Cryptex Review: Is This DeFi Platform a Safe Investment?

This Cryptex review on Scams Radar examines the platform’s claims, compensation plan, ownership, and risks. We analyze cryptex.to, a self-proclaimed DeFi platform, to help investors make informed decisions. Using clear data, charts, and user feedback, this guide uncovers whether Cryptex is a legitimate opportunity or a risky venture.

Table of Contents

What Is Cryptex DeFi Platform?

Pol Orbit presents itself as a decentralized crypto investment platform built on the Polygon blockchain. It promises high returns through a matrix-based referral system, claiming investors can earn up to 96,500 POL from a 2 POL investment. The platform requires wallet connection before revealing details, raising immediate transparency concerns. This review digs deeper into its operations and risks.

Ownership and Transparency

The ownership of Cryptex raises concerns. No executives or company addresses are disclosed. The domain, registered in August 2023 via Namecheap, hides registrant details. No regulatory licenses from bodies like the SEC or FCA are mentioned. Investigations link promoter Mario Emmrich to past scams, including Dividium Capital Ltd.

Key Ownership Red Flags

- Anonymous Leadership: No named founders or team members.

- Hidden Registration: Domain privacy conceals ownership.

- No Regulatory Oversight: Unregistered with financial authorities.

- Promoter History: Ties to known fraudulent schemes.

Cryptex Compensation Plan Explained

Cryptex offers staking contracts with a $100 handling fee. It claims to provide $30,240–$43,200 “loans” per contract, staked for 36–84 months, with daily returns of 0.1%–0.3%. The referral program spans up to 20 levels, paying 30–50% for first-level referrals and 3–5% for deeper levels.

Level | Commission (%) | Amount per $100 Investment |

Level 1 | 30–50% | $30–50 |

Levels 2–4 | 5% each | $15 total |

Levels 5–6 | 4% each | $8 total |

Levels 7–10 | 3% each | $12 total |

Is Cryptex Safe for Cryptocurrency Staking?

Cryptex claims robust security but lacks evidence. It uses HTTPS via Cloudflare, a basic feature. No audits, cold storage details, or SOC2/ISO certifications are provided. The KYC process is vague, raising privacy concerns. User reviews report withdrawal delays and account freezes.

Security and Privacy Concerns

- No Audits: No third-party security verification.

- Vague KYC: Unclear data protection measures.

- Withdrawal Issues: Users report inaccessible funds.

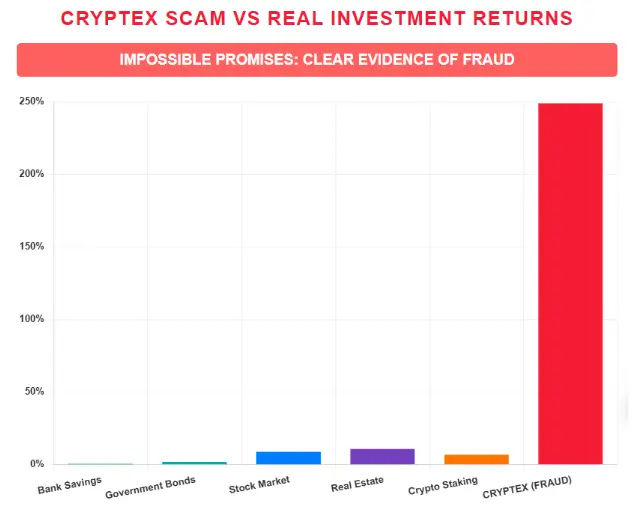

Cryptex Returns and Risk Explained

Investment Type | Annual ROI | Risk Level |

Cryptex | 44–198% | Very High |

Real Estate | 6–13% | Medium |

Bank CDs | 4–5% | Low |

Crypto Staking (e.g., Binance) | 3–12% | High |

ROI Sustainability Analysis

Using the formula ( A = P(1 + r)^{nt} ):

- Initial Investment: $100

- Daily ROI: 0.2% (conservative estimate)

- Annualized ROI: ( (1 + 0.002)^{365} – 1 \approx 107% )

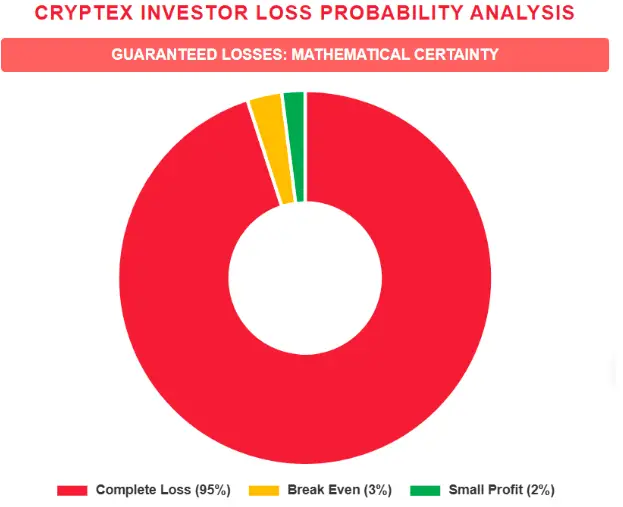

A $100 investment could grow to $207 in one year, far exceeding legitimate crypto staking (3–12% APY). This suggests reliance on new investor funds, a Ponzi scheme trait.

Cryptex Referral Program and User Reviews

The referral program incentivizes recruitment, resembling MLM structures. Commissions heavily favor early investors, unsustainable without constant inflows. User reviews are mixed:

- Trustpilot: Some 5-star reviews defend Cryptex, urging users to avoid early withdrawals.

- SiteJabber: 1.2/5 rating, citing withdrawal issues.

- Reddit: Threads label Cryptex a “Ponzi scheme.”

Cryptex Security Measures and Customer Support

Cryptex lacks transparent support channels. Users report unresponsive support and delayed withdrawals. The platform’s form-based support lacks live chat or ticketing systems, unlike reputable platforms like Coinbase.

Comparison to Traditional Investments

Cryptex’s returns outstrip traditional options:

- Real Estate: 6–13% annual ROI, backed by tangible assets.

- Bank CDs: 4–5% APY, insured by FDIC.

- Crypto Staking: 3–12% APY, with market risks.

Cryptex’s model lacks verifiable revenue sources, relying on recruitment.

DYOR Tools and Findings

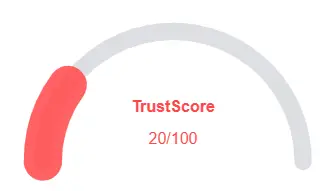

Online tools flag Cryptex as risky:

- ScamAdviser: 0/100 trust score, citing anonymity.

- VirusTotal: Suspicious scripts detected.

- SimilarWeb: Low traffic, heavy referral-driven visits.

Future Outlook

Cryptex may face issues by late 2025 as recruitment slows. Withdrawal restrictions and site shutdowns are likely by 2026, following Ponzi scheme patterns.

Recommendations

Avoid Cryptex due to its high-risk profile. Opt for regulated platforms like Binance or Kraken. If invested, document transactions and report to authorities.

Cryptex Review Conclusion

This Cryptex review highlights significant risks. Anonymous ownership, unrealistic returns, and an MLM structure suggest a Ponzi scheme. Investors should prioritize regulated alternatives and conduct thorough research to protect their funds. For comparison, also see our Pol Orbit Review to understand similar risks across platforms.

Cryptex Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Cryptex currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Cryptex similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

- Old archive age

- Domain in Tranco top 1M

Negative Highlights

- Low AI review rate

- Hidden Whois data

Frequently Asked Questions About Cryptex Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Cryptex is a self-proclaimed DeFi platform operating via secure.cryptex.to.

Our Scams Radar review raises concerns about transparency, ownership, and ROI sustainability.

It claims to offer high returns through DeFi-based contracts and investment strategies.

The promised returns are questionable and may not be sustainable compared to regulated investments.

Due to opaque operations and lack of proper regulation, funds could be at risk

Other Infromation:

Website: cryptex.to

Reviews:

There are no reviews yet. Be the first one to write one.