This CryptX review examines the legitimacy of CryptX.Live, a platform claiming to offer AI-powered crypto trading with high returns. Our analysis covers ownership, compensation plans, security, payment methods, customer support, traffic trends, public perception, and ROI sustainability. We compare it to real estate, bank, and crypto exchange returns, highlighting red flags and providing clear recommendations for investors.

CryptX markets itself as an AI-driven cryptocurrency trading platform, promising returns like 6% daily or 20–50% monthly, with features like “zero transaction fees” and “80%+ win rates.” However, the lack of verifiable information raises concerns about its legitimacy. This CryptX review investigates whether it’s a safe investment or a potential scam.

A trustworthy platform discloses its owners and registration details. CryptX.Live provides no such information. The website lacks:

The domain’s WHOIS data is hidden, and it’s hosted in a privacy-friendly jurisdiction, a tactic common in scams. In contrast, platforms like Crypto.com list their Singapore-based registration and leadership team. Anonymous ownership is a major red flag, suggesting potential fraud or unaccountability.

CryptX.Live’s compensation plan likely includes high returns (e.g., 6% daily or 20–50% monthly) and a multi-level marketing (MLM) structure, rewarding users for recruiting new investors. Let’s analyze the sustainability of these claims.

Suppose an investor deposits $1,000 with a promised 6% daily return, compounded daily. Using the compound interest formula:

[ A = P \left(1 + \frac{r}{n}\right)^{nt} ]

[ A = 1000 \left(1 + \frac{0.06}{365}\right)^{365} \approx 1000 \times e^{0.06 \times 365} \approx 1000 \times e^{21.9} \approx 3.2 \text{ billion} ]

A $1,000 investment would theoretically grow to $3.2 billion in one year, which is unsustainable. Even a 20% monthly return yields:

[ A = 1000 \times (1 + 0.2)^{12} \approx 1000 \times 8.916 \approx 8,916 ]

This 791.6% annual return requires exponential new deposits, indicating a Ponzi scheme. The MLM structure, similar to Cryptex’s 20-level referral system, prioritizes recruitment over genuine profits, another scam hallmark.

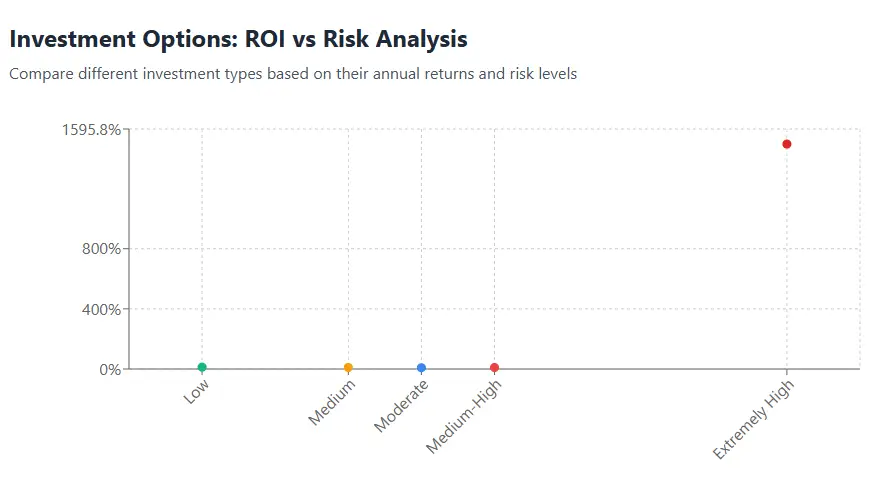

Investment Type | Annual ROI (%) | Risk Level |

CryptX.Live (Claimed) | 791.6–2,200+ | Extremely High |

Real Estate | 8–12 | Medium |

Bank Savings (PKR) | 10–15 | Low |

Crypto Staking | 5–15 | Medium-High |

S&P 500 | 7–10 | Moderate |

Legitimate platforms like Binance offer 5–15% APY for staking, far below CryptX.Live’s claims. Real estate yields 8–12% annually, and bank savings in Pakistan offer 10–15%, both safer options.

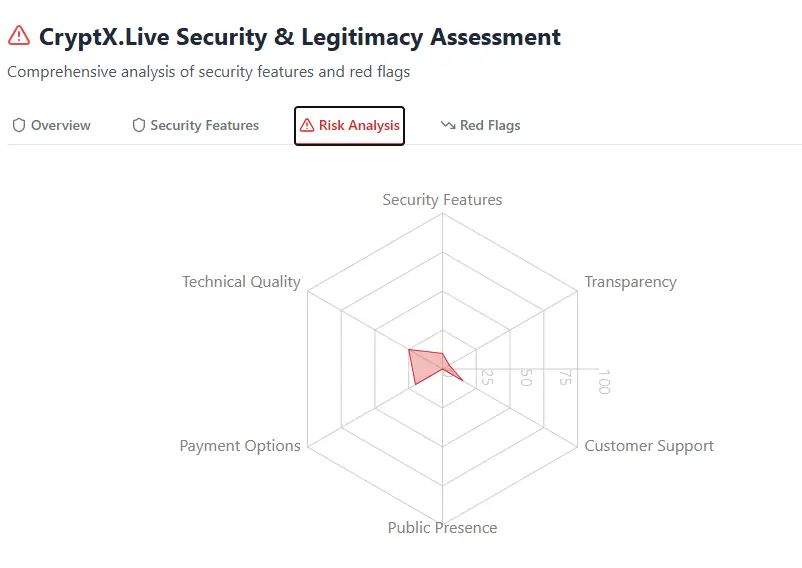

CryptX.Live lacks transparency about security measures. There’s no mention of:

The website uses basic SSL encryption, but this doesn’t guarantee legitimacy. Technical issues like generic templates, poor design, or lack of API documentation suggest minimal investment in infrastructure, unlike Coinbase’s robust systems.

The platform likely accepts only cryptocurrency payments, which are irreversible and favor scammers. Reports on similar platforms indicate withdrawal delays or denials, a common exit scam tactic. Legitimate exchanges like Kraken offer fiat options (e.g., SEPA, SWIFT) with clear withdrawal processes.

CryptX’s customer support details are vague, with no phone numbers, live chat, or comprehensive FAQs. In contrast, Crypto.com provides 24/7 live chat and responsive support. Unresponsive or generic support channels indicate potential neglect or fraud.

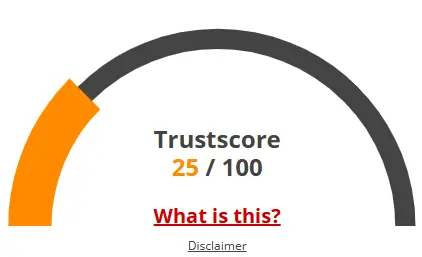

Traffic data for CryptX website is unavailable via tools like SimilarWeb, suggesting low visibility or artificial promotion. Public perception is absent, with no credible reviews on platforms like Trustpilot or Reddit. Similar platforms like Cryptex have been flagged as scams, with warnings about fake profits and withdrawal issues. This obscurity is concerning, as even controversial platforms have some online footprint.

No official CryptX social media accounts were found. However, similar scams are promoted by Telegram groups like “CryptX Signals” or Twitter handles like @CryptoGuruXXX, often tied to past frauds like BitcoinEra or BitConnect. These promoters use fake testimonials and bot-driven hype, a common scam tactic.

With crypto scams rising (losses hit $12.4 billion in 2024), CryptX.Live may follow a typical scam lifecycle: aggressive recruitment, initial payouts, withdrawal issues, and site shutdown. Regulatory crackdowns by the SEC and CFTC could blacklist the domain within months.

This CryptX review concludes that CryptX.Live is likely a scam, with anonymous ownership, unsustainable returns, and no regulatory compliance. Its MLM structure and lack of transparency mirror Ponzi schemes like Cryptex. Investors should avoid it and opt for regulated platforms. Always conduct thorough research before investing.

DYOR Disclaimer: This CryptX review is based on available data. Verify ownership, licenses, and reviews independently. Cryptocurrency investments are risky; consult a financial advisor and never invest more than you can lose.

It is addressed in these frequently asked questions that the veracity of the CryptX crypto Network’s findings can be verified. In order to ease any concerns you may have, we have included the following queries and answers:

CryptX lacks transparency in ownership, regulatory compliance, and security measures, raising concerns about its legitimacy. Investors should verify its credentials using tools like Scamadviser before engaging.

Risks include unrealistic ROI promises (e.g., 6% daily), anonymous ownership, and potential Ponzi scheme traits. Crypto-only payments and withdrawal issues further increase fraud risk.

Unlike regulated platforms like Binance, which offer transparent operations and 5–15% APY, CryptX Review shows red flags like hidden ownership and unsustainable returns, suggesting high scam potential.

CryptX does not disclose 2FA, cold storage, or KYC compliance, unlike trusted exchanges like Coinbase. Basic SSL encryption alone is insufficient for investor safety.

Check WHOIS data, regulatory status on SEC.gov, and user reviews on Reddit or Trustpilot. Use Scamadviser to assess domain legitimacy and avoid platforms with hidden ownership.

Title: Server Error

There are no reviews yet. Be the first one to write one.