Defi Miner Review: Is This Cloud Mining Platform Worth Your Time and Money?

Scams Radar examines that thousands of people will search for easy ways to earn passive income through cryptocurrency. One name that keeps popping up is Defi Miner, a cloud mining service promising daily rewards without buying expensive hardware. But is Defi Miner legit, or just another high-risk platform that sounds too good to be true?

This honest Defi Miner review looks at everything: the company behind it, the exact earnings plans, real user experiences, security checks, and the hard math on those returns. We pull together facts from UK company records, independent scanners, and current 2025 data so you can decide for yourself.

Table of Contents

Part 1: Who Runs Defi Miner? Company and Ownership Details

Defi Miner operates under DEFI TECH INVESTING LTD, a UK-registered company (number 13369211) incorporated on 30 April 2021. The registered address is currently 271 Bensham Lane, Thornton Heath, England. The sole active director is Colis Deon (born October 1986, British nationality).

Having a real UK company is better than many anonymous crypto sites. It costs only £12 to set one up, though, and the business is classified as “IT consultancy”, not financial services or mining. No public information exists about Colis Deon’s background in cryptocurrency, mining operations, or finance. No LinkedIn profile, no previous companies, no interviews. That’s unusual for someone running a platform that claims to serve millions of users.

The site repeatedly calls itself “FCA-regulated.” As of November 2025, direct searches on the official FCA register show no authorisation for DEFI TECH INVESTING LTD or Defi Miner to conduct regulated financial activities in the UK. Making false regulatory claims is illegal in Britain.

Part 2: Defi Miner Cloud Mining Plans The Complete 2025 Compensation Table

Defi Miner offers fixed-term contracts paid in USDT. Daily profits are credited automatically, and they promise your principal back at the end.

Here is the full current contract list (taken directly from their press releases and platform):

| Investment (USDT) | Contract Length | Daily Rate | Daily Earnings (USDT) | Total Profit (USDT) | Profit % | Annualised (approx) |

Investment | Duration | Daily Interest | Daily Earnings | Total Earnings | ROI (%) |

100 | 1 day | 1.6% | 1.60 | 1.60 | 584% |

200 | 2 days | 3.1% | 6.20 | 12.40 | ~1,132% |

520 | 3 days | 2.6% | 13.52 | 40.56 | ~949% |

1,280 | 5 days | 2.9% | 37.12 | 185.60 | ~1,059% |

3,500 | 7 days | 3.1% | 108.50 | 759.50 | ~1,132% |

6,800 | 8 days | 3.25% | 221.00 | 1,768 | ~1,186% |

11,800 | 10 days | 3.4% | 401.20 | 4,012 | ~1,241% |

19,800 | 12 days | 3.6% | 712.80 | 8,553 | ~1,314% |

29,000 | 15 days | 3.9% | 1,131 | 16,965 | ~1,423% |

46,800 | 7 days | 5.6% | 2,620 | 18,345 | ~2,044% |

68,000 | 5 days | 7.0% | 4,760 | 23,800 | ~2,555% |

98,000 | 3 days | 8.4% | 8,232 | 24,696 | ~3,066% |

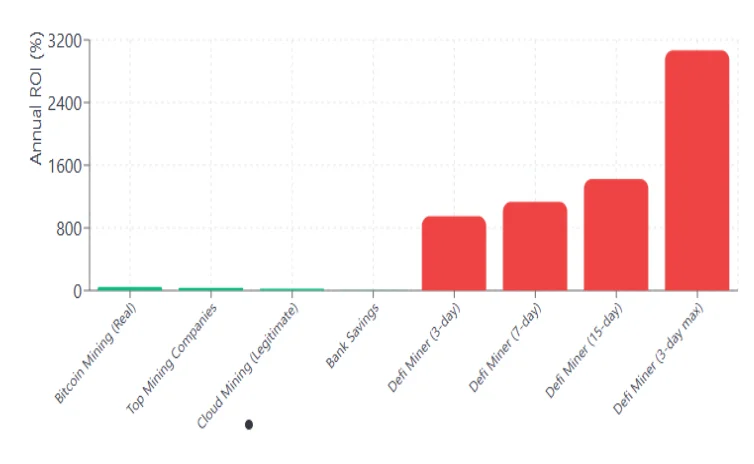

2.1 Why These Returns Are Mathematically Impossible in Real Mining

Take the popular $29,000 × 15-day contract → 58.5% profit.

If you rolled that money every 15 days for a year (≈24 cycles), your money would multiply by 1.585²⁴ ≈ 73,685 times.

$29,000 becomes over $2.1 billion in 12 months.

Even the “small” $100 free trial annualises to 584% if repeated.

Real 2025 Bitcoin mining profitability (after the 2024 halving):

- Top public miners (Marathon, Riot, CleanSpark) run 30-45% gross margins in good quarters.

- Best-case individual ROI with cheap electricity and newest ASICs: 30-60% per year.

- Most legitimate cloud mining services (ECOS, Bitdeer, NiceHash) deliver 10-40% annually when profitable, and often go negative.

Defi Miner promises 15-100 times higher returns than the best professional miners on earth, with zero risk and principal guaranteed.

There is only one business model that can pay those numbers: using new deposits to pay old investors. That is the exact definition of a Ponzi scheme.

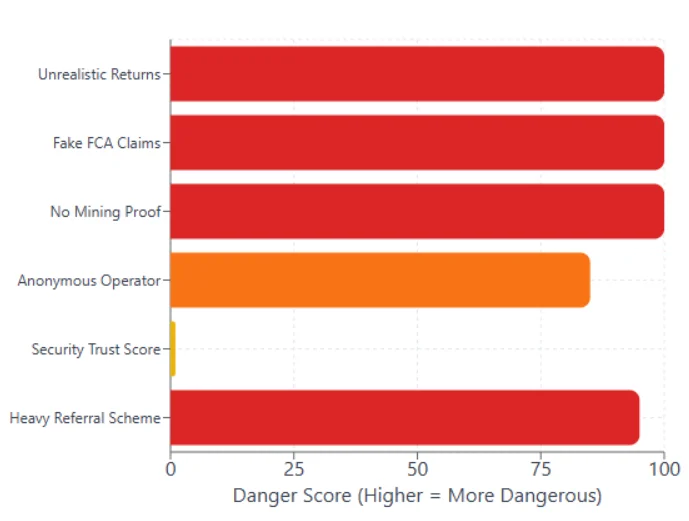

Part 3: Current Security Scanner Results

- Gridinsoft → 1/100 trust score explicitly labelled “Financial Scam” for both defiminer.com and app.defiminer.com

- ScamAdviser → Very low trust on main domain, low on variants

- Trustpilot → Only 5 reviews total, still carries the warning “may be associated with high-risk investments”

Related domains like defining. The website has 79% 1-star reviews complaining of no withdrawals.

3.1 Defi Miner User Experience and Registration Process in 2025

Registration is simple: email + password → instant $100 free trial balance → starts earning 1.6 USDT/day.

The interface is clean and mobile-friendly, supporting deposits via USDT (TRC20 or ERC20). Early small withdrawals often work smoothly, a classic technique to build trust before larger amounts are locked.

Customer support: email and a UK phone number. Responses are quick while depositing, but many similar platforms go silent when big withdrawals are requested.

Is Defi Miner Safe for Crypto Mining? The Honest Answer

No evidence exists of actual mining pools, verifiable hashrate, or third-party audits.

No public wallet addresses are showing real block rewards.

All “proof” stays inside their dashboard, impossible to verify independently.

Every single red flag of 2024-2025 cloud mining scams is present:

- Unrealistic fixed returns

- Principal guarantee

- Heavy referral bonuses

- Fake regulatory claims

- 1/100 trust scores from security tools

- Paid press releases instead of organic growth

Final Verdict and Recommendation

Defi Miner presents itself well with a real UK company and polished marketing. The numbers, however, tell a different story. Returns this high with guaranteed principal are not possible through genuine mining in 2025-or any year.

This platform shows every characteristic of a high-yield Ponzi scheme dressed up as cloud mining.

Our clear advice: Do not invest any money you are not 100% prepared to lose. The $100 free trial is harmless to test withdrawal speed, but anything beyond that carries extreme risk.

Safer alternatives for passive crypto income in 2025:

- Licensed staking on Coinbase, Binance, or Kraken (3-12% realistic)

- Publicly traded mining stocks, if you want mining exposure

- Self-custody lending on audited DeFi protocols (Save, Compound)

Always verify claims directly on official regulator sites and never trust press releases alone.

Do your own research, check everything twice, and only risk what you can truly afford to lose. Stay safe out there.

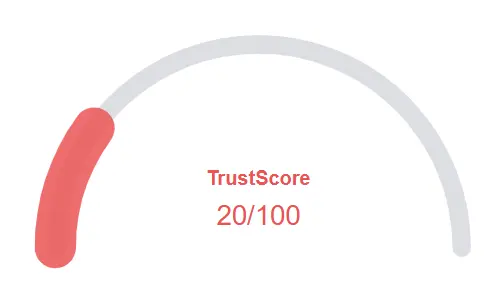

Defi Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. Defi Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Defi Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About Defi Miner Review

This section answers key questions about Defi Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Defi Miner shows all major Ponzi red flags and offers impossible ROIs.

It claims 3%-8% daily, but these earnings are not realistic or sustainable.

No. There is no verified hashrate, mining pool data, or third-party audits.

Fake regulatory claims, unrealistic returns, referral-based payouts, and low trust scores.

Like platforms flagged in the Everstead Review, it shows typical HYIP scam indicators.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.