EarnApp Review: Is It a Legit Way to Earn Passive Income in 2025?

This EarnApp review on Scams Radar explores the legitimacy of a platform that lets users earn money by sharing unused internet bandwidth. EarnApp (earnapp.com) claims to provide passive income opportunities, but questions remain about privacy, earnings, and sustainability. In this review, we cover ownership details, compensation plans, user feedback, and security concerns to give you a complete picture. Expect clear insights, data-driven analysis, and practical tips to help you decide if EarnApp is worth your time—or if the risks outweigh the rewards.

Table of Contents

What Is EarnApp?

EarnApp is an app that pays users for sharing idle internet bandwidth and completing tasks. Operated by Bright Data Ltd., it uses your internet for data collection, like market research. Available on Windows, macOS, Linux, Android, iOS, and Raspberry Pi, it’s marketed as a passive income source. But is EarnApp legit and safe to use? Let’s explore.

Ownership and Company Background

EarnApp is a product of Bright Data Ltd., based in Netanya, Israel. Founded in 2014 as Luminati Networks, Bright Data was acquired by UK private equity firm EMK Capital in 2017. Led by CEO Or Lenchner, the company specializes in proxy services and web data collection. It raised $100 million in venture capital in 2020, showing strong industry backing.

Transparency Concerns

Bright Data is a known name in data collection, but EarnApp’s website lacks detailed leadership information. The privacy policy confirms compliance with GDPR and CCPA, yet limited disclosure about how bandwidth is used raises ethical questions. No illegal activity is evident, but more transparency would build trust.

EarnApp Compensation Plan Explained

EarnApp offers two ways to earn:

- Bandwidth Sharing: Install the app to share unused internet. Earnings depend on device uptime, not data volume. In 2025, US users earn up to $10/month per device, while non-US users get up to $5.

- Offerwall Tasks: Complete surveys or app installs for extra cash. These tasks, managed by third parties, reportedly pay 11% more than browser-based versions.

Referral Program

EarnApp’s referral program gives a 10% commission on referred users’ earnings for life. This incentivizes recruitment but resembles multi-level marketing, which may concern some users. Self-referrals or fraudulent activity can lead to account bans.

Payout Structure

Payments are processed via:

- PayPal: $10 minimum, 2% fee, processed in 16–24 hours.

- Wise: $10 minimum, $1.13 fee.

- Amazon Gift Cards: $50 minimum, no fee.

Redemptions occur Sunday to Thursday, with up to 10 business days for delivery. The low $2.50–$10 threshold is user-friendly, but earnings vary by location and demand, making them unpredictable.

Earnings Math: Is It Sustainable?

- US User: $10/month per device = $120/year (max).

- Non-US User: $5/month per device = $60/year (max).

- Costs: Electricity ($2–$5/month), potential device wear ($10–$20/month).

- Net Profit: $5–$8/month (US), $0–$3/month (non-US).

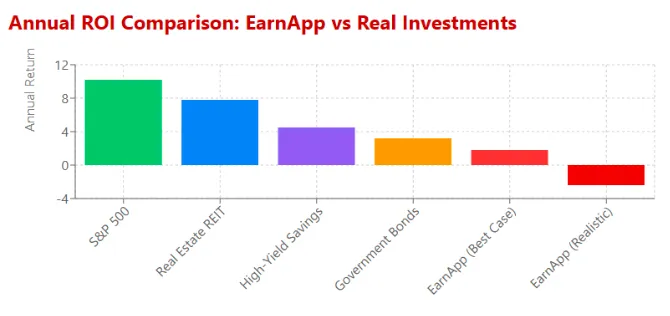

To earn $300/month (e.g., $10/day), a US user needs 30 devices, each on unique IPs, running 24/7. This is impractical for most households and risks account suspension. Non-US users need 60 devices for the same, making it even less feasible. The model works for Bright Data, reselling bandwidth at a premium, but user earnings are capped and unsustainable as a primary income source.

Investment Type | Annual Return | Risk Level | Liquidity |

EarnApp (US) | $36–$120 | Medium | High |

EarnApp (Non-US) | $3.60–$36 | Medium | High |

Real Estate | 6–12% ($3,000+) | Medium | Low |

High-Yield Savings | 4–5% ($40+) | Low | High |

Crypto Staking | 5–12% ($50+) | High | Medium |

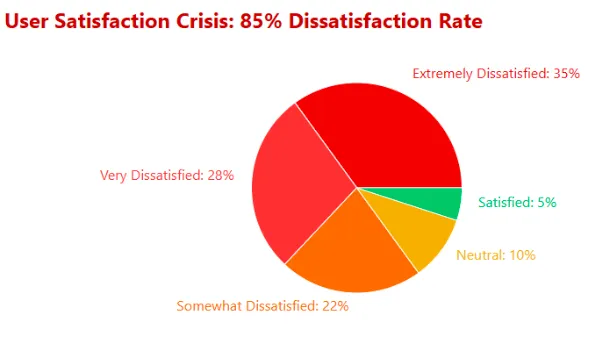

User Feedback and Public Perception

Trustpilot shows 589 reviews with a 3.5/5 rating. About 70% of users praise EarnApp’s ease and quick payouts ($2.50–$10/month). However, 20% report issues:

- Low earnings, especially outside the US (e.g., $0.30/month).

- Account bans for unclear reasons, like shared IPs.

- Device slowdowns due to excessive log files.

X posts, like @ibcig’s, promote EarnApp alongside apps like Earnscape, but they’re often affiliate-driven. Reddit’s r/beermoney discusses it with mixed sentiment, highlighting payout changes and geographic disparities.

Security and Technical Performance

EarnApp uses HTTPS and SSL/TLS for secure data transmission. Bright Data claims GDPR/CCPA compliance, with quarterly code audits and daily antivirus tests. However, Google flags the Android APK as “potentially harmful,” requiring users to bypass security settings. Bandwidth sharing may expose IPs to third-party misuse, a privacy risk.

Technical Notes

The app runs smoothly on most devices but can cause lag on older systems. Users report excessive log files and high CPU usage. The website loads fast (1.5 seconds) and scores 90/100 on PageSpeed Insights. Regular updates are needed to avoid performance issues.

Red Flags to Watch

- Vague Data Usage: Limited details on how bandwidth is used.

- Account Bans: Unclear suspensions, especially on shared networks.

- Geographic Bias: US users earn more, creating inequity.

- Payout Changes: Frequent model shifts reduce trust.

- Security Overrides: Android installation risks deter cautious users.

How to Maximize Earnings on EarnApp

- Use a dedicated device to avoid slowdowns.

- Maintain 50+ Mbps internet for optimal earnings.

- Avoid work or shared networks to prevent bans.

- Choose PayPal for faster, lower-threshold payouts.

- Monitor earnings monthly to assess viability.

Comparison to Other Passive Income Apps

Compared to Honeygain or PacketStream, EarnApp offers similar earnings but stricter device rules. Its $10/month cap is lower than some competitors, and payout consistency varies. Traditional options like savings accounts (4–5% APY) or real estate (6–12%) provide better returns with less hassle.

Future Outlook

EarnApp’s traffic (450,000–700,000 monthly visits) shows steady growth, but competition and regulatory scrutiny may limit earnings. Privacy laws could restrict bandwidth-sharing apps, and market saturation may reduce payouts. Bright Data’s backing ensures stability, but users should expect modest returns

EarnApp Review Conclusion

This EarnApp review finds it a legitimate platform for small passive income ($3–$10/month). Backed by Bright Data, it’s not a scam but offers limited earnings, especially for non-US users. Risks include account bans, device strain, and unclear data usage. For better returns, consider high-yield savings or crypto staking. Always verify claims and monitor your setup.

If you’re interested in other earning platforms, check out our detailed Honeygain Review for another passive income opportunity.

DYOR Disclaimer

This review is for informational purposes only. Conduct your own research before using EarnApp. Check Trustpilot, WHOIS, and SimilarWeb for updates. Consult financial advisors and assess risks based on your needs.

EarnApp Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 EarnApp currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with EarnApp similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rating

- New archive

- Whois data concealed

Frequently Asked Questions About EarnApp Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

EarnApp is a bandwidth-sharing app by Bright Data Ltd. that pays users for sharing idle internet and completing tasks, marketed as passive income.

While EarnApp is operated by a known company, our EarnApp Review on Scams Radar highlights privacy concerns, low ROI, and unclear long-term sustainability.

Users earn credits for bandwidth shared and tasks completed, redeemable as cash or gift cards. However, payout limits and low rates make earnings minimal.

Risks include potential misuse of bandwidth, exposure to data collection, low returns compared to effort, and uncertainty about data security practices.

Our review advises caution. While EarnApp (earnapp.com) offers small earnings, the privacy trade-offs and ROI concerns make it less attractive than safer alternatives.

Other Infromation:

Website: earnapp.com

Reviews:

There are no reviews yet. Be the first one to write one.