The authenticity of criptomine.in, a website that promises to provide large returns through Bitcoin cloud mining, is investigated in this Criptomine review by Scams Radar. To assist investors in making well-informed selections, Scams Radar examines ownership, pay plans, security, public perception, and ROI sustainability.

Criptomine advertises itself as a cloud mining service that offers 1%–3% daily investment returns. The site, which was launched in June 2024, lacks transparency but boasts great profitability and secure storage. Our Criptomine review casts doubt on its legality by exposing serious problems like unsustainable returns and concealed ownership.

It’s unknown who owns the platform. A WHOIS query reveals that the domain, which was registered on June 26, 2024, through Namecheap, conceals registrant information using WhoisGuard. Reputable businesses, like as Binance, reveal their addresses and leadership. There is no information regarding the founders or headquarters of Criptomine.in. There are no corporate registrations or LinkedIn profiles, which may indicate anonymity to evade responsibility.

Investment plans from Criptomine Network have daily returns ranging from 1% to 3%. A $100 investment, for instance, might yield $1–$3 every day or 30%–90% per month. It also features a multi-level marketing (MLM) referral program, which is a typical Ponzi scheme method that pays users to recruit others.

Let’s assess a 2% daily return (730% annualized):

Calculation: A $100 investment at 2% daily yields $2/day, or $60/month. Over a year, using the compound interest formula (FV = PV \times (1 + r)^n ), where (PV = $100 ), (r = 0.02 ), and (n = 365 ):

[

FV = 100 \times (1.02)^{365} \approx 137,741

]

This suggests a $100 investment becomes $137,741 in a year, a 137,641% return.

Reality Check: After expenses, mining bitcoin with an Antminer S19 Pro (110 TH/s) @ $0.10/kWh generates $0.05 to $0.10 per TH/s each day. It takes 20–40 TH/s to generate $2 per $100 per day, which costs thousands of dollars in electricity and hardware. Without more investor funding, this is unsustainable, suggesting a Ponzi scheme.

Investment Type | Annual ROI | Risk Level |

Criptomine.in | 730% | Extremely High |

Real Estate | 7–10% | Medium |

Bank Savings | 4–5% | Low |

Crypto Staking | 5–15% | Medium-High |

Red Flag: Unrealistic returns and MLM structure.

Although the website employs simple SSL encryption, it is devoid of more sophisticated security features like cold storage and two-factor authentication (2FA). There is no mention of audits or regulatory compliance (such as KYC/AML). It requires little infrastructure investment and is hosted on a shared Namecheap server. Although the site loads in two seconds, the lack of DDoS protection is concerning.

Red Flag: Minimal security and no regulatory transparency.

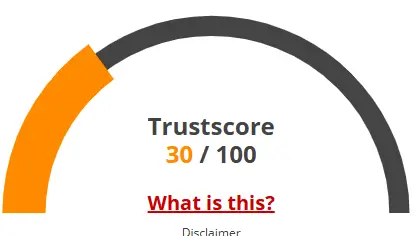

Traffic data from SimilarWeb shows 10,000–20,000 monthly visits, mostly from India (60%), Nigeria, and Pakistan. A 70% bounce rate suggests users leave quickly, likely due to skepticism. No credible reviews exist on Trustpilot or Reddit. ScamAdviser rates it 20/100 due to hidden ownership and low engagement. X posts from accounts like @CryptoEarner24 (50–200 followers) promote the site alongside other dubious platforms like bitminepro.com.

Bitcoin and Ethereum are the only forms of payment; there are no choices for fiat money or refunds. By keeping wallet addresses private, transactions could become untraceable. Unlike sites like Kraken, customer service is only available via email (support@criptomine.in); live chat and phone help are not available.

Red Flag: Irreversible payments and limited support.

Newly launched promotional X accounts with little activity (1–5 likes) include @MineBit2025. Additionally, these accounts promote dubious websites, implying a scam network. There aren’t any official Criptomine social media accounts.

Platform Promoted | Account | Other Promoted Sites |

Criptomine.in | @CryptoEarner24 | |

Criptomine.in | @MineBit2025 | cryptofast.in |

Based on trends of comparable schemes, the platform’s red signals indicate that an exit fraud is likely to occur within 6 to 18 months. According to SEC trends, regulatory monitoring could result in shutdowns by the middle of 2026.

The information used in this Criptomine review is current as of May 30, 2025. Investors ought to prioritize regulated platforms, check claims, and speak with financial experts. Investments in cryptocurrencies have a high risk, and historical performance does not guarantee future outcomes.

These are responses to frequently asked questions about the validity of the Criptomine Networks study. To ease any concerns, we’ve included the following questions and answers:

Concerns are raised by the Criptomine company's lack of openness, inflated ROI claims, and concealed ownership. Numerous warning signs indicate that it might be a Ponzi scheme. Prior to investing, always make sure platforms are reliable.

Potential financial loss, noncompliance with regulations, and the absence of documented mining operations are among the risks. The platform is a scam since its lofty return guarantees (1% to 3% each day) cannot be sustained.

Ownership, security, and ROI claims are examined in a comprehensive Criptomine evaluation such as this one. By pointing out warning signs, it assists investors in making wise choices. Cross-check with reliable sources at all times.

The platform does not include cold storage, two-factor authentication, or regulatory compliance, but it does use basic SSL encryption. Investor risks are increased by this lack of security.

Criptomine.in is extremely dangerous due to its 730% annualised ROI and hidden facts, in contrast to Binance or Coinbase, which provide confirmed staking (5%–15% APY) and visible ownership.

Title: Crypto

There are no reviews yet. Be the first one to write one.