BJ Mining Review: Is This Cloud Mining Platform Legit or a Scam?

In this BJ Mining review, Scams Radar examines whether BJ Mining’s cloud mining service is a reliable choice for Bitcoin mining or raises serious concerns. Many seek BJ Mining’s passive income through its contract plans, but questions about legitimacy persist. We cover ownership backgrounds, full compensation details, ROI claims, user experiences, and risks to guide informed decisions.

Table of Contents

Part 1: Understanding BJ Mining: What the Platform Offers

BJ Mining presents itself as a top cloud mining provider offering services for major cryptocurrencies, including Bitcoin, Ethereum, XRP, and Doge. It states that it began operating in 2015 and claims to run its operations from England with a network of more than sixty green-powered mining farms using solar and wind energy. The company further promotes having over one point two million ASIC machines and more than five million registered users across one hundred eighty countries. It highlights features such as a mobile application for easy access, daily sign-in rewards of close to sixty cents, and a fifteen-dollar welcome bonus for new members. The platform also promotes the use of AI-based mining technology designed to improve efficiency without requiring users to set up any physical hardware.

According to the company, users simply create an account on the official website, deposit funds in supported cryptocurrencies such as Bitcoin or USDT, and then select the mining contracts they prefer. The platform emphasizes real-time mining statistics to build trust, multilingual customer support, and security options that include multi-factor verification. While these claims appear attractive on the surface, deeper research shows several inconsistencies and gaps that raise questions about the true legitimacy of the platform.

1.1 Ownership and Background: Who Runs BJ Mining?

BJ Mining states it operates under BJ Management Limited, a UK company with number 09480668, registered in 2015 as a management consultancy. The address is Unit 1, 71 Moor Park Avenue, Blackpool, Lancashire, FY2 0LY. Records show this as a small firm with modest turnover and few staff, not a global mining giant.

Independent sources link the address to BM Furniture, a local warehouse. No public ties exist between the company and large-scale mining. Domain bjmining.com was registered in 2012, updated in 2018 via a Chinese registrar with hidden details. This opacity contrasts with claims of FCA regulation under FRN 927459. Searches on the FCA register find no match, marking a key red flag in this BJ Mining review.

Part 2: BJ Mining Contract Plans: Full Compensation Breakdown

BJ Mining offers various mining contracts with fixed returns, targeting passive income seekers. Plans vary by investment, term, and cryptocurrency. Here’s a detailed table of select options based on platform data:

Contract Name | Minimum Deposit (USD) | Duration (Days) | Daily Income (USD) | Total Profit (USD) | Total ROI (%) | Daily ROI (%) Approx |

New User Experience Contract | 100 | 2 | 3.00 | 6 | 6 | 3.00 |

WhatsMiner M60S++ | 600 | 7 | 7.50 | 52.50 | 8.75 | 1.25 |

Avalon Miner A1566 | 1,200 | 15 | 15.60 | 234 | 19.50 | 1.30 |

WhatsMiner M66S+ | 5,800 | 30 | 87.00 | 2,610 | 45 | 1.50 |

Antminer L7 | 12,000 | 40 | 204.00 | 8,160 | 68 | 1.70 |

Bitmain Antminer S21e XP Hyd | 27,000 | 45 | 486.00 | 21,870 | 81 | 1.80 |

These BJ Mining cryptocurrency contracts promise stability without market fluctuations. Renewal and reinvestment options exist, with a referral program offering 3% direct and 2% indirect commissions. VIP contract terms allow higher tiers but often tie to larger deposits.

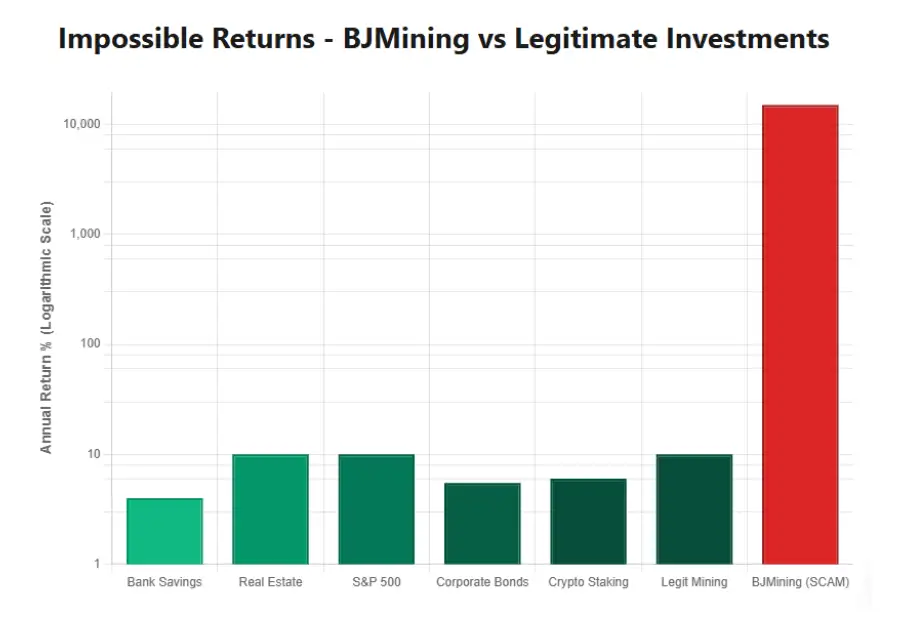

2.1 BJ Mining Mining ROI and Earning Stability: Why Claims Fall Short

BJ Mining’s mining ROI appears attractive, with daily rates from 1.25% to 1.80%. Yet, calculations show unsustainability. For a 1.5% daily ROI, annual compounding yields (1 + 0.015)^365 ≈ 229 times the initial investment, or 22,800%. Higher rates hit 600,000%.

Real mining faces electricity costs, hardware wear, and network difficulty. Legitimate Bitcoin mining yields 5-15% annually. Compare in this table:

Investment Type | Typical Annual ROI (%) | Risk Level | Notes |

Bank Savings | 3-5 | Low | Insured, stable |

Real Estate | 8-12 | Medium | Rental yields |

Crypto Staking | 4-15 | High | Variable, regulated platforms |

BJ Mining Claims | 500-30,000 | Extreme | Fixed, unproven |

This disparity signals Ponzi traits, where payouts rely on new funds, not actual mining. BJ Mining cryptocurrency mining profitability ignores halving events and volatility.

Part 3: BJ Mining Security and Compliance: Gaps in Protection

BJ Mining claims enterprise SSL, encryption, and FCA regulation for safety. It mentions AIG insurance and BJ Mining KYC requirements for verification. However, no independent proof supports these. Tools like ScamAdviser rate it low trust due to hidden ownership and crypto risks. VirusTotal shows no malware, but financial legitimacy is lacking.

BJ Mining security protocols include 24/7 monitoring, yet user reports question data protection. Without verifiable audits or on-chain proof, trust erodes.

3.1 BJ Mining Withdrawals and Customer Support: Common Issues

The BJ Mining withdrawal process supports coins like BTC and ETH, claiming no fees and quick processing. Yet, reviews highlight blocks once balances grow. Users face demands for extra deposits, taxes, or VIP upgrades, often $100,000+ to unlock funds. This matches advance-fee patterns.

BJ Mining customer support offers email and chat, but responses turn evasive. Trustpilot scores hover at 3.3/5, with positives seeming generic and negatives detailing traps. BJ Mining user reviews and reputation in 2025 lean negatively on Reddit and X, linking it to scams.

3.2 BJ Mining Investment Risk and Caution Tips

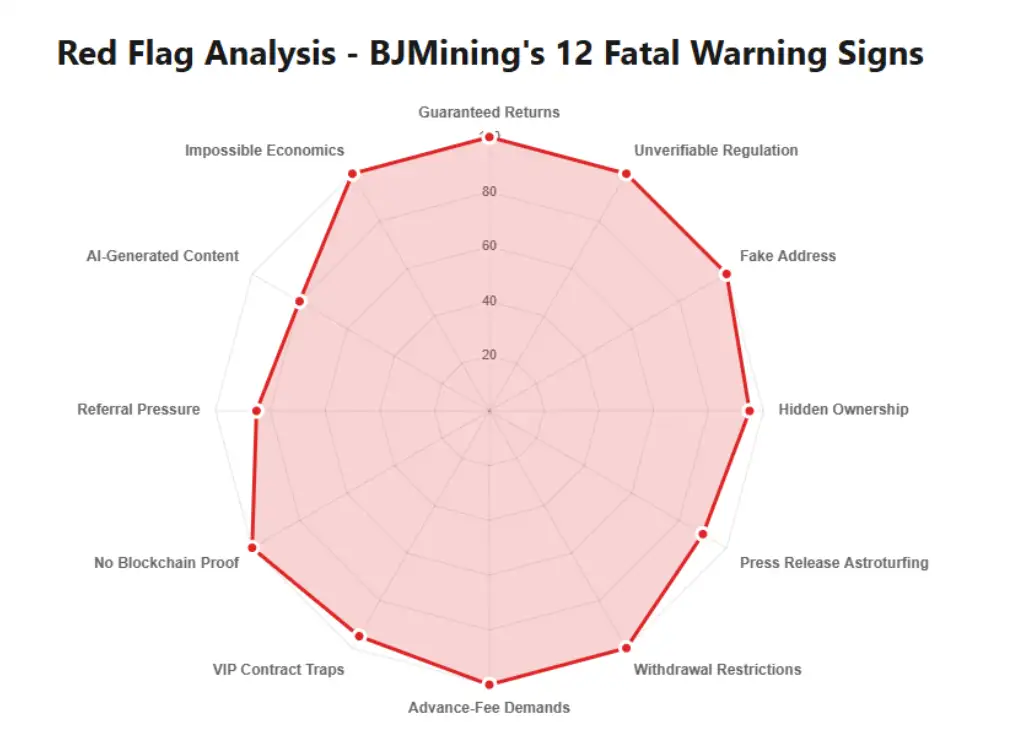

Key red flags:

- Unverifiable regulation and address.

- Hidden owners with mismatched company backgrounds.

- Unrealistic ROIs ignore market realities.

- Withdrawal issues and fee demands.

- Press releases, not independent coverage.

- Low traffic despite big claims.

Social promoters, often recovery accounts on X like @AngelPowell142, warn while pitching services, tying to other dubious sites like KYOTOEXC.

Legitimate Alternatives to BJ Mining

Consider regulated options:

- Crypto staking on Kraken or Binance: 4-10% APY.

- Self-mining with verified pools: Variable but transparent.

- Traditional savings: 4-5% secure yields.

Always assess the BJ Mining investment risk before committing.

Conclusion: Proceed with Caution in This BJ Mining Review

This BJ Mining review uncovers a platform with bold promises but lacking proof. While BJ Mining’s renewable energy and AI mining sound appealing, evidence points to high risk. Verify claims independently. Crypto carries volatility; only invest what you can lose. For BJ Mining’s global user experiences, forums show mixed but concerning testimonials. DYOR always.

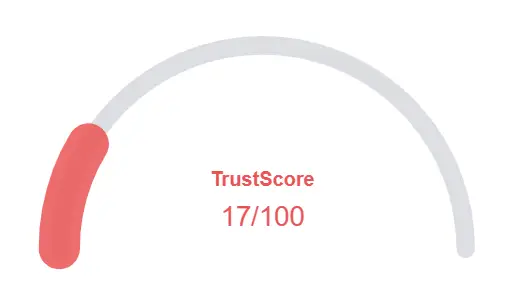

BJ Mining Review Trust Score

A website’s trust score is an important indicator of its reliability. BJ Mining currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the BJ Mining or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- We found several positive reviews for this site

Frequently Asked Questions About BJ Mining Review

This section answers key questions about BJ Mining, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Its fake regulation, hidden owners, and blocked withdrawals show high scam risk.

Unrealistic ROIs, unverifiable mining farms, fake FCA claims, and user withdrawal issues.

No. It offers 1–2% daily, while real BTC mining averages only 5–15% yearly.

Only with extreme caution. Most evidence shows it operates like a Ponzi-style setup.

Both expose identical patterns: fake claims, no proof of operations, and high withdrawal risk.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.