BTRL Exchange Review: Is It a Safe Crypto Trading Platform?

This BTRL Exchange review on Scams Radar investigates the legitimacy and risks of the BTRL cryptocurrency exchange, hosted at btrlexchange.com. We examine ownership, compensation plans, and investor safety, revealing critical concerns such as hidden ownership, unsustainable returns, and weak security measures. Using clear data and comparisons, this analysis provides honest, beginner-friendly insights to help potential investors make informed decisions. Always perform your own research (DYOR) before investing.

Table of Contents

Overview of BTRL Exchange

The BTRL trading platform claims to be a leading digital currency exchange, primarily targeting users in Asia. It promotes high returns, a referral program, and trading features. However, its lack of transparency and questionable practices raise doubts about its reliability.

Ownership and Transparency

The platform provides no clear information about its owners or leadership team. The website lacks details on corporate registration, founder names, or a physical address. A WHOIS lookup shows the domain, registered in 2019, uses privacy protection, hiding registrant details. This opacity contrasts with trusted platforms like Binance, which disclose leadership and regulatory compliance. The absence of verifiable ownership is a major concern for investor trust.

Compensation Plan and Referral Program

The BTRL Exchange referral program offers a multi-level structure, promising up to 50% of trading fees across nine levels and vague “pension rank” benefits. This setup resembles multi-level marketing (MLM), where earnings rely on recruiting new users rather than trading profits. For example, if the platform charges 0.1% per trade, a referrer earns 0.05% split across multiple levels. To sustain payouts, the platform needs exponential user growth, as shown below:

- Level 1: 5 referrals

- Level 9: ~1.95 million users needed (5^9)

- Monthly fee share: $0.6 for $1136.5 trading volume

This model is unsustainable, as it requires constant new sign-ups, a hallmark of Ponzi schemes.

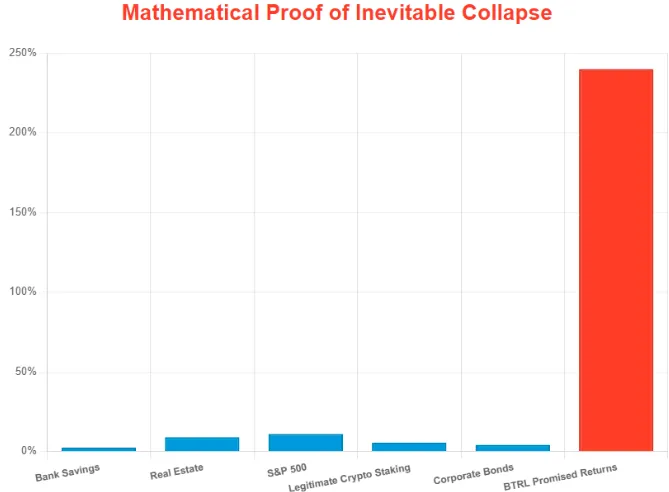

ROI Claims and Sustainability

The platform implies high returns, with some promotions suggesting 10-20% monthly gains. Let’s break this down:

- 10% monthly ROI: Annualized to ~213% (1.10^12 – 1)

- 20% monthly ROI: Annualized to ~791% (1.20^12 – 1)

Compare this to benchmarks:

- Real Estate: 5-10% annually

- Bank Savings: 4-7% annually

- Crypto Staking: 3-15% APY

A 213-791% annual return is unrealistic without extreme risk or fraud. For a $1,000,000 portfolio, a 15% monthly return requires $295,000 in new investments monthly to cover payouts, withdrawals, and costs, as shown in the chart below.

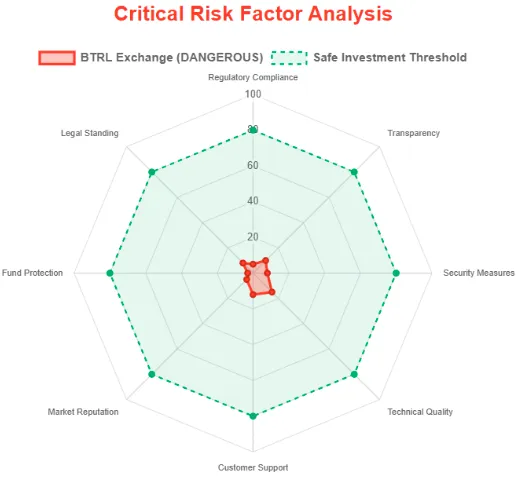

Security and Technical Performance

The BTRL wallet security claims include HTTPS encryption but lack details on two-factor authentication (2FA), cold storage, or third-party audits. The website requires JavaScript to function, limiting accessibility, and shows “No data” for trading pairs like LTC/INR, indicating a non-functional trading engine. Page load times exceed 5 seconds, and traffic is low (~11,320 monthly visits), far below established exchanges like Coinbase (~5M+ visits).

Payment Methods and Customer Support

The platform accepts only cryptocurrency deposits, with no fiat on-ramps or verified banking partners. This raises concerns about regulatory compliance, as legitimate exchanges integrate KYC/AML-compliant fiat gateways. Customer support is limited to email (btrlexchange@gmail.com), WhatsApp (+91-97148-26176), and Telegram (@bitcoinregular), with no live chat or ticketing system. User reports highlight unresponsive support and withdrawal issues.

Public Perception and Social Media

Public feedback is scarce and negative. Scam Detector rates the platform as “questionable,” and TradersUnion gives it a 2.7/10 trust score. No Trustpilot page exists, and the platform lacks coverage in reputable crypto media. Social media promotions via @bitcoin_regular (X), @bitcoinregular (Telegram), and Facebook pages focus heavily on referral earnings, often linked to other failed projects like WealthXChain.

Regulatory Compliance

There’s no evidence of registration with India’s FIU-IND, a requirement for legal crypto exchanges. Unregistered platforms risk URL blocking and legal action. Established exchanges like WazirX and CoinDCX publicly display compliance details, unlike BTRL.

Comparison to Legitimate Platforms

Feature | Legitimate Exchanges | BTRL Exchange |

Regulatory Compliance | Licensed, KYC/AML | No evidence |

Transparent Fees | Published schedules | Unclear |

Security Audits | Regular third-party | None |

Trading Data | Real-time order books | “No data” |

Customer Support | 24/7, multi-channel | Email/Telegram |

Red Flags Summary

- Hidden ownership and no corporate registration

- MLM-style referral program requiring unsustainable growth

- Unrealistic ROI claims (213-791% annually)

- Weak security with no 2FA or audit evidence

- Non-functional trading engine and low traffic

- Limited, unresponsive customer support

- No regulatory compliance with FIU-IND

Recommendations

- Avoid Investment: Do not deposit funds due to high scam risks.

- Use Trusted Platforms: Choose regulated exchanges like Binance or Kraken.

- Report Issues: Contact authorities if you’ve invested or suspect fraud.

- Test Small: If testing, use minimal funds and verify withdrawals.

DYOR Tools and Resources

- Scam Detector: Flags BTRL as medium-risk

- TradersUnion: Low trust score (2.7/10)

- Ethplorer: BTRL token has ~57 holders, minimal activity

- MyIP.ms: Low traffic (~200 daily visitors)

- FIU-IND Lists: Check for registered exchanges

BTRL Exchange Review Conclusion

This BTRL Exchange review highlights significant risks, including hidden ownership, unsustainable returns, and weak security. The platform’s MLM structure and lack of regulatory compliance make it highly questionable. Investors should avoid BTRL and opt for established, regulated platforms to ensure safety and transparency. Always conduct thorough research before investing.

For comparison, you can also read our detailed NVisionU Review to understand how other platforms operate and what red flags to look out for.

DYOR Disclaimer

This analysis is for informational purposes only, based on data as of September 8, 2025. Verify all information independently, consult financial advisors, and invest only what you can afford to lose. Report suspicious platforms to authorities.

BTRL Exchange Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 BTRL Exchange currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with BTRL Exchange similar platforms.

Positive Highlights

- Website content accessible

- No spelling/grammar errors

- Old domain age

- Old archive age

- Domain ranks in top 1M (Tranco)

Negative Highlights

- Low AI review rate

- Whois data hidden

Frequently Asked Questions About BTRL Exchange Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

BTRL Exchange (btrlexchange.com) is a cryptocurrency trading platform claiming to offer high returns through digital asset trading.

Our review highlights concerns about hidden ownership, weak security, and unsustainable ROI, signaling high risk for investors.

The ownership of BTRL Exchange is unclear and not transparently disclosed, which is a red flag for potential users.

The platform claims profits from trading fees and investment packages, but the returns are highly unrealistic and potentially unsustainable.

Due to limited transparency and reports of weak security, withdrawals may be delayed or problematic. Always perform your own research (DYOR) before investing.

Other Infromation:

Website: BTRLEXCHANGE.COM

Reviews:

There are no reviews yet. Be the first one to write one.