Dozo Trade Review: Assessing the Platform's Legitimacy and Risks

In this Dozo Trade review, Scams Radar examines the platform’s features, ownership, and potential pitfalls for investors. Launched in 2025, Dozo Trade positions itself as an AI trading tool for crypto and forex. We cover key aspects, such as compensation, returns, and security, to help you decide if it’s a safe investment.

Table of Contents

Part 1: Understanding the Dozo Trade Platform

Dozo Trade offers automated trading through AI. Users connect via APIs to exchanges. The system handles trades 24/7. It includes risk optimization and real-time insights. The dashboard shows portfolio performance. Claims focus on ease for beginners and pros alike.

The site highlights testimonials. Users praise the quick setup and gains. But these lack verification. Content feels generic. No unique data backs claims. This raises questions about content authenticity.

Dozo Trade targets crypto trading and forex trading. It promises better results than manual methods. Features include trading strategies and tools. Yet, no demos or backtests appear on the site.

1.1 Ownership and Background Details

Ownership ties to DOZOTRADE LIMITED. This UK firm was formed on January 28, 2025. Company number is 16212767. Address: Flat 58 Cullum Welch House, Golden Lane Estate, London, EC1Y 0SH.

Directors and key controllers: Harrison Dean (born August 1982) and Wilson Wayne (born June 1992). Each holds 25-50% voting rights. Harrison Dean also appoints directors.

Searches show limited backgrounds. Harrison Dean links to various roles elsewhere. One is a manufacturing engineer. Another is a medical student. No clear finance or tech history connects to Dozo Trade. Wilson Wayne yields no public profiles or experience in trading.

This lack of transparency matters. Legit firms share leader bios. Here, the team stays vague. No LinkedIn links or past achievements.

Part 2: Breaking Down the Compensation Plan

The plan blends fixed returns with referrals. Base: 1% daily dividend up to 200% on deposits. Boosts come from recruiting.

- With 3 direct referrals: 2% daily.

- 6 referrals: 3% daily.

- 9 referrals: 4% daily.

- 12 referrals: 5% daily.

Team bonuses span unlimited levels. Ranks pay per ID. Society Club cycles: $100 every hour if 3 referrals or top-ups occur.

Fees deduct 30%: 5% processing, 5% liquidity, 20% to top-up wallet. Withdrawals: Min $10, once daily.

Payments use VAYA USDT. This token’s details are unclear. It may not match standard USDT. Liquidity and redeemability need checks.

The plan requires a Sponsor ID for signup. This points to the MLM structure. Focus shifts from trading to recruiting.

2.1 ROI Claims and Why They Raise Concerns

Dozo Trade promises steady gains. But real markets vary. Fixed 1% daily annualizes to over 3,600% compounded. With boosts, it skyrockets.

We calculated using math. For 1% daily: (1 + 0.01)^365 – 1 = 3,678%. For 5%: Massive 5.4 billion %.

Banks offer 4-7%. Real estate: 8-12%. Crypto APY: 5-15%. Dozo Trade dwarfs these. No strategy sustains this without risks.

Payouts likely rely on new funds. This mirrors unsustainable models.

Part 3: Security Features and Payment Methods

Traffic analysis tools indicate extremely low engagement. SimilarWeb returned no data (status code 202, suggesting insufficient metrics), and ScamAdviser notes a low Tranco rank, implying few visitors. For a project launched in September 2025 (per roadmap), this lack of organic traffic suggests reliance on paid promotions rather than genuine interest.

3.1 Public Perception: Sparse and Concerning

Claims include encrypted APIs. Funds stay on exchanges. SSL is valid.

But Wallet Connect contradicts this. Funds may move to controlled addresses.

Payments: Only VAYA USDT. Withdrawal issues could arise from fees and limits.

3.1 Traffic Trends and Technical Performance

The site claims “audited smart contracts” and multi-layered security but provides no audit reports, firm names, or links. A valid DV SSL certificate exists (issued by Google Trust Services), but this is basic. No contract address is published, preventing on-chain verification of minting privileges or honeypots.

3.3 Content Authenticity: Inconsistencies Abound

Traffic is low. Global rank: Over 24 million. Few visitors monthly. Domain started May 5, 2025. New sites build slowly.

Site loads fast via Cloudflare. HTTPS secures it. But no uptime data or tests were shared.

3.2 Public Perception and Customer Support

Reviews are scarce. ScamAdviser scores 81/100. Notes new domain, low traffic.

Trustpilot: No page. Similar sites rate 3.5-4 stars. Some mention delays.

Reddit: No scam threads found.

Support: Email only (support@dozotrade.com). No chat or phone. Response time unknown.

User experience seems beginner-friendly. But the lack of forums hurts.

Red Flags and Comparisons

Key issues:

- New entity, unproven owners.

- Recruitment-heavy plan.

- No regulatory status. Not FCA-authorized.

- Opaque token, high fees.

- Generic content, no proofs.

Vs. legit options: Binance has regulated APY 5-10%. Dozo Trade lacks scale.

Trading bot vs manual: Claims outperform, but unverified.

Recommendations

Test small if curious. Watch withdrawals. Seek audits and compliance.

DYOR: Check FCA, Companies House.

This Dozo Trade review shows high risks. Crypto carries losses. Consult experts.

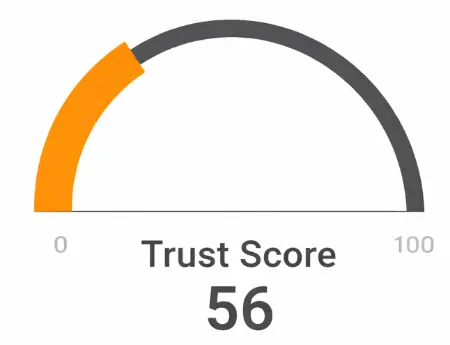

Dozo Trade Review Trust Score

A website’s trust score is an important indicator of its reliability. Dozo Trade currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Dozo Trade or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions About Dozo Trade Review

This section answers key questions about Dozo Trade, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Dozo Trade shows high-risk signs such as fixed daily ROI claims, MLM referrals, and a lack of verified trading proof.

It claims AI-based crypto and forex trading, but provides no audited results, backtests, or live trade verification.

No. The promised returns are far higher than banks, real estate, or legitimate crypto APYs, making them unsustainable.

Both Dozo Trade Review and Everstead Review highlight similar red flags, such as unrealistic returns and unclear income sources.

The promise of fixed 1–5% daily returns is mathematically unsustainable in real markets.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.