BlockDAG Review: Assessing Legitimacy, Risks, and Investment Potential

In this BlockDAG review, Scams Radar examines the platform’s claims as a Layer 1 blockchain using Directed Acyclic Graph technology. We combine insights from multiple sources to cover ownership, compensation plans, and key risks. This helps investors understand if BlockDAG is a legit opportunity or carries high risks.

Table of Contents

Part 1: Understanding BlockDAG Technology

BlockDAG uses a hybrid blockchain model that blends Proof of Work with a DAG blockchain structure. This aims to solve the blockchain trilemma by improving scalability, security, and decentralization. Unlike traditional blockchain, BlockDAG allows parallel block creation. This reduces delays and boosts transaction speeds.

How does BlockDAG work? It references protocols like PHANTOM and GHOSTDAG. These enable multiple blocks to reference each other without forming a linear chain. The result is higher throughput and fewer orphaned blocks. BlockDAG claims thousands of transactions per second with low fees.

BlockDAG vs traditional blockchain: Linear chains like Bitcoin limit speed due to sequential processing. BlockDAG’s approach offers better scalability beyond Solana in theory. Yet, without a live mainnet, these claims remain unproven.

1.1 Ownership and Team Profiles

Ownership details are limited. The platform links to DAG Systems Ltd in its whitepaper, copyrighted 2024. Jurisdiction is unclear, with mentions of Seychelles, UAE, or Samoa in community discussions. WHOIS data hides behind privacy services like Cloudflare or Whois Privacy Corp in the Bahamas. This setup is common in crypto but reduces accountability.

The team is doxxed on the site. CEO Antony Turner has over 30 years in fintech, including blockchain work at SwissOne Capital. CTO Jeremy Harkness comes from LGRU Immedia. Chief Security Officer Dr. Youssef Khaoulaj holds that role. Advisors include Dr. Maurice Herlihy, a blockchain expert.

Profiles add credibility, but verifiable track records in successful crypto projects are thin for some members. No LinkedIn links or independent checks confirm all claims. This raises questions in a field where transparency builds trust.

Part 2: Compensation Plan Breakdown

The compensation plan centers on presale, mining, referrals, and a payment card. Tokenomics show a 150 billion BDAG token supply. Presale takes 33.3%, or 50 billion tokens in some docs, with adjustments noted.

Presale: Tokens sell in batches, starting low and rising. Current price is around $0.0015 to $0.0168 average. Over $420 million raised across 27 batches. Early buyers get bonuses, but an extended duration of over 18 months signals potential issues.

Referral Program: Referrers earn 25% commission in BDAG on purchases. Friends get 5% bonus on their first buy. This totals 30% extra tokens per sale, creating dilution. It drives promotion but risks pyramid-like dynamics if growth stalls.

Mining: Options include mobile app (X1 mines 20 BDAG/day) and hardware (X10 at 200 BDAG/day, X30, X100 up to 2,000 BDAG/day at 1,800W). Claims promise profitability, but energy costs (e.g., $0.12/kWh) cut into gains. For X100: Daily power is 43.2 kWh, costing $5.18. At $0.05 per BDAG, revenue is $100, profit $94.82. Scaling to thousands of miners adds sell pressure.

Payment Card: Marketed as upcoming for crypto spending without KYC at first. It promises live conversions, but the status remains pre-launch.

Overall, the plan rewards early participants and promoters. Yet, high outflows from referrals and mining could flood the supply post-listing.

2.1 ROI Claims and Sustainability Analysis

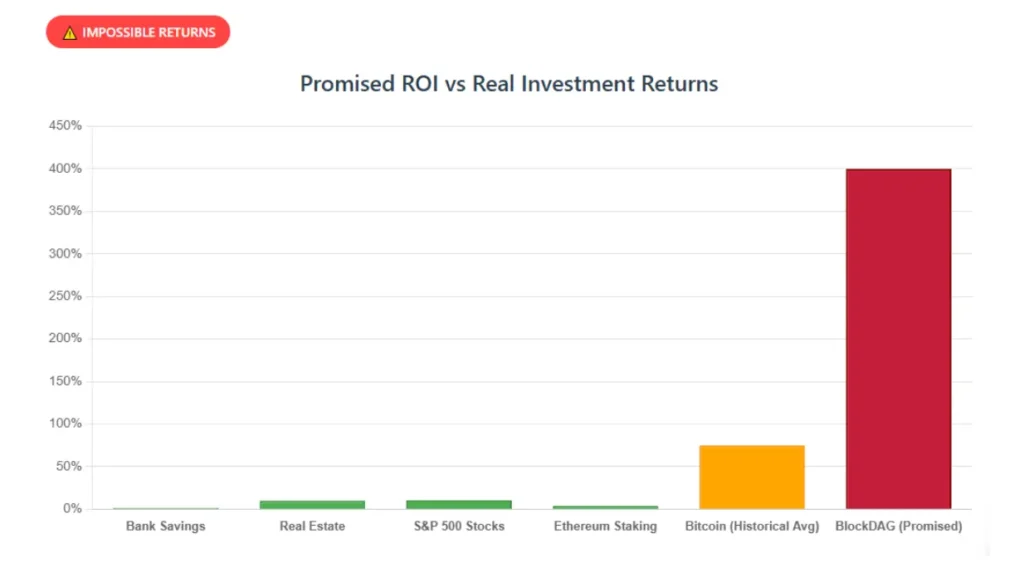

BDAG token promises high returns. Early ROI claims reach 2,900% or 400% in models. Total supply 150 billion; presale 50 billion.

Math shows issues. For 1,000x pump to $1: Market cap $150 trillion, far beyond Bitcoin’s $1-2 trillion peak. Even 10x to $0.10 yields $15 trillion, rivaling all crypto.

Real calc: $1,000 at $0.001 buys 1 million BDAG. At $0.01 launch, 900% gain, but unlocks could drop to break-even or loss.

Investment Type | Annual ROI | Risk Level |

Bank APY | 4-5% | Low |

Real Estate | 4-10% | Medium |

Crypto Staking | 5-20% | High |

BlockDAG Claim | 400%+ | Extreme |

BlockDAG mining profitability in 2025 depends on price stability, but emissions strain economics.

Part 3: Traffic Trends and Public Perception

Site ranks around 67,000 globally per SimilarWeb, with the U.S. and Azerbaijan leading traffic. Visits rose 42% month-over-month, session time 2:33 minutes, bounce rate 43%. This shows engagement, but possibly from marketing.

Perception is mixed. Trustpilot scores 2.5-2.9/5 from 359 reviews, with half negative on fund losses and support. Reddit threads and ZachXBT label it suspicious, citing delays and fake numbers. Positive notes come from partnerships like Seattle Orcas, but Inter Milan and Borussia Dortmund claim a lack of confirmation on club sites.

Media mentions in Bloomberg and CoinTelegraph are often sponsored. Scamadviser gives low trust scores.

3.1 Security Measures and Technical Performance

Security includes Halborn and CertiK audits. Halborn found 12 issues, one critical; CertiK noted 7. No full public reports. Site claims EVM compatibility and bug bounties.

Content uses hype like “best altcoin for 2025.” A technical blueprint exists, but no downloadable whitepaper or GitHub. Testnet “Awakening” (ChainID 1043) has an explorer, but no mainnet after 18 months.

BlockDAG protocol security features aim for quantum resistance. Yet, absent no code limits verification.

3.2 Social Media and Promoters

Official: X @blockdagnetwork, Telegram t.me/blockDAGnetworkOfficial, YouTube @BlockDAGofficial.

Promoters like @PrudentSammy push presales, with history in DeFi. Others promote Kaspa or memes. Fake accounts tied to past presales.

DYOR tools: Scamadviser (low trust), Trustpilot (mixed), Reddit (delays noted).

Part 4: Payment Methods and Customer Support

Payments use Visa, Mastercard, Google Pay, and Apple Pay via MoonPay for USDT/ETH/BNB. Funds stay custodial until distribution, adding risk.

Support via email (support@blockdag.network), Telegram, and Discord. Responses vary; some praise the speed, while others note delays and unaddressed refunds. Fake X accounts like @ZinuSupport0 pose phishing risks.

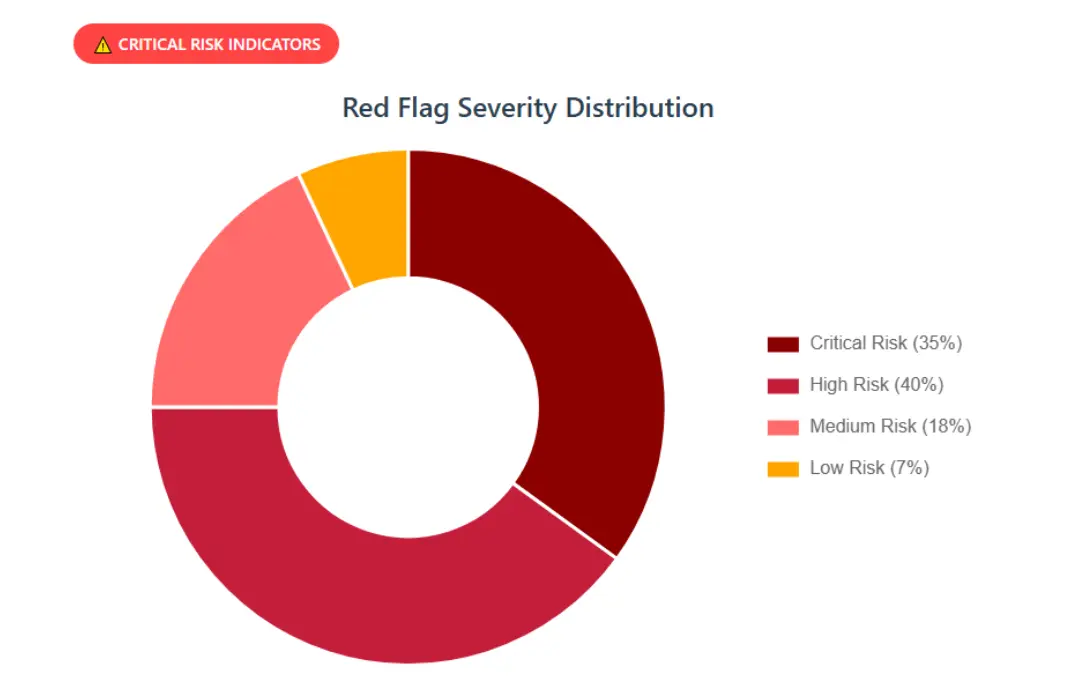

Red Flags and Comparisons

Key concerns: Long presale, no mainnet, opaque ownership, high referral incentives, unverified partnerships. Unlike banks with FDIC insurance or real estate with tangible assets, this is a speculative investment.

BlockDAG smart contract compatibility claims EVM, but no proof. Vs Bitcoin security, it adds DAG for speed but lacks a track record.

Conclusion: Proceed with Caution

This BlockDAG review highlights innovative tech but stresses risks like delays and unproven claims. Weigh ownership transparency and compensation against benchmarks. Diversify and verify independently. Always DYOR; this is not advice. Invest wisely in Layer 1 blockchain options.

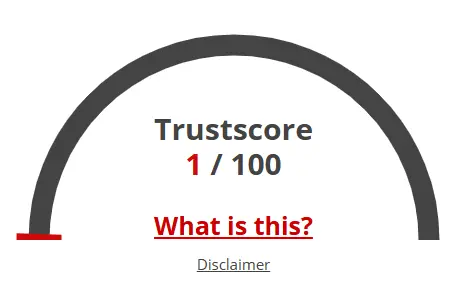

BlockDAG Review Trust Score

A website’s trust score is an important indicator of its reliability. BlockDAG currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with HyvinX Review or similar platforms.

Positive Highlights

- Website content is accessible

- According to the SSL check the certificate is valid

Negative Highlights

- This website does not have many visitors

- Cryptocurrency services detected, these can be high risk

- Several spammers and scammers use the same registrar

Frequently Asked Questions About BlockDAG Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

BlockDAG claims Layer-1 DAG tech, but opaque ownership and unverified partnerships make its legitimacy uncertain.

BlockDAG touts 400%+ ROI, which is far above bank (4 - 5 %) or real estate (4 -10 %) returns; such high claims are risky.

No live mainnet, heavy referral incentives, no public audits, and potential token dumping are key red flags.

The site names some executives, but ownership details are hidden, and the team claims a lack of independent verification.

BlockDAG Review inspects a crypto blockchain project; Everstead Review typically examines real-estate or asset-backed returns. The focus and risk models differ.

Other Infromation:

Website: blockdag.network

Reviews:

There are no reviews yet. Be the first one to write one.