Bitrage Markets Review: Is It a Legit Trading Platform?

This Bitrage Markets review examines the legitimacy of the cryptocurrency trading platform. For an in-depth scam analysis, visit xfor a detailed review.

Bitrage Markets, accessible at bitragemarkets.com, promises high returns through AI-powered crypto trading and crypto arbitrage. However, its unregulated status, hidden ownership, and questionable practices raise concerns. Read on to explore whether bitragemarkets.com is safe, covering features, compensation plans, security, payment methods, and ROI claims with clear insights and comparisons for investors.

Table of Contents

Ownership and Corporate Structure

Bitrage Markets operates under Bitrage Capital Markets Ltd., registered in Saint Lucia at Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, P.O. Box 838, Castries. It also claims a Dubai presence via a phone number (+971045548913), but no UAE regulatory license (DFSA/SCA) is listed.

Key Issues

- Hidden Ownership: WHOIS data is obscured via Domains By Proxy, LLC, hiding registrant details.

- Unverifiable Registration: No records of Bitrage Capital Markets Ltd. exist in Saint Lucia or Dubai registries.

- Offshore Risks: Saint Lucia does not regulate forex or crypto trading, per its Financial Services Regulatory Authority, limiting investor recourse.

- No Leadership Transparency: No information on owners or executives is available, raising trust concerns.

Red Flag: The lack of verifiable ownership and offshore registration suggests high risk for investors.

Compensation Plan and ROI Claims

Bitrage Markets promotes an Introducing Broker (IB) program and claims 5-6% monthly returns through an algorithmic trading robot targeting EUR/USD and GBP/USD pairs. The compensation structure includes:

- Commission Structure: Competitive rates based on referred clients’ trading volume.

- Bonuses: Welcome and referral bonuses for new traders and affiliates.

- Partnership Models: Hybrid plans and transparent reporting tools for tracking performance.

ROI Sustainability Analysis

The platform’s claim of 5-6% monthly returns translates to 79.6-101.2% annualized ROI:

- Formula: Annualized Return = ((1 + \text{Monthly Rate})^{12} – 1)

- For 5%: ((1.05)^{12} – 1 = 79.6%)

- For 6%: ((1.06)^{12} – 1 = 101.2%)

- For 5%: ((1.05)^{12} – 1 = 79.6%)

Example Calculation

- Initial Investment: $1,000

- After 1 Year at 5% Monthly: $1,796

- After 5 Years at 5% Monthly: $18,679

Investment Type | Annual Return | Risk Level |

Bitrage Markets | 79.6-101.2% | Extreme |

Bank Savings | 4-5% | Low |

Real Estate | 5-8% | Moderate |

Crypto Staking | 2-6% | Moderate |

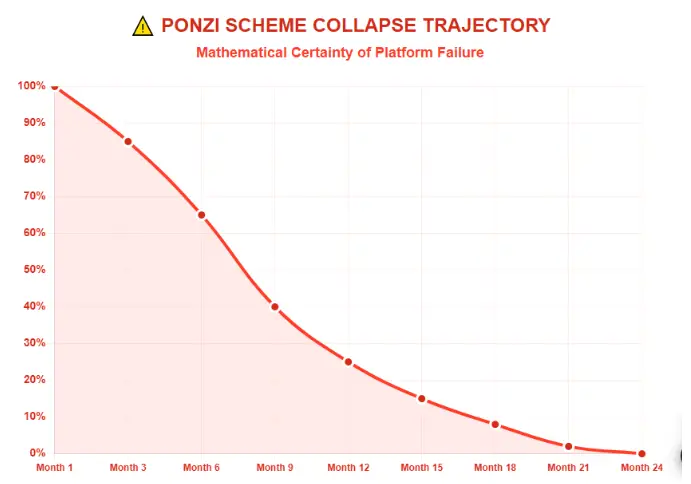

Why Unsustainable

- Market Reality: Even top hedge funds average 20-30% annually, with high risk.

- Ponzi Characteristics: High returns require constant new investor funds, typical of Ponzi schemes.

- No Strategy Disclosure: No details on how the algorithmic trading achieves such returns.

Red Flag: The unrealistic ROI and recruitment-focused compensation resemble pyramid schemes.

Traffic Trends and Public Perception

Bitrage Markets has minimal web presence:

- Organic Traffic: ~184-204 monthly visits (FxVerify).

- Bounce Rate: 0%, suggesting bot traffic or no engagement.

- Visit Duration: 0 seconds, indicating no real user interaction.

Public Perception:

- ScamAdviser: 0/100 trust score due to hidden ownership and low traffic.

- WikiFX: 1.82/10 score, labeled high-risk and unregulated.

- BrokersView: Warns of scam potential due to offshore status.

- User Complaints: Issues include withdrawal delays, hidden fees, and unresponsive support.

Platform | Monthly Visits | Trust Score |

Bitrage Markets | ~200 | 0/100 |

eToro | Millions | 85/100 |

XM | Millions | 90/100 |

Security Measures and Content Authenticity

The platform claims robust security:

- SSL Encryption: Present (Let’s Encrypt certificate).

- Two-Factor Authentication (2FA): Claimed but unverified.

- MT5 Platform: Advertised, but no server found in MT5’s list.

Content Issues:

- Vague Details: Lists forex, crypto, and commodities but lacks specifics (e.g., tradable pairs).

- Fake Testimonials: Uses stock names and unverifiable identities.

- Contradictory Claims: Dubai-based marketing vs. Saint Lucia registration.

Red Flag: Unverified security claims and deceptive content suggest a lack of authenticity.

Payment Methods and Customer Support

Bitrage Markets supports payments via Visa, Mastercard, Skrill, Neteller, bank transfers, and cryptocurrencies.

Issues

- No fee or processing time details.

- Withdrawals restricted to original funding source, with reported delays (2-7 days).

Customer Support

- Email-only (info@bitragemarkets.com), no live chat or phone support.

- Complaints of unresponsive or ineffective support.

Technical Performance

- MT5 Claim: Unverified, as no server is listed.

- Website Uptime: Reports of downtime and identity changes.

- Server Ping: 155 ms (Netherlands), average but not exceptional.

Red Flag: Technical deficiencies and unverifiable platform claims reduce reliability.

Social Media and Promotional Tactics

Bitrage Markets has a LinkedIn profile (104 followers) and limited activity on X and Instagram:

- X: @imemon15 and @bitrage_markets promote referral links.

- Instagram: @mariam_bts, @bitragemarketsuae, @mahfuztrader use flashy ads and referral links.

- Tactics: Focus on “easy money” and recruitment, with no evidence of promoting other platforms.

Red Flag: Aggressive marketing via referral links resembles pig-butchering scams.

Future Outlook

- Short-Term (3-6 months): Aggressive marketing to attract novice investors.

- Medium-Term (6-18 months): Increased withdrawal issues and regulatory scrutiny.

- Long-Term (18+ months): Likely platform shutdown or rebranding due to unsustainable model.

Recommendations

- Avoid Investment: High risk due to unregulated status and unrealistic returns.

- Choose Regulated Brokers: Opt for FCA, ASIC, or CySEC-regulated platforms like eToro or XM.

- Verify Independently: Use tools like ScamAdviser, WikiFX, and regulatory databases.

- Report Issues: Contact your bank or local regulator if affected.

DYOR Disclaimer

This Bitrage Markets review is for informational purposes only, not financial advice. Conduct your own research using regulatory databases, review platforms, and professional advice. Crypto trading carries high risks, and past performance does not guarantee future results.

Bitrage Markets Review Conclusion

This Bitrage Markets review reveals a high-risk, unregulated platform with questionable ownership, unsustainable ROI claims, and poor public perception. Compared to bank savings (4-5% APY), real estate (5-8%), or crypto staking (2-6%), its promises are unrealistic. Investors should avoid Bitrage Markets and choose regulated alternatives for safer digital asset trading. Always verify platforms independently to protect your funds. For related insights, you can also read our Cvcapitals Review.

Bitrage Markets Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Bitrage Markets currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Bitrage Markets similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

Negative Highlights

- Low AI review rate

- New domain

- New archive

- Whois hidden

Frequently Asked Questions About Bitrage Markets Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. Bitrage Markets raises concerns due to its unregulated status and lack of verified trading results.

It claims high returns through AI-powered crypto trading and crypto arbitrage, but these claims are unverified.

No. Bitrage Markets is not licensed or registered with any recognized financial regulator, increasing investor risk.

Risks include potential financial loss, lack of investor protection, unverified ROI claims, and unclear ownership.

It is not recommended. The platform’s lack of regulation, transparency, and reliability make it a high-risk investment opportunity.

Other Infromation:

Website: BITRAGEMARKETS.COM

Reviews:

There are no reviews yet. Be the first one to write one.