DAOBIT Review: Is This Crypto Platform Safe for Investors?

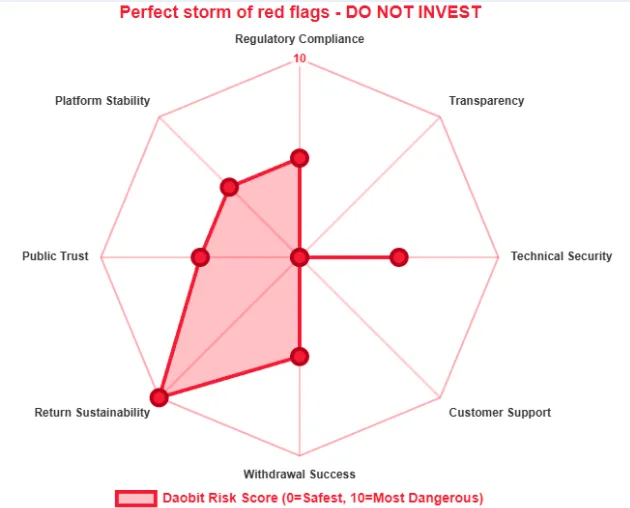

This DAOBIT review examines the legitimacy of the DAOBIT trading platform, focusing on its ownership, compensation plan, and risks for investors. For an in-depth scam analysis, visit Scams Radar for a detailed review. Operating as a cryptocurrency exchange, DAOBIT claims to offer high returns through trading, staking, and referral programs. However, concerns about transparency, regulation, and unsustainable promises raise red flags. This analysis helps beginners understand whether daobit.com is a safe choice, using clear language, charts, and bullet points to compare it with safer alternatives.

Table of Contents

What Is DAOBIT?

DAOBIT presents itself as a global cryptocurrency exchange offering spot trading, futures trading (up to 125× leverage), margin trading (3×), staking, and copy trading. It claims to be operated by DAOBIT HOLDINGS LIMITED, a Colorado-registered entity formed on September 16, 2024, and touts a U.S. FinCEN MSB license. Features include a user-friendly interface, a mobile app hosted on AWS S3, and a promotional “20,000 USDT signup bonus.” Despite these claims, multiple issues suggest caution.

Ownership and Transparency Concerns

DAOBIT’s ownership lacks clarity, a critical factor for trust in crypto platforms:

- Company Details: DAOBIT HOLDINGS LIMITED is listed in Colorado’s business registry (ID 20241965716, address: 1312 17th St Suite 347, Denver, CO 80202). However, this registration does not confirm an exchange license.

- Regulatory Claims: The platform claims a FinCEN MSB license, but no record appears in FinCEN’s public database, making this claim unverified.

- Hidden WHOIS Data: The domain, registered on May 4, 2016, uses privacy protection, hiding ownership details. Legitimate exchanges like Binance disclose leadership and addresses.

Red Flag: Anonymous ownership and unverified licensing are major risks. Always check regulator databases like FinCEN or SEC before investing.

DAOBIT Compensation Plan Explained

DAOBIT’s compensation plan promotes high returns through trading Bitcoin, NFTs, altcoins, staking, and referral bonuses. Here’s how it works:

- Trading and Staking: Promises daily returns (e.g., 1–3%) via spot, futures, and copy trading, plus staking rewards.

- Referral Program: Offers bonuses for recruiting new users, resembling multi-level marketing (MLM) tactics.

- Signup Incentives: Advertises a “20,000 USDT” bonus to attract deposits, followed by pressure to invest more.

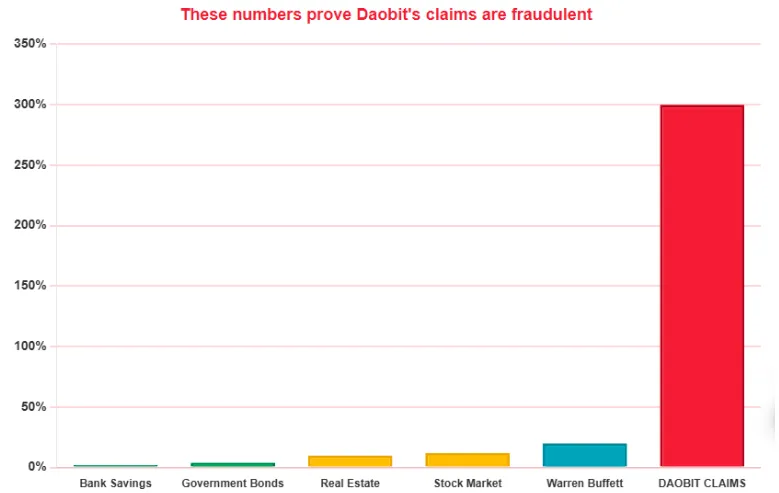

Why Returns Are Unsustainable

DAOBIT’s promised returns are mathematically impossible. Consider a 2% daily return:

- Daily: $1,000 × 1.02 = $1,020

- Monthly: $1,000 × (1.02)³⁰ ≈ $1,811

- Yearly: $1,000 × (1.02)³⁶⁵ ≈ $1,377,400 (137,740% APY)

Investment Type | Annual ROI | Time to Double |

DAOBIT (2% daily) | ~137,740% | ~35 days |

Real Estate | 6–10% | ~7–12 years |

Bank Savings | 4–5% | ~14–18 years |

Crypto Staking (Binance) | 2–10% | ~7–35 years |

Security and Technical Performance

DAOBIT claims robust security, including:

- Cold-hot wallet separation

- Two-factor authentication (2FA)

- DDoS protection

- Device access controls

However, these claims lack evidence:

- SSL Certificate: Uses a basic Domain Validated SSL, not Extended Validation (EV), offering minimal business verification.

- Accessibility Issues: Frequent downtime and connection failures indicate instability.

- No Audits: No proof of cold storage, multi-signature wallets, or third-party audits, unlike trusted exchanges.

Red Flag: Unverified security claims and technical issues undermine reliability.

Payment Methods and Withdrawal Issues

DAOBIT primarily accepts cryptocurrency deposits (e.g., Bitcoin, USDT) and mentions C2C fiat-to-USDT ramps. However:

- Opaque Policies: No clear list of supported payment methods or banking partners.

- Withdrawal Problems: Users report delays, fees, or account lockouts, a common scam tactic.

Red Flag: Crypto-only payments and withdrawal issues increase risk.

Public Perception and Social Media

Public sentiment is negative:

- ScamAdviser: 66/100 trust score, with 159 reviews averaging 1.9/5 stars.

- Trustpilot: 3.2/5 from three reviews, two labeling DAOBIT a scam.

- Social Media: The X account (@DaoBit_Official) and Telegram (~10.8k subscribers) promote “AI risk control” and “global compliance,” but lack engagement. YouTube and Instagram posts warn of scams, with deepfake promotions (e.g., Elon Musk) noted.

Red Flag: Negative reviews and deceptive marketing suggest fraud.

Comparing DAOBIT to Trusted Platforms

Feature | DAOBIT | Binance | Coinbase |

Regulation | Unverified MSB | FCA, others | SEC, others |

Transparency | Hidden ownership | Public leadership | Public leadership |

Annual ROI | ~137,740% (claimed) | 2–10% | 2–8% |

Withdrawals | Reported issues | Reliable | Reliable |

Recommendations for Investors

- Avoid DAOBIT: Unregulated status, unrealistic returns, and withdrawal issues make it high-risk.

- Choose Regulated Exchanges: Use Binance, Coinbase, or Kraken for transparent, audited services.

- Verify Licensing: Check FinCEN, FCA, or SEC databases for legitimacy.

- Test Withdrawals: If invested, attempt small withdrawals and document all transactions.

Use DYOR Tools: Check ScamAdviser, Trustpilot, and CoinGecko for reviews.

DAOBIT Review Conclusion

This DAOBIT review highlights significant risks: anonymous ownership, unverified licensing, unsustainable returns, and withdrawal issues. The platform’s MLM-style compensation and deceptive marketing mirror Ponzi schemes. Similar concerns were noted in our PhoenixFx AiWorld Review, where hidden ownership and unrealistic ROI claims posed serious investor risks. Investors should prioritize regulated exchanges like Binance or Coinbase for safety. Always verify claims using FinCEN, ScamAdviser, or Trustpilot, and consult financial advisors before investing.

DYOR Disclaimer: This DAOBIT review is based on public data as of August 12, 2025, and is not financial advice. Conduct independent research, verify regulatory status, and only invest what you can afford to lose.

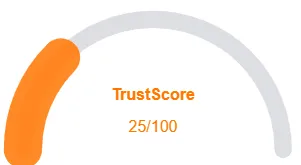

DAOBIT Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and DAOBIT a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with DAOBIT or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- No spelling or grammar errors

- Old domain age

- Old archive age

Negative Highlights

- Low AI review score

- Hidden WHOIS data

Frequently Asked Questions About DAOBIT Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. DAOBIT raises concerns due to its lack of transparency, questionable ROI claims, and absence of clear regulatory oversight.

It claims to provide high returns through cryptocurrency trading, staking, and referral programs, but these promises appear unsustainable.

No. DAOBIT is not licensed by any recognized financial regulator, making it a high-risk platform for investors.

Risks include potential fund loss, lack of legal protection, unsustainable earnings promises, and unclear operational practices.

It’s not recommended. The platform’s red flags, lack of regulation, and unrealistic returns make it an unsafe choice for investors.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.