BNB Capital Review: Exploring This Decentralized Investment on Binance Smart Chain

If you’re eyeing BNB Capital as a way to grow your holdings, read on. This BNB Capital review breaks down its features for everyday investors. Scams Radar covers ownership, the full compensation plan, ROI claims, and more in simple terms.

Table of Contents

Part 1: What Is BNB Capital?

BNB Capital is a decentralized investment platform on Binance Smart Chain. It offers yield farming through an immutable smart contract. Users deposit BNB tokens for daily returns. Plans range from short to longer terms. The setup promises no admin control for security. But questions linger about its long-term viability.

The platform draws interest for its high yields. Yet, many seek a clear BNB Capital review to weigh risks. Let’s dive into key areas.

1.1 Ownership and Team Profiles

Details on ownership are scarce. The site claims full decentralization with no owner. No founders or team members are named. This raises transparency issues. Searches show no LinkedIn profiles or backgrounds linked to developers.

One link points to BNB CAPITAL LIMITED, an overseas entity in Guernsey. Registered in 2022, it has a Jersey address. But no proof ties it to the smart contract. No director info crosses over. Investors often value known teams for trust. Here, anonymity is a gap.

Part 2: Compensation Plan Breakdown

The compensation plan centers on deposits and referrals. Minimum investment is 0.01 BNB. No upper limit exists. Users pick plans from 7 to 30 days. Longer ones yield higher totals.

Duration | Daily ROI | Total ROI | Example (1 BNB Deposit) |

7 days | 17% | 119% | 1.19 BNB |

10 days | 13.4% | 134% | 1.34 BNB |

15 days | 10.6% | 159% | 1.59 BNB |

20 days | 9.2% | 184% | 1.84 BNB |

25 days | 8.36% | 209% | 2.09 BNB |

30 days | 7.8% | 234% | 2.34 BNB |

Earnings build per second. Withdraw anytime after a 1-hour cooldown. Up to 100 active deposits allowed. This aids BNB Capital investment diversification options.

The BNB Capital referral program adds layers. It’s a 5-level system: 5% on level 1, 3% on 2, 2% on 3, 1% on 4, 0.5% on 5. Total potential is 11.5%. Rewards hit your balance auto. Share links to earn from network deposits. Understanding BNB Capital’s 5-level referral system is key for extra income

2.1 ROI Claims and Why They Raise Questions

ROI tops at 234% over 30 days. Sounds strong, but math shows issues. Let’s calculate.

Take 1 BNB at 17% daily for 7 days. Formula: A = P(1 + r)^t. Here, P=1, r=0.17, t=7. Result: About 3.04 BNB. But the site claims 1.19 BNB in total. They use simple interest, not compound.

For 30 days at 7.8%: A = 1 * (1 + 0.078)^30 ≈ 9.52 BNB if compounded. Site says 2.34 BNB. Gap is huge.

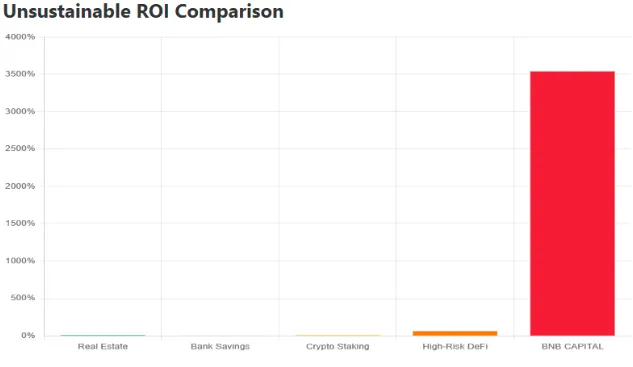

Annualize 17% daily: Over 365 days, it’s 4.74e+14 BNB from 1 – impossible without endless new funds. This screams Ponzi risks. New deposits pay old ones.

Compare to norms:

- Real estate ROI: 8-12% yearly.

- Bank ROI: 4-5% APY on savings.

- Crypto exchange APY: 5-15% on staking like Ethereum.

BNB Capital’s claims far exceed these. Earning potential and ROI accuracy of BNB Capital seem off.

Part 3: Security and Audits

Security leans on immutability. What makes the BNB Capital contract immutable? No changes post-deploy. Address: 0x8447592f16b45c7e84cc301f82dc516a1bd645ca. Verified on BSCScan.

Audits: HazeCrypto gave a perfect score. CertiK is ongoing. BNB Capital smart contract audit results are public. But HazeCrypto isn’t top-tier like CertiK.

Risks: Contract holds 511 BNB. Recent deposits and withdrawals show activity. Yet, referral focus could drive pyramid vibes.

How to check BNB Capital contract on BSCScan? Search the address for transactions.

3.1 Traffic, Perception, and Authenticity

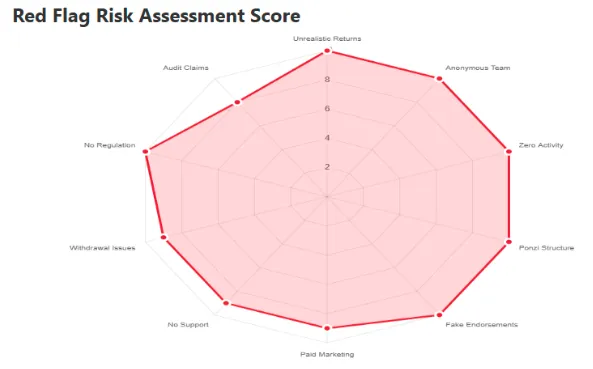

Traffic is low per SimilarWeb – under 1K monthly visits. Public views are mixed. Trustpilot has few reviews, some praise UI, others flag withdrawals. Reddit warns of HYIP traits.

Content authenticity: “Featured in” logos like Forbes lack links. Often a red flag.

Payment methods: BNB only via wallets like MetaMask. Gas fees on BNB Capital platform explained as under $0.50.

Customer support: Telegram channels. BNB Capital support and community channels are @bnbcapitaldev and @bnbcapitalorg.

Technical performance: TVL at 0 on site, but contract shows 511 BNB. Mismatch noted.

3.2 Red Flags and Comparisons

Red flags: Zero users shown, anonymous team, high ROIs. Risks associated with BNB Capital investments include total loss if inflows stop.

Vs. others: BNB Capital vs other BSC investment platforms like PancakeSwap offers lower, real yields from liquidity.

3.3 Social Media Promoters

X profiles promoting: @HayatoBNB shares positive updates. @JoaoPau70808094 posts referrals. Past: Similar HYIPs like Forsage. @xwinfinance promotes the BNB ecosystem broadly.

DYOR Tools Reports

Use these for checks:

- RugDoc: No listing, high risk.

- DeFiSafety: No rating.

- ScamAdviser: Low trust score.

Is the BNB Capital contract safe and audited? Partial yes, but DYOR.

Future Outlook

Predictions: If inflows slow, collapse likely in months. Like past scams, it may be a rug pull. BNB Capital reviews and user experiences 2025 could turn sour.

Final Thoughts

This BNB Capital review highlights pros like easy entry but big risks in yields and transparency. Step-by-step guide to using BNB Capital: Connect wallet, pick plan, deposit. But think twice. Now Visit TravelPro Review.

How to reinvest earnings on BNB Capital? Withdraw and redeposit.

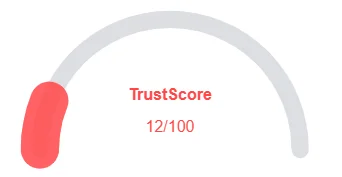

BNB Capital Review Trust Score

A website’s trust score is an important indicator of its reliability. BNB Capital currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with BNB Capital or similar platforms.

Positive Highlights

- The SSL certificate is valid

- This website is (very) old

- This website is safe according to DNSFilter

Negative Highlights

- Whois details are concealed.

- The registrar has a high % of spammers and fraud sites

Frequently Asked Questions About BNB Capital Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

bnbcapital.org is a decentralized yield-farming dApp on Binance Smart Chain that offers fixed-term ROI plans and a 5-level referral program.

Its anonymous team, unrealistically high ROI, and referral-driven payouts raise Ponzi-like concerns, invest cautiously.

While real estate or bank returns average 5–12% annually, bnbcapital.org advertises up to 234% in 30 days, an unsustainable gap.

Yes, it’s audited by HazeCrypto and listed on BSCScan, but it lacks top-tier audits like CertiK, so risks remain.

You can read our Everstead Review to compare platforms’ transparency, ROI claims, and risk factors before investing.

Other Infromation:

Website: bnbcapital.org

Reviews:

There are no reviews yet. Be the first one to write one.