Capital Spring Review: Legitimate Investment or High-Risk Scheme?

In this Capital Spring review, Scams Radar examines the platform at credi-spring.org. It claims to offer high returns through forex and crypto trading. Many see it as a promising option. Yet, questions arise about its legitimacy. We combine insights from multiple sources to provide a clear picture. This helps investors decide wisely.

Table of Contents

Part 1: Executive Summary

Capital Spring positions itself as a regulated forex broker. It promises daily, hourly, or weekly returns up to 15%. Plans include lifetime payouts and capital guarantees. However, analysis shows signs of a high-yield investment program, often linked to Ponzi structures. Ownership remains hidden. Returns appear unsustainable. Investor risks are extreme with potential for total loss. Overall verdict Approach with caution. Score: 1/10. Better alternatives exist in regulated markets.

1.1 Ownership and Transparency

Details on Capital Spring’s owners are scarce. The site mentions no founders or executives. Domain records use privacy protection, hiding registrant info. One report ties “David Kalu” to marketing materials. Searches for his background yield no professional history or LinkedIn profile. Addresses claim ties to Dubai, London, or Mauritius, but none verify. Legitimate brokers like eToro list clear leadership and licenses from bodies like the SEC or FCA. Here, anonymity raises concerns. Without traceable owners, accountability is low. This setup often shields operators from legal action.

Part 2: Compensation Plan Breakdown

Capital Spring offers five plans focused on fixed returns. Each includes affiliate bonuses across five levels. These reward recruitment more than trading. Below is a clear table of the plans:

Plan Name | ROI (%) | Frequency | Min Investment (USD) | Max Investment (USD) | Affiliate Bonuses (Levels 1-5) |

VIP2 Ultimate | 15 | Weekly | 100,000 | 100,000,000,000 | 8%-30% |

VIP Ultimate | 10 | Daily | 40,000 | 99,900 | 2%-15% |

Harvest Plus | 0.5 | Hourly | 5,000 | 39,900 | 5%-30% |

Growth Flow | 0.3 | Hourly | 2,000 | 4,900 | 10%-50% |

Spring Start | 0.8 | Hourly | 250 | 1,900 | 5%-25% |

All plans guarantee capital return and lifetime earnings. Withdrawals require a $100 minimum and KYC verification. The “Forex Book” PDF serves as a basic guide, lacking depth on strategies or risks. Fixed profits ignore market ups and downs. This structure relies on new deposits to pay existing users.

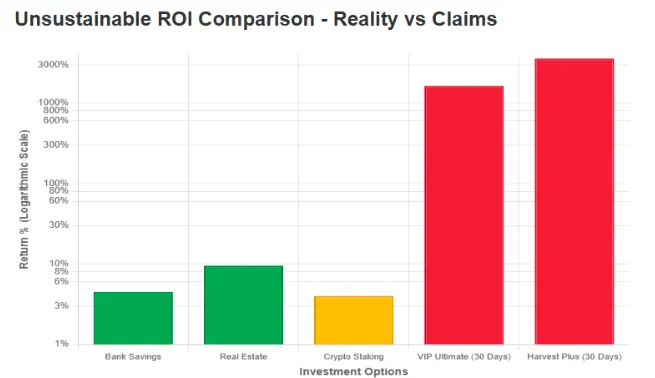

2.1 ROI Claims: Why They Don't Add Up

Capital Spring’s returns sound appealing. But math shows they can’t last. Take the VIP Ultimate plan: 10% daily on $1,000. After 30 days, it grows to about $17,449. That’s a 1,645% monthly gain. Over 90 days, it hit over $5 million. Annually it exceeds 1,700,000%

Here’s a simple breakdown using compound interest (A = P (1 + r)^n) :

- Principal : $1,000

- Rate : 0.10 daily

- Days : 30

- Amount : $1,000 × (1.10)^30 near about $17,449

For 0.5% hourly In 30 days (720 hours), $1,000 becomes around $36,000. Such growth demands endless new funds. Real markets don’t work this way.

Compare to proven options:

- Bank savings : 4-5% APY (e.g. high yield accounts)

- Real estate : 7-12% annual (rental yields plus appreciation)

- Crypto staking : 2-6% APY on platforms like Binance.

Capital Spring’s claims dwarf these. No asset class sustains 3,650% APY without collapse. Ponzis fail when recruitment slows. For $1 million in deposits at 10% daily, outflows hit $100,000 per day. Scaling needs exponential growth, which ends badly.

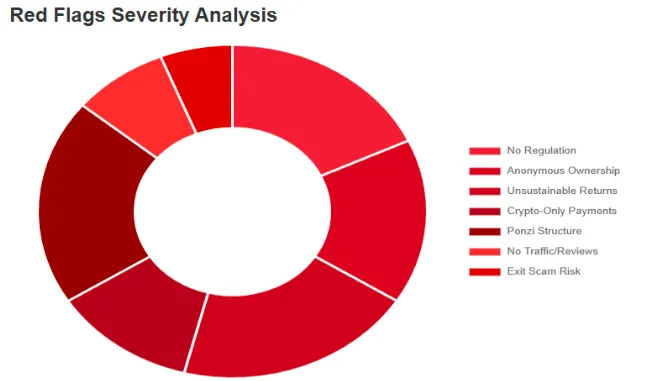

Part 3: Key Red Flags and Investor Risks

Several issues stand out:

- No regulation: Claims “regulated” status without license numbers or proofs.

- Anonymous operations: Fabricated names like Wayne Pointon or Annie Van Dom; unverifiable testimonials.

- Crypto-only payments: Bitcoin, USDT, Arbitrum – irreversible, no chargebacks.

- KYC for withdrawals: Often used to delay or deny funds.

- Affiliate focus: Up to 50% bonuses encourage pyramids over real trading.

- Generic content: Stale blogs, broken award links, fluffy PDF.

- Exit scam potential: Delays under “compliance” excuses.

Risks include fund loss via sudden shutdowns. History shows HYIPs last 6-12 months before vanishing.

Part 4: Traffic Trends and Public Perception

Data from tools like SimilarWeb shows minimal traffic. No monthly visitors or growth metrics. Legit sites like Binance see millions. Public buzz is absent. Trustpilot has one review, averaging 3.3/5 – unverified and sparse. Reddit and forex forums lack mentions. Scam watchdogs like BehindMLM label it a “Dubai MLM crypto Ponzi.” No genuine user stories emerge. Promoters? None found on X or social media. Past promotions link to unrelated crypto pushes.

4.1 Security Measures, Payment Methods, and Support

The site uses basic HTTPS via Let’s Encrypt. Claims advanced encryption and cold storage, but no audits. Payments limit to crypto, aiding anonymity. Support offers 24/7 email and Telegram (+44 7983 964177). No phone or live chat. Performance: Decent load times, but offshore hosting. DYOR tools like ScamAdviser flag low trust due to hidden WHOIS. URLVoid notes low reputation for new domains.

4.2 Future Outlook and Predictions

Short-term: Smooth payouts to build trust; affiliate drives growth. Mid-term: Delays, excuses like maintenance. Long-term: Site offline, 90%+ losses. Regulators target similar “Spring” variants. Collapse likely in 6-12 months.

Recommendations for Investors

Skip deposits. Use regulated platforms: eToro for forex, Vanguard for ETFs, Coinbase for crypto. If involved, withdraw fast and document. Report to SEC, FCA, or IC3. Aim for under 5% annual returns. Diversify and check licenses via BrokerCheck.

DYOR Toolkit and Reports

- WHOIS: Privacy-protected; registered August 2025.

- SSL Check: Valid but basic.

- ScamAdviser: Low trust for anonymity.

- Social Analysis: Generic promotions, no real engagement.

- Benchmarks: See ROI table above vs. real yields.

Always verify independently. This uses public data as of October 1, 2025.

Conclusion

This Capital Spring review highlights major concerns. High ROIs and anonymity point to risks. Stick to proven paths for safe investing. Research thoroughly before committing funds.

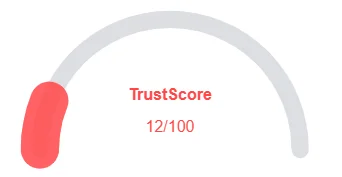

Capital Spring Review Trust Score

A website’s trust score is an important indicator of its reliability. Capital Spring currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Capital Spring or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- Whois details are concealed.

- The registrar has a high % of spammers and fraud sites

Frequently Asked Questions About Capital Spring Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No, it shows Ponzi-like traits with hidden ownership and unrealistic returns.

It advertises up to 15% weekly and hourly profits, which are unsustainable.

Unlike licensed brokers, it has no regulation, clear leadership, or transparency.

Risks include fund loss, withdrawal delays, and possible sudden shutdown.

Both reviews highlight similar red flags and warn investors to stay cautious.

Other Infromation:

Website: bnbcapital.org

Reviews:

There are no reviews yet. Be the first one to write one.