BitTON AI Review: Is This Crypto Platform Worth Your Investment?

In this BitTON AI review, Scams Radar examines the cryptocurrency platform’s key features, risks, and legitimacy. Launched in 2025, BitTON AI promises high returns through staking and referrals. We cover everything from tokenomics to security features. Our goal is to help you decide if it’s a safe choice for passive income.

Table of Contents

Part 1: What Is BitTON AI? A Quick Overview

BitTON AI calls itself an AI-powered Layer 1 blockchain ecosystem. It blends artificial intelligence with decentralization. The platform runs on the TON blockchain. Users can stake tokens for rewards. It also offers a referral program for extra earnings.

The main token is BTN. It has a total supply cap of 21 million, like Bitcoin. Tokenomics focuses on scarcity and progress-based emission. This means new tokens are released based on network growth, such as new wallets or transactions.

BitTON AI claims to use AI for better trading and efficiency. But details on how artificial intelligence works remain vague. No clear audit reports back these claims.

1.1 Ownership and Team Background

Ownership details raise questions in this BitTON AI review. The platform lists Pavel Chervenkov and Ivan Boyko as co-founders. Pavel has some background in tech startups. Ivan links to finance projects. However, we found limited public records on their past work in blockchain.

No LinkedIn profiles or verified histories show up in searches. The domains use privacy protection. Bitton.ai registered on April 2, 2025. Bittonai.com followed on August 6, 2025. This short history suggests a new venture without a proven track record.

Legitimate platforms often share team bios and past successes. Here, transparency falls short. This lack could signal risks for investors seeking accountability.

Part 2: BitTON AI Compensation Plan Explained

The compensation plan drives much of the platform’s appeal. It centers on staking, referrals, and liquidity rewards. Let’s break it down step by step.

Staking and Passive Income Strategies

Users deposit TON or BTN tokens for 135 days. The minimum deposit is 1 TON, about $5. Returns a promise 256% total over the term. This breaks into daily yields that increase over time.

- Days 1-7: 0.5% daily

- Days 8-14: 0.6% daily

- And up to 3% daily by days 100-135

Rewards are paid in BTN tokens. You can convert them to TON. Withdrawals happen every seven days, with a 1 TON minimum.

This setup aims for passive income. But fixed returns ignore market changes. In real crypto, yields vary with network activity.

Referral Program and Affiliate Marketing

Referrals boost earnings through a 10-level system. Level 1 gives 10% bonus on referrals’ deposits. It drops to 0.5% by level 10.

Promotions like “Match & Up!” reward top recruiters. For example, reach 75,000 TON in team turnover for $2,500 in prizes. This ends October 31, 2025.

The focus on recruitment mirrors multi-level marketing. Earnings depend more on bringing in others than on platform value. This raises Ponzi scheme warnings.

Liquidity Provider Program

Provide liquidity on exchanges like Uniswap. Submit proof to the team for 0.25% weekly USDT rewards. This requires direct contact, often via Telegram.

While it sounds helpful, sending proofs opens risks. Legit DeFi uses smart contracts, not manual checks.

2.1 ROI Claims: Mathematical Breakdown and Sustainability

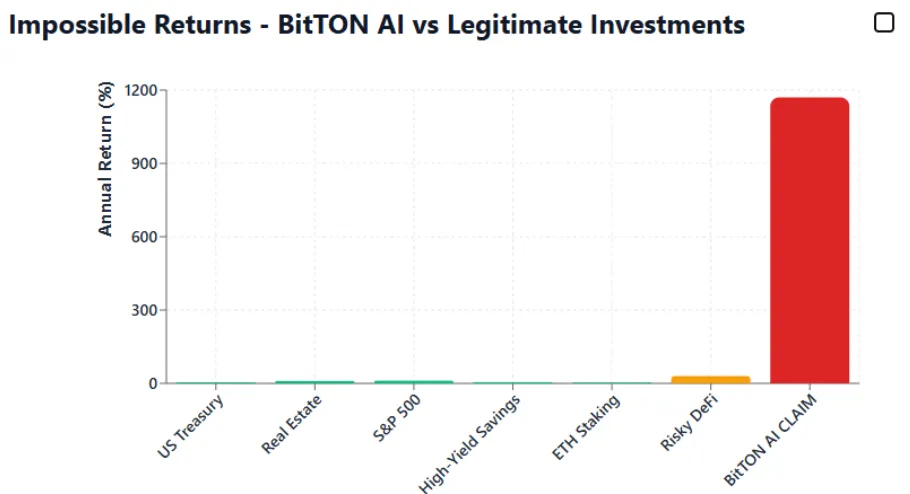

BitTON AI staking promises stand out. But are they realistic? We crunched the numbers.

The 256% return over 135 days means a 3.56x multiplier on your deposit. Daily compound rate: about 0.699%. Annualized, that’s 1,170% APY.

Here’s the math:

Formula: A = P (1 + r)^n

- P = Principal (say $1,000)

- r = Daily rate (0.00699)

- n = 135 days

- A ≈ $3,560

To sustain this, the platform needs huge revenue. Without it, new deposits pay old ones. This can’t last forever.

Investment Type | Typical Annual Return |

Bank Savings | 4-5% |

Real Estate | 7-10% |

Crypto Staking (e.g., ETH) | 5-20% |

BitTON AI Claim | 1,170% |

As shown, BitTON AI dwarfs others. Real estate ROI takes years for similar gains. Banks offer safety but low yields. Legit crypto like Binance staking stays modest, backed by fees.

Unsustainable math points to risks. When recruitment slows, payouts fail.

Part 3: Security Features and Platform Usability

Security matters in any BitTON AI review. The site uses HTTPS with a valid SSL certificate. It claims Proof of Decentralization, mixing stake and participation.

But no independent audits from firms like Certik exist. Smart contracts lack verification. Users rely on Telegram for support, not formal channels.

App access seems mobile-friendly. Account setup needs a wallet connection. No heavy verification, which skips KYC but raises compliance issues.

Encryption claims are standard, but without reports, trust is low. Fraud prevention tips: Use hardware wallets and avoid sharing keys.

3.1 Public Perception and User Experience

Reviews paint a mixed picture. Positive posts come from affiliates on X and Telegram. They highlight easy passive income and community growth.

Critics dominate independent sites. BehindMLM calls it an AI ruse Ponzi. ScamAdviser gives low trust scores. YouTube videos question returns.

User experience reports note smooth deposits but withdrawal delays. Social media presence is active on @BitTON_AI, with 274 followers. It promotes BTN as Bitcoin’s better version.

Community focuses on Telegram groups. But coordinated posts suggest marketing tactics over organic talk.

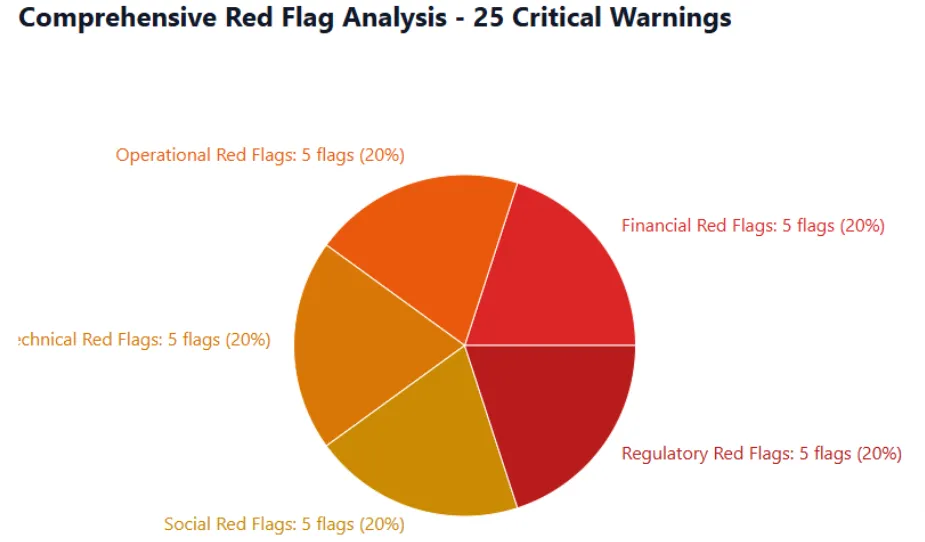

3.2 Risks of Investing in BitTON AI Crypto Platform

Several risks stand out. Regulatory status: No licenses found. This could mean unregistered securities.

The token scarcity model aims for value, but a thin CoinMarketCap listing shows low adoption. Comparison with other crypto AI platforms like Fetch.ai reveals gaps in tech depth.

Environmental impact claims are absent. No green energy incentives mentioned.

How to spot Ponzi warnings: Fixed high returns, referral push, hidden owners.

3.3 BitTON AI Withdrawal and Deposit Process

Deposits use TON tokens only. No fiat options. Rewards in BTN, convertible to TON.

Withdrawal process on Tuesdays. Test small amounts first. If delays occur, it’s a red flag.

Part 4: BitTON AI Community and Social Media Presence

Promotion networks include @ephraim_akundu (Web3 educator) and @kennystrendy (crypto advocate). They share staking tips. Past promotions link to other tokens like BNB.

Searches for “BitTON AI 256% 135 days” show affiliate videos. Many cross-promote high-yield schemes.

4.1 BitTON AI Legal and Compliance Status

No clear compliance. Operating without registration risks shutdowns. Check local laws before joining.

4.2 BitTON AI Platform Security and Encryption

Basic measures exist, but the lack of audits weakens claims. Use two-factor auth where possible.

4.3 BitTON AI Marketing Tactics and User Reviews

Tactics emphasize urgency and FOMO. Reviews vary, but warnings prevail.

Conclusion: Should You Invest in BitTON AI Investment Platform?

This BitTON AI review highlights promises versus realities. Strong returns tempt, but math and red flags warn caution. Hidden owners, an MLM structure, and low transparency suggest avoidance. For safer passive income, choose regulated options. Always verify claims. Consult experts. Your money deserves careful thought.

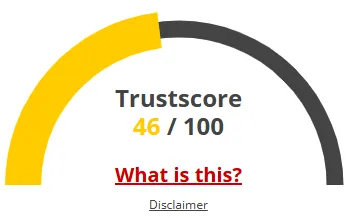

BitTON AI ReviewTrust Score

A website’s trust score is an important indicator of its reliability. BitTON AI currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with BitTON AI or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- This website has existed for quite some years

- DNSFilter considers this website safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- A risk/high return financial services are offered

- This website does not have many visitors

- The age of this site is (very) young.

Frequently Asked Questions About BitTON AI Review

This section answers key questions about BitTON AI, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

BitTON AI shows Ponzi-like signs, hidden owners, fixed ROIs, and no audits. Invest carefully.

It claims AI-based trading and staking, but no proof supports such profits.

Unverified team, no regulation, and referral-driven income make it risky.

Both lack transparency and rely on unrealistic AI-profit claims.

Not recommended. The math doesn’t add up, and sustainability is doubtful.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.