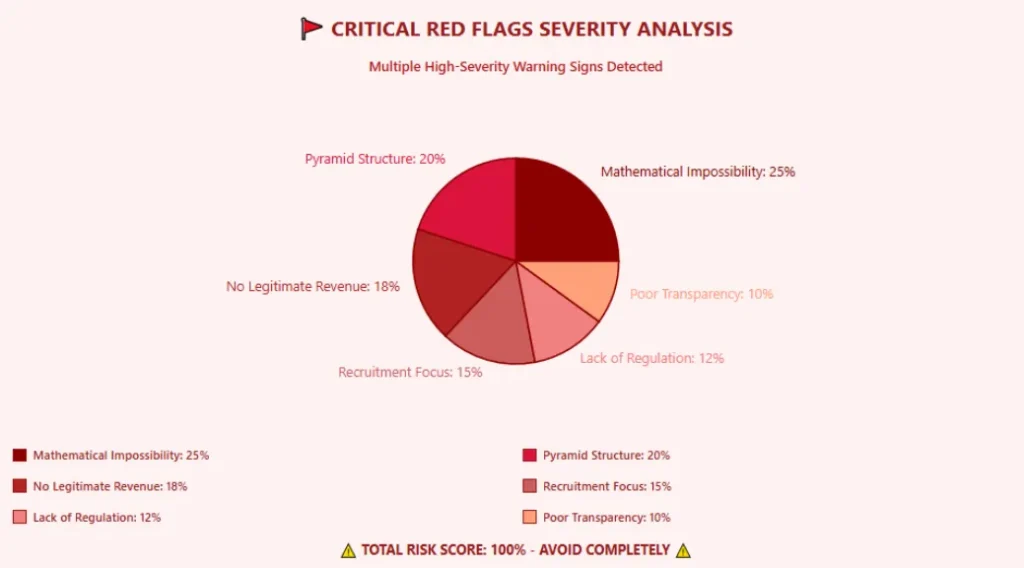

This Easylona review investigates the legitimacy and risks of Easylona International, a platform promising interest-free loans and high returns through a referral-based system. We analyze its ownership, compensation plan, traffic, public perception, security, and ROI claims to help you decide if it’s a scam or legit. Below, we present clear facts, charts, and comparisons to guide potential investors. For more scam investigations like this, visit our Scams Radar section.