ClusterYield Review: Is This AI Trading Platform Safe or a Risky Bet?

This ClusterYield review on Scams Radar investigates the legitimacy of an AI-driven trading platform promising high daily returns. We examine ownership, compensation plans, traffic, public perception, security, content, payments, customer support, technical performance, and ROI claims to help everyday investors avoid potential scams. Using clear data and math, we highlight risks and offer practical advice in simple language for ClusterYield (clusteryield.ai).

Table of Contents

What Is the ClusterYield Platform?

The ClusterYield platform claims to use AI to trade forex, crypto, stocks, and commodities on the Binance Smart Chain. It offers daily returns of 0.7–5% through smart contracts, appealing to those seeking passive income. However, its structure raises serious concerns about sustainability and trustworthiness.

ClusterYield Review: Ownership and Transparency Issues

Trustworthy platforms share clear details about their owners, but ClusterYield hides this information. The domain was registered on March 10, 2024, via NameCheap, using WhoisGuard to conceal owner details. It mentions “ClusterYield Ltd” at a virtual office (20-22 Wenlock Road, London), a tactic often used to fake legitimacy. No team bios, founder names, or regulatory licenses from bodies like the SEC or FCA are provided, unlike reputable platforms like Coinbase. Promotional posts link to @DevMarcus on Telegram, but no verifiable credentials exist.

- Red Flags:

- Anonymous ownership.

- No regulatory oversight.

- Virtual office address.

- Anonymous ownership.

Compensation Plan: High Promises, High Risks

ClusterYield’s investment plans promise daily returns with a referral-heavy model:

- Basic Plan: $100–$5,000, 0.7–1% daily for 7–180 days (255–280% annual return).

- Premium Plan: $50,000+, 2.8–5% daily for 180–365 days (1,022–1,925% annual return).

- Referral Program: 8–20% commissions across 17 levels, plus binary bonuses for recruiting.

- Lock-in Periods: 7–180 days, preventing early withdrawals.

- Auto-Reinvestment: Encourages compounding to boost yields.

- Payments: Crypto-only (USDT, BNB), with claimed instant withdrawals, though users report delays.

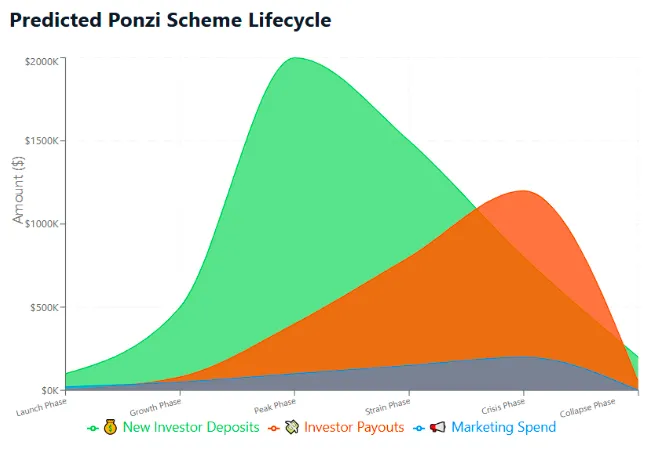

This multi-level marketing (MLM) structure prioritizes recruitment over trading, resembling a Ponzi scheme where new deposits fund payouts.

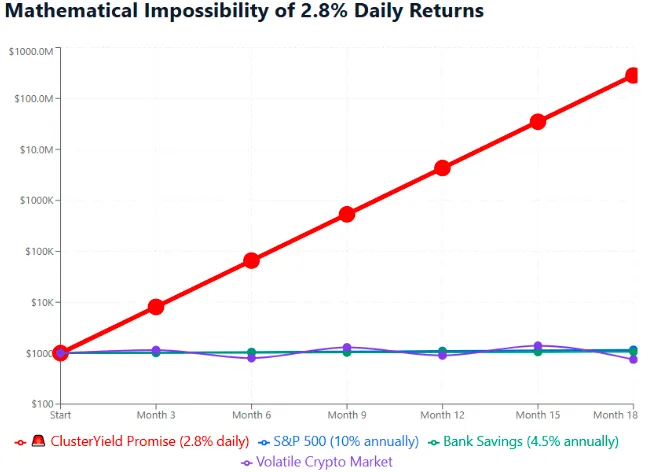

Why These Returns Are Impossible

Let’s break down a $1,000 investment at 2.8% daily, compounded for 180 days:

- Formula: ( A = P(1 + r)^t ), where ( P = 1000 ), ( r = 0.028 ), ( t = 180 ).

- Calculation: ( A = 1000 \times 1.028^{180} \approx 140,470 ).

- Result: $1,000 grows to ~$140,470 in 6 months.

For 365 days at 5%:

- ( A = 1000 \times 1.05^{365} \approx 540,000,000 ).

- Result: $1,000 becomes ~$540 million.

No legitimate trading strategy—AI or otherwise—can achieve this. Compare to:

- S&P 500: 7–10% annually (medium risk).

- Real Estate: 6–12% annually (rentals, medium risk).

- Crypto Staking: 4–20% APY (high risk, e.g., Kraken).

- Bank Savings: 4–5% APY (low risk, FDIC-insured).

Traffic Trends and Public Perception

SimilarWeb estimates 10,000–20,000 monthly visits, mostly from Nigeria, India, and Pakistan—regions often targeted by risky platforms. It lacks organic search rankings for “AI trading platform,” relying on paid ads. Trustpilot shows fewer than 50 reviews, mostly generic and likely manipulated. Scamadviser rates it 55/100 due to anonymity and recent domain creation. Reddit and X show no organic buzz, with scam forums flagging similar high-yield investment programs (HYIPs).

- Red Flags:

- Low, ad-driven traffic.

- Suspect reviews.

- Suspect reviews.

- No community engagement.

- Low, ad-driven traffic.

Security Measures and Payment Risks

The platform uses basic SSL (Let’s Encrypt) and Cloudflare but lacks two-factor authentication (2FA) or verified smart contract audits. It claims audits by CertiK, HazeCrypto, and DappAudit, but no public reports confirm this. Crypto-only payments (USDT, BNB) are irreversible, posing risks. No fund custody or insurance details are provided.

- Red Flags:

- No 2FA or verified audits.

- Irreversible crypto payments.

- No 2FA or verified audits.

Content Authenticity and Technical Performance

The website uses buzzwords like “smart contract immutability” and “AI yield generation” but offers no whitepapers, trading data, or risk disclosures. Its content mimics other HYIPs, lacking originality. The site loads quickly but lacks advanced features like mobile apps or transparent event logging. Users report issues with account access and transaction processing.

Customer Support and Withdrawals

Support is limited to a contact form, email, and Telegram (@ClusterYieldAi, ~689 subscribers). No live chat or phone support exists. Users report delayed or unresponsive support, especially for withdrawals, despite claims of instant processing.

Social Media Promotion

Accounts like @cryptogainz and @investfast on X and Instagram promote the platform alongside other risky ventures (xrpaibot.com, solarchain.app, earnwithaffigo.com). The official @ClusterYieldAi Telegram channel focuses on referral bonuses, not trading performance, indicating an MLM-driven model.

DYOR Tool Reports

- Scamadviser: 55/100 trust score, flags anonymity.

- Trustpilot: <50 unverified reviews.

- WHOIS: Hidden registrant, March 2024.

- VirusTotal: No malware, but phishing risks noted.

- SimilarWeb: Low traffic, ad-driven.

Future Outlook

The platform may pay small amounts early to build trust but is likely to face payout delays within 6–12 months. Its MLM structure and crypto-only payments suggest a collapse or rebranding by mid-2026, typical of HYIPs.

Recommendations for Investors

- Avoid investing due to extreme risks.

- Choose regulated platforms like FTMO, Coinbase, or Vanguard.

- Diversify with stocks (7–10%), real estate (6–12%), or crypto staking (4–20%).

- Report suspicious activity to financial authorities.

ClusterYield Review Conclusion:

This ClusterYield review reveals a high-risk platform with hidden ownership, unrealistic returns, and Ponzi-like MLM tactics. Its low trust score, lack of regulation, and crypto-only payments demand caution. Protect your money by sticking to transparent, regulated investments. Research thoroughly to avoid costly mistakes.

For a similar in-depth analysis, check out our TradeXMastery Review.

DYOR Disclaimer

This analysis, based on public data as of August 26, 2025, is for educational purposes only. Investments carry risks. Always conduct your own research and consult financial advisors before investing. If returns seem too good to be true, they likely are.

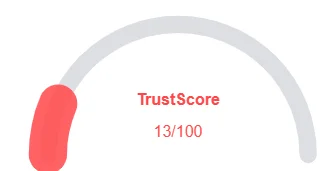

ClusterYield Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 ClusterYield currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ClusterYield similar platforms.

Positive Highlights

- Website content is accessible.

- No suspicious patterns found.

Negative Highlights

- Low AI review rating.

- New domain.

- New archive.

- Whois data hidden.

Frequently Asked Questions About ClusterYield Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

ClusterYield is an AI-driven trading platform promising high daily returns. However, it raises questions about sustainability and transparency, which our review addresses.

While ClusterYield claims high returns, our ClusterYield Review highlights several red flags such as lack of transparency and unverified ROI claims, suggesting potential risks for investors.

ClusterYield offers profit-sharing and referral incentives. However, the emphasis on recruitment over actual returns raises concerns about the platform's long-term viability

The primary risks of investing in ClusterYield include unsustainable returns, security vulnerabilities, and the possibility of the platform operating like a Ponzi scheme, relying on new investments for payouts.

We recommend exercising caution before investing in ClusterYield. Our review urges potential investors to conduct thorough research and consider more transparent, regulated alternatives.

Other Infromation:

Website: clusteryield.ai

Reviews:

There are no reviews yet. Be the first one to write one.