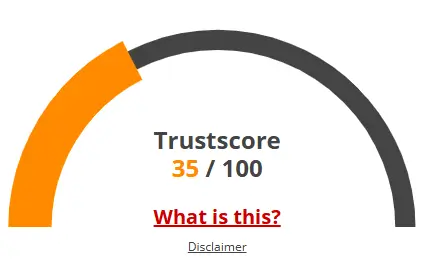

A website’s trust score is one of the most important measures of its credibility. There are concerns about the veracity of Crypto Labs because of its incredibly low rating. Users should be extremely cautious.

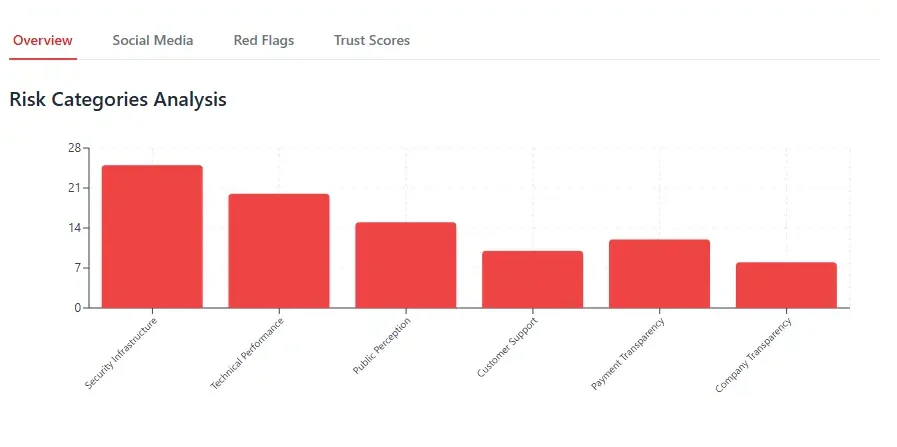

The main problems are minimal traffic, bad reviews, phishing tactics, ambiguous ownership, ambiguous hosting details, and inadequate SSL protection.

This low score makes fraud, data theft, or questionable activity more likely. Before using the Crypto Labs website or other similar apps, make sure to verify these details.