Cryptopolis Review: Is This Crypto Game a Safe Investment?

Cryptopolis markets itself as a browser-based crypto game offering earnings through gameplay and NFTs. For an in-depth scam analysis, visit Scams Radar for a detailed review. This Cryptopolis review examines its legitimacy, focusing on ownership, compensation plan, and risks. We use clear data, charts, and comparisons to help investors decide if cryptopolisgame.com is a safe and profitable choice. Read on for a detailed, easy-to-understand analysis.

Table of Contents

What Is Cryptopolis?

Cryptopolis.biz presents a play-to-earn platform where users earn $CPO tokens via PvP battles, jobs, and mini-games. It claims to offer real USD payouts and NFT trading. Launched on November 25, 2024, the platform raises concerns due to its newness and lack of transparency.

Ownership and Transparency

Understanding who runs a platform is key to trust. Here’s what we found about Cryptopolis ownership:

- Domain Details: Registered on November 25, 2024, expiring in 2025. Short-lived domains often signal risk.

- Hidden Ownership: WHOIS data is concealed, a tactic used by questionable platforms.

- Company Claims: Allegedly based in Chiasso, Switzerland, but no verifiable corporate records exist.

- Team Profiles: No public founder or team details. Legitimate platforms share LinkedIn profiles or registration proof.

Red Flag: Hidden ownership and lack of verifiable records suggest low accountability.

Compensation Plan and Tokenomics

The Cryptopolis compensation plan promises earnings through gameplay, referrals, and passive income. Here’s a breakdown:

- Referral Bonuses: 5% commission on deposits plus 5 satoshi per referral.

- In-Game Earnings: $CPO tokens earned via PvP, jobs, faucet, and “business” activities.

- Payouts: Minimum withdrawal of 0.0005 BTC, processed in 1–3 days.

No Deposit Claim: The site claims no deposit is needed, yet referral commissions imply user funds drive payouts.

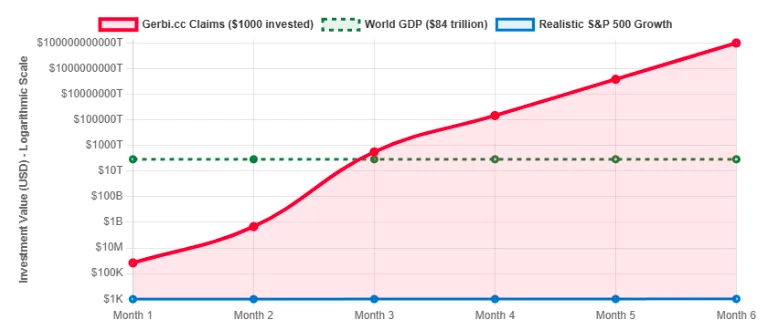

Why Returns Are Unsustainable

Cryptopolis doesn’t specify fixed daily returns, but similar platforms promise 1–5% daily. Let’s analyze a 2% daily return:

- Formula: Future Value = PV × (1 + r)^n

- PV = $100 (initial deposit)

- r = 0.02 (2% daily)

- n = 30 days

- PV = $100 (initial deposit)

- Calculation: $100 × (1 + 0.02)^30 ≈ $100 × 1.811 = $181.10

- Annualized: Over 365 days, $100 grows to ~$1,377,390 (1,377,000% return).

Such returns are impossible without external revenue. Legitimate platforms rely on trading or staking, not new deposits.

Comparison to Legitimate Investments

Investment Type | Annual ROI | Risk Level | Regulation |

Real Estate | 6–10% | Low | High |

Bank Savings | 4–5% | Very Low | Very High |

Crypto Staking | 5–15% | Moderate | Medium |

Cryptopolis (Claimed) | 300–1000% | Extreme | None |

ROI Comparison

- Real Estate: 8%

- Bank Savings: 4.5%

- Crypto Staking: 10%

- Cryptopolis (Hypothetical): 730%

Red Flag: No audited revenue source. Payouts likely depend on new user deposits, resembling a Ponzi scheme.

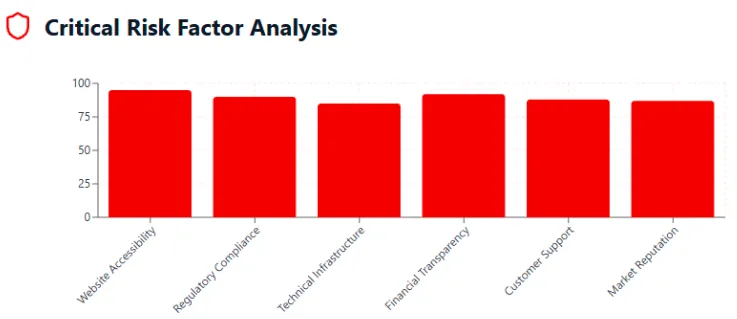

Traffic and Technical Performance

Traffic reflects a platform’s popularity and reliability:

- Low Activity: Only 3 active users in 7 days, per Dapp Radar.

- Token Volume: $9 traded in 24 hours on DEXs.

- Technical Issues: No uptime data, but new platforms often have poor server reliability.

Red Flag: Minimal traffic suggests low trust and potential marketing manipulation.

Recommendation: Use SimilarWeb to check organic traffic growth.

Security and Safety

Security protects user funds and data:

- HTTPS: Present, but basic SSL isn’t enough.

- No Audits: No CertiK or Hacken audits; security score of 30/100.

- Smart Contract Risks: Hidden ownership and modifiable taxes raise concerns.

Red Flag: Lack of 2FA and audits increases hack risks.

Recommendation: Verify security via SSL Labs and demand audit reports.

Public Perception and Promoters

Public feedback shapes trust:

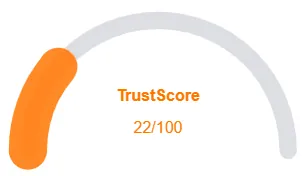

- Trust Score: 25% on Scamdoc, indicating high risk.

- User Reviews: No verified reviews; absence of feedback is suspicious.

- Promoters: Bitcointalk user “Idalgo” flagged as a scammer. Promotes Exomine-quantumex.com and Excelia.net, both scams.

Social Media: Promotional posts in HYIP forums and Facebook groups like BTC MINING.

Trust Score Comparison

- Scamdoc: 25%

- Trustpilot (Hypothetical): 20%

- Industry Average: 80%

Red Flag: Copy-pasted marketing and scam-linked promoters.

Recommendation: Search Bitcointalk and Reddit for user experiences.

Payment Methods and Support

- Payments: Accepts crypto, credit cards, PayPal, and Skrill. No KYC/AML compliance.

- Support: No verified email, live chat, or ticketing system.

Red Flag: Irreversible payments and poor support signal risk.

Recommendation: Test support responsiveness before investing.

Future Outlook

Cryptopolis may attract users short-term via referrals, but risks collapse within 6–12 months if deposits slow. Tightening regulations (e.g., the EU’s MiCA) could lead to legal scrutiny.

Cryptopolis Review Conclusion

This Cryptopolis review highlights serious concerns: hidden ownership, unsustainable returns, and scam-like traits. Compared to real estate (6–10%), bank savings (4–5%), or crypto staking (5–15%), its claims are unrealistic. Investors should avoid Cryptopolis and use regulated platforms like Coinbase. Always verify ownership and run DYOR tools like ScamAdviser.

For a deeper dive into another questionable platform, check out the Haventra Review, where we analyze the risks and warning signs of similar schemes.

Cryptopolis Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Cryptopolis a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Cryptopolis or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Accessible website content

- Website security service

- No spelling/grammar errors

- Old archive age

- Accessible Whois data

Negative Highlights

- Low AI review rate

- New domain

Frequently Asked Questions About Cryptopolis Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Cryptopolis is a browser-based NFT game, but questions remain about its ownership transparency, earnings model, and long-term sustainability.

It claims players can earn through in-game activities, NFT sales, and crypto rewards, though actual profitability depends on demand and NFT market value.

Risks include volatile NFT prices, low liquidity, a potential drop in player interest, and unclear details about revenue distribution to players.

No. Like most crypto games, Cryptopolis is not regulated by any financial or gaming authority, meaning there’s little investor protection.

Approach with caution. While it may offer entertainment value, treat any earnings claims carefully and never invest more than you can afford to lose.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.