BoosterApp.ai asserts that its multi-level marketing (MLM) structure provides high returns and AI-driven solutions. This Booster Review looks at its ownership, legitimacy, compensation structure, and investor dangers. The platform presents significant issues because to its unsustainable returns, dubious leadership, and lack of verifiable items. Scams Radar analysis is provided below to assist you in making an investment decision.

Marketed as an AI-powered platform, BoosterApp.ai allows members, retailers, and promoters to receive commissions. It prioritizes earnings based on recruitment over material goods. Launched in December 2024, the website occasionally fails to load (HTTP 503 errors), indicating technical difficulties. To evaluate its legitimacy, this review delves deeply into its ownership, remuneration, and hazards.

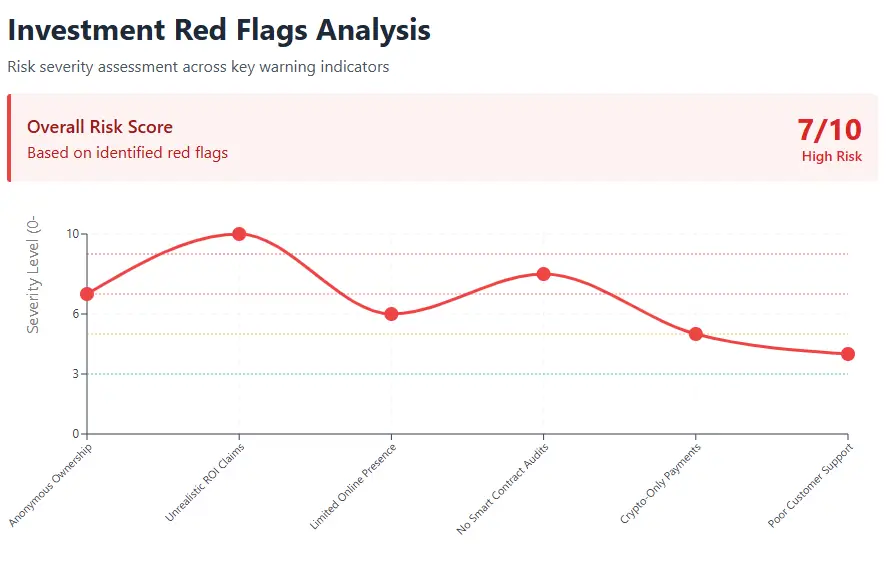

There is no precise information available regarding the platform’s proprietors. There is no “About Us” section on the website, and WHOIS information is concealed. Unverified is the address 230 CityGreen Way, Unit 108, Chattanooga, TN. Important figures consist of

Concern: High risk is indicated by a CEO with a fraud conviction and hidden ownership. Reputable platforms, such as Salesforce, openly reveal their leadership.

The platform uses an MLM structure with commissions across 10 levels:

Level | Commission Rate |

1 | 25% |

2 | 20% |

3 | 15% |

4 | 12% |

10 | 2% |

Founding Circle Member (FCM) Tiers:

Example Calculation:

Level | Recruits Needed |

1 | 5 |

2 | 25 |

3 | 125 |

4 | 625 |

5 | 3,125 |

Concern: Recruitment is prioritised over product sales, which is similar to a pyramid scheme. Reputable companies depend on product sales rather than rapid hiring.

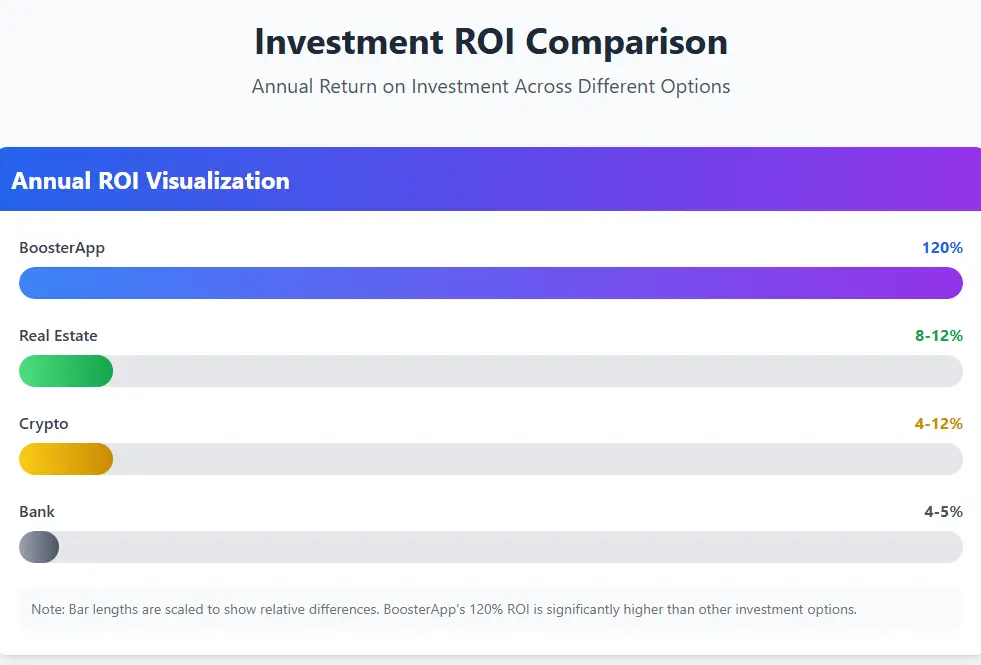

The platform’s implied returns (e.g., 10% monthly) are unsustainable. Let’s compare:

Calculation:

Investment | Annual ROI |

BoosterApp | 120% |

Real Estate | 8-12% |

Bank | 4-5% |

Crypto | 4-12% |

Concern: High returns without a clear revenue source suggest a Ponzi-like structure.

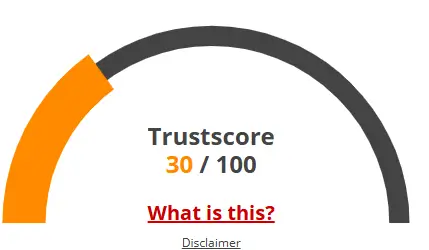

The site receives very little traffic (poor Tranco rank) and is not very active on X, Reddit, or Trustpilot. Zapier and other competitors receive millions of hits per month. Some reviews call it a scam, pointing to problems with transparency.

Concern: Lack of user base and organic engagement indicates low credibility.

The site receives very little traffic (poor Tranco rank) and is not very active on X, Reddit, or Trustpilot. Zapier and other competitors receive millions of hits per month. Some reviews call it a scam, pointing to problems with transparency.

Concern: Weak security and technical issues increase risks of data breaches or service disruptions.

The payment information is ambiguous and most likely crypto-only, making it more difficult to track down. There are no visible customer service channels, such as live chat. Reputable systems, such as PayPal, provide clear payment methods and strong assistance.

Concern: Limited support and untraceable payments raise scam risks.

No social media profiles promote the platform on X or Instagram. DYOR tools report:

Concern: Minimal online presence suggests deliberate obscurity.

Without major adjustments, the platform can fail in 12 to 18 months as a result of regulatory action or recruitment fatigue. The AI industry is cutthroat, and platforms with unclear products seldom make it.

The objective of this booster review is to provide information. Before making an investment, independently confirm all statements and speak with financial professionals. Use resources such as SEC EDGAR, ScamAdviser, and court documents to perform due diligence.

These are answers to commonly asked issues regarding the reliability of the Booster Networks investigation. We’ve included the following queries and responses to allay any worries:

Concerns are raised by Booster's unsustainable MLM structure, convicted CEO, and concealed ownership. Investors may find it dubious due to its lack of validated products and regulatory compliance, which implies significant risk.

With commissions ranging from 25% (Level 1) to 2% (Level 10), the site employs a multi-level marketing strategy. It has no obvious product revenue and is largely dependent on recruitment, much like a pyramid scheme.

Risks like a CEO with a history of deception, no physical goods, and irrational profits (such 120% a year) are highlighted by Booster Review. These elements, along with a lack of transparency and technical difficulties, point to possible frauds.

The stated returns of BoosterApp.ai are unsustainable, necessitating ongoing new hires to reimburse previous investors, in contrast to real estate (8–12% ROI), bank savings (4–5% APY), or cryptocurrency staking (4–12% APY).

The platform lacks security certifications and GDPR compliance; however, it does have basic SSL. Uncertain data protection measures and frequent outages (HTTP 503 failures) increase the possibility of security breaches or unreliability.

Title: Booster – Join The Booster Revolution

There are no reviews yet. Be the first one to write one.