Crypto Mining Firm Review: Legit Opportunity or Hidden Risks?

In this Crypto Mining Firm review, Scams Radar explores whether this cloud mining service stands as a solid investment or raises concerns for users. With claims of easy earnings through Crypto Mining Firm investment, many seek details on its cloud mining setup, mining profitability, and overall reliability. Our analysis draws on public records, user feedback, and financial breakdowns to help you make an informed decision.

Table of Contents

Part 1: Understanding Crypto Mining Firm Cloud Mining

Crypto mining involves solving complex puzzles to validate transactions on blockchain networks. Crypto Mining Firm’s cloud mining lets users rent computing power remotely, avoiding hardware costs. The platform touts access to advanced rigs for mining supported cryptocurrencies like Bitcoin, Ethereum, and others. But how does it stack up in terms of Crypto Mining Firm mining profitability?

The site highlights “97+ data centers” and “9.39 million users,” promising steady gains. Yet, checks show no hard proof for these numbers. Real mining fluctuates with market prices and energy use. This setup appeals to beginners, but questions linger on transparency.

1.1 Ownership and Background Check

Ownership ties to Cooke Capital Limited, a UK entity formed in 2021 under number 13219561. Based in Liverpool, it is listed as a financial management firm per official records. No clear directors emerge from public filings, and no direct links to cryptocurrency operations appear.

Searches for backgrounds yield little. The company handles routine updates, like address changes, but nothing points to mining expertise. No FCA approval for investment services exists, a must for UK financial offers. This gap raises flags, as true owners stay hidden behind private domain registration via a Singapore firm.

Hosting runs on Tencent Cloud in Asia, clashing with UK branding. No team profiles or executive histories surface, unlike established players. For the Crypto Mining Firm’s security, this opacity could mean risks if issues arise.

Part 2: Complete Compensation Plan Breakdown

The Crypto Mining Firm’s compensation plan centers on contract-based mining. Users buy packages for daily returns, backed by “100% guaranteed principal and interest.” Here’s a clear outline:

- Registration Perks: New sign-ups get $10 to $100 bonus. This hooks users fast.

- Daily Rewards: Log in for $0.60 extra each day, building a habit.

- Minimum Thresholds: Start with $100 deposit, same for withdrawals. Labeled as anti-money laundering steps, but often a way to lock funds.

- Investment Packages: Options range from basic to premium. For example:

- Low-tier: $100 for short terms, yielding 1-2% daily.

- Mid-tier: $500+, up to 6% daily on select contracts.

- High-tier: Thousands for “VIP” plans, promising faster payouts.

- Referral System: Crypto Mining Firm’s affiliate program pays for bring-ins, up to 10% on referrals’ deposits.

- Profit Mechanics: Claims let you “become a millionaire in ten years” via compounding. Withdrawal process in crypto like BTC or ETH.

Crypto Mining Firm offers mining contracts lasting days to months, with auto-reinvest options. But no audits back these yields. Crypto Mining Firm fees include “staff costs” in minimums, potentially eating profits. For Crypto Mining Firm withdrawal, users report delays or extra charges.

Compared to others, plans seem aggressive. Legit firms offer variable rates, not fixed highs. How to start investing with a Crypto Mining Firm? Sign up, deposit via wallet, pick a plan. But weigh the Crypto Mining Firm’s minimum investment and plans carefully.

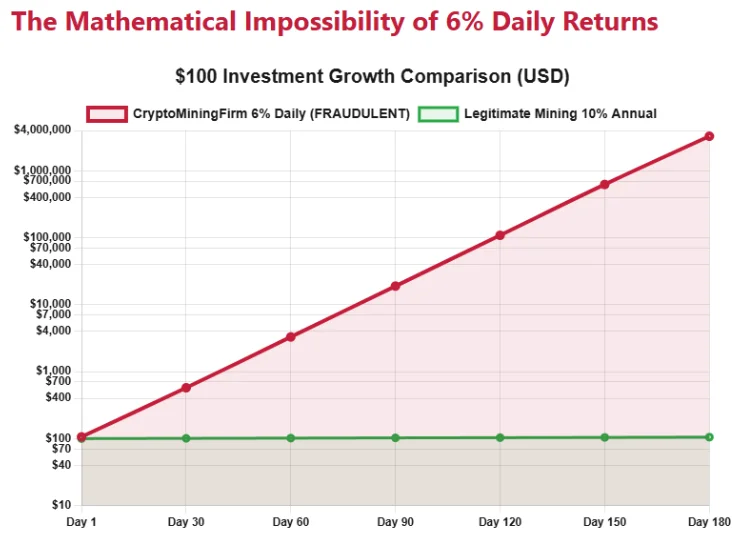

2.1 ROI Claims and Mathematical Reality

Crypto Mining Firm ROI touts high daily gains, but math shows issues. Assume 2% daily on $100: After 365 days, it compounds to about $137,740 – over 1,374% APY. At 6%, it’s billions, impossible without endless new funds.

Real benchmarks:

- Bank CDs: 4-5% yearly, safe.

- Real estate: 7-10% annual, asset-backed.

- Crypto staking: 5-15% APY, variable.

Investment Type | Typical Annual ROI | Risk Level |

Bank Savings | 4-5% | Low |

Real Estate | 7-10% | Medium |

Crypto Staking | 5-15% | High |

Crypto Mining Firm Claims | 1,000%+ | Extreme |

This table highlights gaps. Expected profit margins from Crypto Mining Firm investments ignore market dips. Strategies for maximizing returns with Crypto Mining Firm? Diversify, but guarantees feel off.

Part 3: Security and User Experience

Crypto Mining Firm’s security uses basic SSL, but lacks multi-factor checks or audits. Crypto Mining Firm’s user experience via the app seems simple, with QR scans for mobile. Yet, reports note slow loads and vague dashboards.

Crypto Mining Firm’s customer support relies on email or app chat, often scripted. Crypto Mining Firm customer service review: Mixed, with delays common. For Crypto Mining Firm Green Mining, claims of eco-friendly ops lack proof. How sustainable is the Crypto Mining Firm’s mining operation? No energy data shared.

Crypto Mining Firm mining hardware and infrastructure? Undetailed, unlike peers showing rigs.

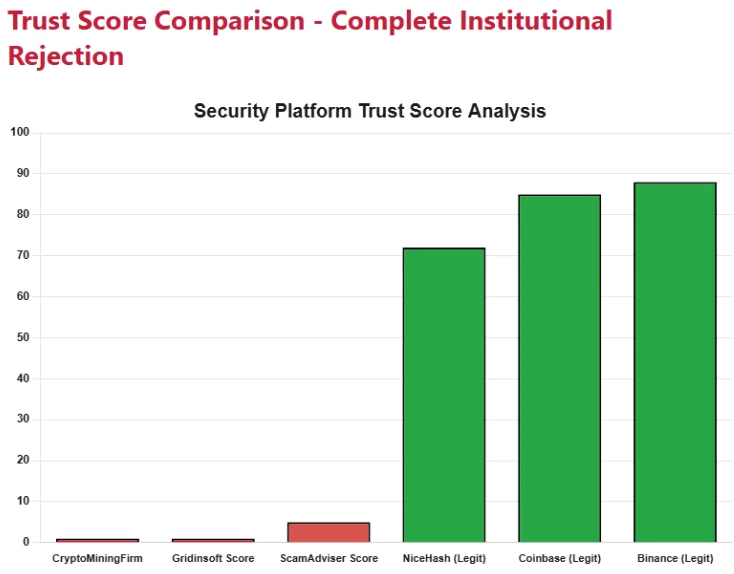

3.1 Public Perception and Red Flags

User reviews and testimonials of Crypto Mining Firm vary. Trustpilot has a few entries, some calling it “a total scam” over withdrawals. Reddit warns of non-payments. Scam check tools flag low trust.

Is Crypto Mining Firm a scam or a legit platform? Patterns match risky schemes: Bonuses lure, then barriers block exits. Comparison of Crypto Mining Firm with other mining companies, like NiceHash, shows gaps in proof.

Crypto Mining Firm’s referral program earnings tempt, but fuel pyramid vibes. Fees and hidden costs at Crypto Mining Firm explained: Minimums as “AML,” but questionable.

Environmental impact of Crypto Mining Firm’s mining farms? Unclear, no reports. How transparent is Crypto Mining Firm about mining operations? Minimal, no hashrate shares.

Crypto Mining Firm contract terms and conditions: Vague on disputes. How does Crypto Mining Firm perform in volatile crypto markets? Claims stability, but unlikely.

Crypto Mining Firm supported coins and tokens: BTC, ETH, more. Troubleshooting and common issues with the Crypto Mining Firm platform: Withdrawal blocks, fee demands.

3.2 Social Media and Promotions

Promotion centers on X via @MININGCRYPTOLTD, linking to the site in news posts. Low engagement, no big follows elsewhere. Past pushes tie to similar risky sites.

Future Outlook and Predictions

Based on trends, such platforms may fade in 6-12 months via rebrands or shutdowns. Rising regs could hit hard. Crypto adoption grows, but clones persist.

Recommendations

Steer clear of deposits. If in, document all, report to authorities like the FTC or Action Fraud. Avoid recovery scams.

DYOR: This info aids, but verify yourself. Consult pros. Crypto holds risks; lose only what you can.

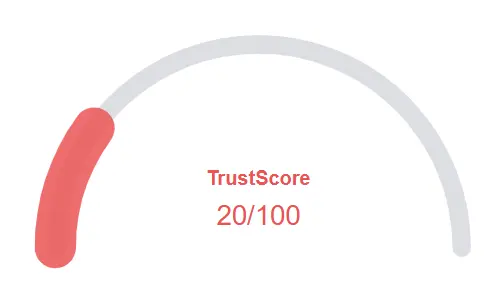

Crypto Mining Firm ReviewTrust Score

A website’s trust score is an important indicator of its reliability. Crypto Mining Firm currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Crypto Mining Firm or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About Crypto Mining Firm Review

This section answers key questions about the Bit Crypto Mining Firm, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Crypto Mining Firm shows red flags due to unclear ownership, unrealistic ROI promises, and limited transparency, making it a high-risk platform.

It claims returns from rented mining power, but no verifiable mining data or hardware proof is provided.

The platform requires a minimum deposit of $100, which is also the minimum withdrawal amount.

Yes, multiple user reports mention withdrawal holds and extra fee demands, especially when trying to withdraw profits.

Compared to platforms reviewed in the Everstead Review, Crypto Mining Firm lacks transparency and offers much higher, riskier, and mathematically unsustainable returns.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.