Cvcapitals Review: Is This Investment Platform Legitimate?

This Cvcapitals review examines the platform’s legitimacy, ownership, compensation plan, and risks. For an in-depth scam analysis, visit Scams Radar for a detailed review.

Cvcapitals, accessible at cvcapitals.com, claims to offer high returns and advanced trading solutions. However, limited transparency, lack of regulatory oversight, and unverified ROI claims raise concerns. Read on to explore whether cvcapitals is safe, covering ownership, compensation, security, and more, with clear insights and comparisons to real-world investments.

Table of Contents

Ownership and Corporate Transparency

The platform provides no clear ownership details. Unlike CVCapital, a legitimate investment bank in Shanghai, it lacks verifiable information about its founders or leadership. CVCapital, known for M&A advisory and cross-border deals, lists its team and history. In contrast, the reviewed platform hides its WHOIS data, a tactic often used by questionable sites. The domain, registered on July 13, 2025, is only months old, raising doubts about its credibility.

Key Ownership Concerns

- No Leadership Profiles: No names or credentials for executives or advisors.

- Hidden Registration: WHOIS privacy conceals the domain’s true owners.

- Recent Domain: A 40-day-old domain lacks the history of trusted firms like CVCapital.

Compensation Plan Analysis

The compensation structure mirrors multi-level marketing (MLM) models, not typical for regulated trading platforms. Promotional content suggests rewards like referral commissions, rank bonuses, and global turnover shares. This resembles Ponzi schemes, where payouts depend on new investor funds, not legitimate profits.

Compensation Structure Breakdown

Income Type | Description | Risk Level |

Level Income | Earnings from referrals | High |

Booster Level Income | Higher commissions for recruitment volume | High |

Rank & Reward | Bonuses for achieving ranks | High |

Monthly Salary | Fixed payouts, unusual for trading bots | High |

Global Turnover Income | Share of platform revenue | High |

Millionaire Club Income | Rewards for top recruiters | High |

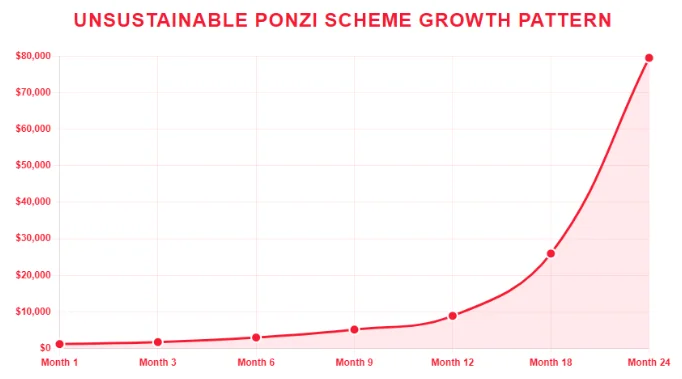

ROI Claims and Sustainability

The platform claims an 81% win rate and 47.1% annual returns, far exceeding realistic benchmarks. Let’s break down the math for a $1,000 investment at 47.1% annually:

- Year 1: $1,471

- Year 3: ~$3,179

Compare this to legitimate options:

Investment Type | Annual ROI | 3-Year Return ($1,000) |

Real Estate (REITs) | 8–12% | $1,260–$1,404 |

Bank Savings | 4–5% | $1,157–$1,225 |

Crypto Staking (ETH) | 4–10% | $1,125–$1,331 |

Cvcapitals (Claimed) | 47.1% | $3,179 |

Analysis: Sustaining 47.1% returns requires high-risk assets, unlike CVCapital’s measured approach to private placement deals. Without audited data, these claims are unsustainable.

Traffic Trends and Public Perception

Traffic data shows low engagement, with visits mainly from South Asia and Africa, driven by referral campaigns. No reputable financial outlets mention the platform, unlike CVCapital’s coverage in M&A and deal value reports. Social media presence is limited to promotional YouTube videos and a Facebook page with minimal engagement.

Public Perception Issues

- No Independent Reviews: Absent from Trustpilot or SiteJabber.

- Promotional Tactics: Relies on Telegram and WhatsApp groups, often linked to other risky platforms like FCX or XTB.

- Low Trust Scores: ScamAdviser rates similar domains poorly, citing hidden WHOIS and negative feedback.

Customer Support

No dedicated customer support channels (e.g., live chat, email, or phone) are prominently listed on Nuvix.com. Legitimate platforms typically provide clear contact options and response time guarantees. The absence of a support framework suggests limited operational capacity or intent to avoid accountability. For comparison, established companies like Nuix offer robust support for their investigative software, including training and implementation services. The lack of visible support options on Nuvix.com is a significant red flag.

Security and Content Authenticity

The site uses basic HTTPS but lacks advanced security like 2FA or segregated accounts, unlike CVCapital’s robust compliance in financial services. Content is generic, with placeholder text like “0 K Users Joined,” suggesting a template site. Testimonials lack verifiable identities, undermining trust.

Payment Methods and Customer Support

Payment details are unclear, likely involving cryptocurrencies or offshore transfers, common in high-risk platforms. Support is email-only, with no phone or live chat, unlike CVCapital’s accessible client support for strategic buyers.

Technical Performance

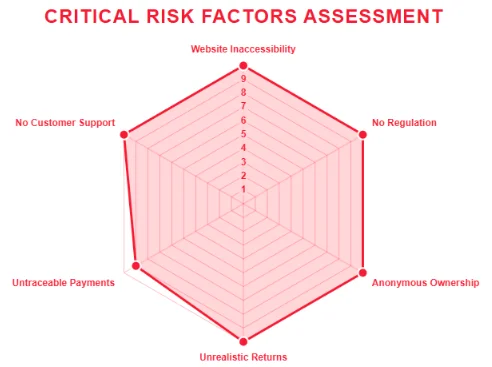

The site’s performance is poor, with high bounce rates (>80%) and low visit times (<30 seconds). CVCapital, focused on Asia-Pacific finance, maintains a professional, optimized platform. Inaccessibility issues suggest potential server instability or intentional downtime.

Red Flags Summary

- No Regulation: No FCA, SEC, or ASIC licensing.

- Unrealistic Returns: 47.1% ROI is mathematically improbable.

- Opaque Ownership: Hidden WHOIS and no leadership details.

- MLM Compensation: Focuses on recruitment, not profits.

- Weak Security: Lacks 2FA or audited systems.

DYOR Tool Findings

- ScamAdviser: 66% trust score, citing hidden WHOIS.

- ScamDoc: 45% trust score, noting recent domain creation.

- WHOIS Lookup: Confirms July 2025 registration.

- Social Blade: Shows low engagement on promotional accounts.

Social Media Promotion

Promoters on YouTube and Telegram (@UIEFO1KTcXk5NzFl) also push platforms like CVTrade, which has a 2.6/5 Trustpilot score. This pattern suggests coordinated marketing of high-risk schemes.

Comparison to CVCapital

CVCapital, a Shanghai-based firm, excels in cross-border M&A and private placements, with a clear leadership team and global coverage. The reviewed platform lacks these credentials, making it a riskier choice.

Recommendations

- Avoid Investment: Do not deposit funds without regulatory proof.

- Use Regulated Platforms: Consider CVCapital or brokers like Coinbase for safer options.

- Verify Claims: Check licensing on FCA or SEC websites.

- Consult Advisors: Seek professional guidance for investment decisions.

Future Outlook

Without transparency, the platform may face regulatory action or collapse within 3–12 months, similar to past HYIPs. CVCapital’s track record in deal execution offers a safer model for investors.

Cvcapitals Review Conclusion

This Cvcapitals Review highlights significant risks due to hidden ownership, unsustainable ROI claims, and MLM-style compensation. Unlike CVCapital’s trusted M&A advisory services, this platform lacks credibility. For further insights into similar platforms, you can also check our detailed Nuvix Review. Investors should prioritize regulated alternatives and conduct thorough research to protect their funds.

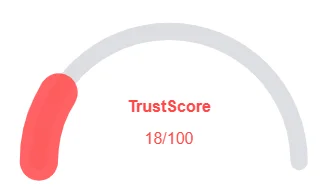

Cvcapitals Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Cvcapitals currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Cvcapitals similar platforms.

Positive Highlights

- Accessible content

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden Whois data

Frequently Asked Questions About Cvcapitals Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Cvcapitals raises concerns due to limited transparency, hidden ownership, and lack of regulatory oversight.

The platform claims high returns through advanced trading strategies, but there is no verifiable evidence of profitable trading.

No. Cvcapitals is not registered with any recognized financial regulator, which increases the risk for investors.

Risks include unclear ownership, potential technical issues, data security concerns, and unverified claims regarding traffic and user engagement.

It is not recommended. The platform’s lack of regulation, transparency, and unverified ROI claims make it a risky investment opportunity.

Other Infromation:

Website: CVCAPITALS.COM

Reviews:

There are no reviews yet. Be the first one to write one.