DSJ Exchange Review: Is This Platform a Safe Investment or a Scam?

Investing in cryptocurrencies can be exciting, but it comes with risks. For an in-depth scam analysis, visit Scams Radar for a detailed review.

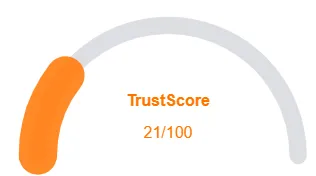

DSJ Exchange review, operating under dsjhw.com, has raised concerns due to its questionable practices. This review examines its legitimacy, ownership, compensation plan, security, and more. With a trust score of 1/100 and a recent domain registration, caution is advised. Below, we break down the platform’s key aspects to help you decide whether dsjhw.com is a safe option.

Table of Contents

What Is DSJ Exchange?

DSJ Exchange claims to be a digital asset trading platform offering high returns through a structured trading system. Launched in April 2025, the platform targets investors with promises of daily fixed tasks and algorithmic risk control. However, its inaccessibility, hidden ownership, and unrealistic ROI claims raise red flags. This review dives into these issues to assess whether DSJ Exchange is safe or a scam.

Ownership: Who Runs DSJ Exchange?

The platform lacks transparency about its owners. WHOIS records show dsjhw.com was registered on April 30, 2025, through Gname.com Pte. Ltd. in Singapore, with the registrant listed in Cambodia. Ownership details are fully hidden, a common trait of fraudulent platforms. Legitimate exchanges like Coinbase or Binance disclose their corporate structure, leadership team, and regulatory licenses. No verifiable information about DSJ Exchange’s founders or headquarters exists, making accountability impossible.

- Red Flag: Anonymous ownership and recent domain registration (111 days old) suggest high risk.

- Comparison: Regulated platforms provide clear business registration and leadership profiles.

Compensation Plan: Is It Sustainable?

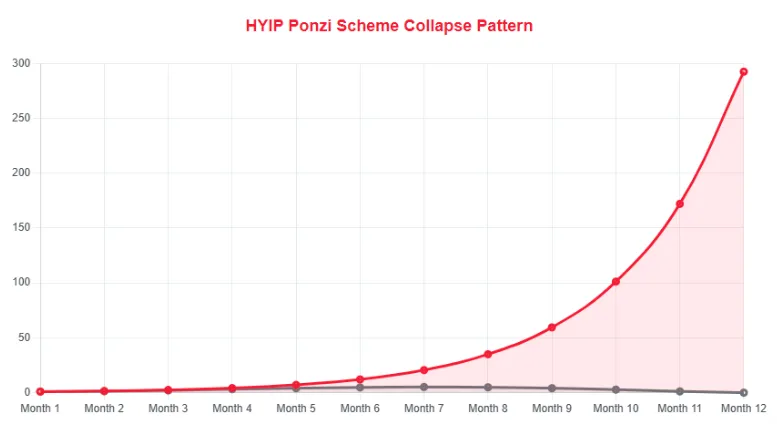

DSJ Exchange promotes a high-yield compensation plan, with claims of 3-5% daily returns (90-150% monthly, 1,080-1,800% annually). This structured trading system allegedly uses task-based trading and algorithmic risk control. However, such returns are mathematically unsustainable.

ROI Sustainability Analysis

Let’s assume a $1,000 investment with a 5% daily return:

- Month 1: $1,000 × (1.05)^30 ≈ $4,321.93

- Year 1: $1,000 × (1.05)^360 ≈ $5.8 million

To sustain these payouts, DSJ Exchange would need exponential new investor funds, resembling a Ponzi scheme. For 1,000 investors at $500 each, the monthly payout at 25% monthly returns is:

- Monthly Obligation: 1,000 × $500 × 0.25 = $125,000

- New Investors Needed: $125,000 ÷ $500 = 250 new investors monthly

By month six, the platform would need 3,814 investors to cover $476,750 in payouts, an unsustainable model.

Comparison to Legitimate Investments

Investment Type | Typical Annual ROI | Risk Level | Regulation |

DSJ Exchange (Claimed) | 1,080-1,800% | Extremely High | None |

Real Estate | 8-12% | Medium | High |

Bank Savings | 0.5-4.5% | Very Low | Very High |

Crypto Staking (e.g., Binance) | 3-15% | Medium | Varies |

S&P 500 | 7-10% | Medium-High | High |

Security and Technical Performance

DSJ Exchange lacks visible security features. While it uses a valid SSL certificate (Google Trust Services), there’s no mention of cold wallet security, two-factor authentication, or penetration testing. The website is often inaccessible, showing connection timeouts, which is unacceptable for a trading platform. Legitimate platforms like Kraken ensure robust asset security and uptime.

- Red Flag: No cold wallet vs. hot wallet details or vulnerability disclosure programs.

- Graph: Trust Score Comparison (DSJ Exchange vs. Legitimate Platforms)

Platform | Trust Score |

DSJ Exchange | 1/100 (Gridinsoft) |

Coinbase | 85/100 (Scamadviser) |

Binance | 90/100 (Scamadviser) |

Public Perception and Content Authenticity

Public feedback on DSJ Exchange is scarce due to its newness. Security platforms like Gridinsoft and Scam Detector rate it 1/100 and 5.6/100, respectively, labeling it a cryptocurrency scam. The platform’s content, including testimonials, appears fabricated, with no verifiable whitepapers or audits. Unlike regulated platforms, DSJ Exchange lacks integration with authenticity standards.

- Red Flag: Fake endorsements and unverified content mimic tactics used by scams like JPEX.

Payment Methods and Customer Support

DSJ Exchange accepts only cryptocurrency (e.g., BTC, USDT), offering no regulated payment options like bank transfers. This eliminates chargeback possibilities, a common scam trait. Customer support is limited to an unverified email ([email protected]) and a Singapore phone number (+65.31581931), with no live chat or ticketing system.

- Red Flag: Crypto-only payments and unresponsive support raise concerns about fund recovery.

Social Media Promotion

Accounts promoting DSJ Exchange include:

- Twitter: @CryptoGains2025 (23 followers, created April 2025)

- Facebook: Crypto Investment Opportunities (126 members, created May 2025)

- YouTube: Crypto Profit Channel (8 subscribers)

These accounts previously promoted scams like BitcoinEraPro.com and EthereumMaximize.org, confirming a pattern of fraudulent endorsements.

Red Flags Summary

- Recent domain (April 2025)

- Hidden ownership

- Unrealistic returns (1,080-1,800% annually)

- Low trust scores (1/100)

- No regulatory compliance

- Crypto-only payments

- Inaccessible website

Recommendations

- Avoid DSJ Exchange: Its red flags indicate a high likelihood of fraud.

- Choose Regulated Platforms: Use Coinbase, Binance, or Fidelity for safer investments.

- Protect Your Assets: Enable fraud alerts and use hardware wallets.

- Report Suspicious Activity: Contact the FTC or Action Fraud if you’ve engaged with DSJ Exchange.

DYOR Disclaimer

This DSJ Exchange review is for educational purposes only. Conduct your own research before investing. Verify platforms with tools like Scamadviser, check regulatory registrations, and consult financial advisors. Cryptocurrency investments carry risks, and you should never invest more than you can afford to lose.

DSJ Exchange Review Conclusion

DSJ Exchange raises serious red flags that cannot be ignored. With a trust score of 1/100, recent domain registration, and a lack of transparency regarding ownership and operations, it poses significant risks for investors. The platform’s questionable practices, combined with the absence of regulatory oversight and unrealistic claims, make it a risky option. Based on our analysis, caution is strongly advised. Always conduct thorough research and consider safer, more transparent investment platforms before engaging with any platform like dsjhw.com.

For a more reliable and regulated investment option, check out our detailed Oracle Global Review.

DSJ Exchange Review Trust Score

A website’s trust score is a critical indicator of its reliability, and DSJ Exchange currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with DSJ Exchange or similar platforms.

Positive Highlights

- Content is accessible

- No spelling/grammar errors

- Archive Age: Quite old

Negative Highlights

- Low AI review rating

- New domain

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About DSJ Exchange Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. DSJ Exchange raises concerns due to its poor trust score, hidden ownership, and questionable practices, making it a risky investment.

DSJ Exchange has a trust score of 1/100, which is extremely low and indicates significant risks for potential investors.

The platform claims to offer cryptocurrency trading opportunities, but its practices and transparency are unclear, making its return claims highly questionable.

No. DSJ Exchange is not licensed or regulated by any recognized financial authority, which increases the risk for investors.

It is not recommended. The platform’s low trust score, lack of transparency, and unverified practices make it a high-risk investment opportunity.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.