BitNasdaq Review: Is This Crypto Exchange Legit?

In this BitNasdaq review, Scams Radar examines whether the platform stands as a reliable crypto exchange for Bitcoin trading, Ethereum exchange, and altcoin trading. Launched around 2019, BitNasdaq positions itself as a centralized exchange with P2P trading, spot and futures markets, and BNQ token mining. We draw from user reports, domain data, and recent 2025 updates to assess its legitimacy. Key areas include ownership, compensation plan, security, and ROI claims. This guide helps beginners understand risks and compare them to options like Binance.

Table of Contents

Part 1: Ownership and Team Background: What We Know

BitNasdaq’s ownership raises questions. The domain, registered in 2019 via Amazon, uses privacy shields. Records link to BITNASDAQ LIMITED in the UK and a Singapore foundation. No full addresses or names appear in public filings. The site mentions CEO Emeka P, claiming over 10 years in B2B SaaS. Yet, no LinkedIn profile or verified bio confirms this. Searches show other Emekas in unrelated fields, like public health or finance, but none match. This lack of transparency differs from Coinbase, where leaders share clear profiles. Without solid backgrounds, trust erodes in a space prone to issues.

Part 2: Complete Compensation Plan: Affiliate and Mining Details

The compensation plan centers on affiliates and BNQ mining. Users earn rewards through referrals, sharing codes on social media, or blogging. The program offers up to 50% commission on referrals’ trading profits. For example, invite friends to join, and get bonuses like extra hashrate or BNQ tokens.

BNQ mining adds another layer. New users receive 50 BNQ and 10K hashrate after KYC. Daily rewards hit 2.5 BNQ, with burns for deflation. Formula: Daily reward = (Your hashrate / Network total) x Output. Campaigns like 2025’s Node Upgrade give 10M-50M hashrate boosts. Promoters on X, such as @MandalaSad1602 (code 15445F) and @HungTinh1993 (50CA8B), push free mining. These accounts also backed Bitunix before. Official @BitnasdaqGlobal runs events. This setup rewards recruitment, but echoes pyramid risks if growth stalls.

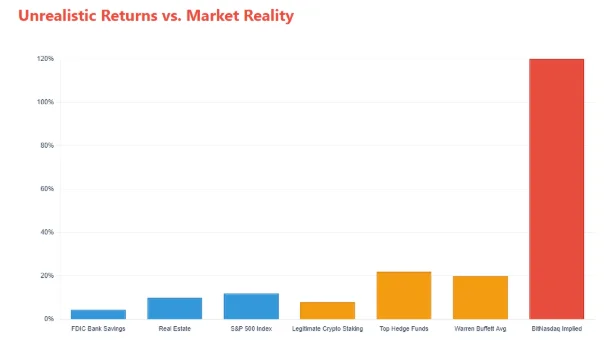

2.1 ROI Claims: Unsustainable Math Exposed

BitNasdaq lures with BNQ mining ROI, like 3.5x growth claims. One user got 2520 BNQ ($29.66) in 78 days. With 60K miners, daily issuance nears 150K BNQ at $0.01 each $1,500 value outflow. Burns aim to deflate, but exponential user growth is needed: 2x monthly hits 1B users in 20 months is impossible.

Compare accurate crypto exchange APY:

- Bank ROI: 4-5% APY, safe.

- Real estate ROI: 7-10%, steady.

- Legit staking: 3-6%.

Investment | Annual ROI (%) |

Bank Savings | 4.5 |

Real Estate | 10 |

Crypto Staking | 6 |

BitNasdaq Claimed | ~120 |

Part 3: BitNasdaq Fees, Deposit, and Withdrawal Explained

BitNasdaq trading fees stay low, though exact rates vary by VIP level. Higher tiers cut costs via volume. Deposit options include bank transfers, cards, and P2P like PayPal. Withdrawal process via crypto or fiat, with limits for new users. Withdrawal times claim 24-48 hours, but reports note delays. Fees for withdrawing crypto align with network costs. Compared to Binance, BitNasdaq lacks clear stats on trading volume, hurting liquidity checks.

Feature | BitNasdaq | Binance |

Trading Fees | Tiered, up to 0.2% | 0.1% base |

Deposit Options | Crypto, fiat, P2P | Similar, more integrations |

Withdrawal Limits | Varies by verification | Higher for verified users |

3.1 Security Protocols and User Fund Protection

BitNasdaq security includes escrow for P2P and Google Authenticator. A 2024 Hacken audit scored 9.6 for a smart contract, but not the full platform. No proof of reserves or insurance exists. How does BitNasdaq protect user funds? Claims focus on basics, missing cold storage details. Crypto wallet integration works via the app. Is BitNasdaq safe for crypto trading? Mixed: Gridinsoft scores 86/100, but ScamAdviser flags suspicions.

Part 4: Public Perception and Customer Support Reviews

BitNasdaq exchange’s reputation in 2025 shows polarization. Reddit threads warn of demo bait: Fake profits lure deposits, then blocks hit. Trustpilot has low reviews; some praise app updates. No CoinMarketCap listing. Customer support offers 24/7 email and Telegram, but complaints that slow responses occur post-deposit. BitNasdaq mobile app features easy trading, but early bugs linger in feedback.

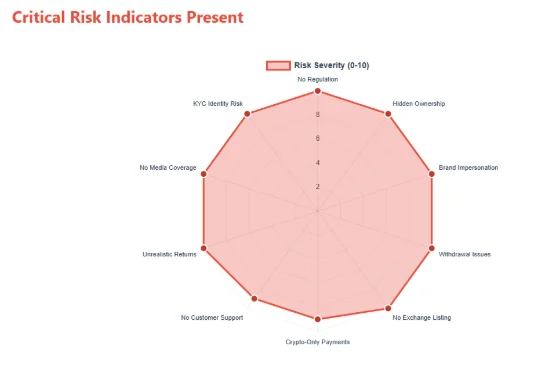

Red Flags in This BitNasdaq Review

- The misleading “Nasdaq” name has no ties.

- No regulation: Lacks SEC, FCA.

- Demo tactics: Builds false confidence.

- Referral focus: 80% promotions.

- Hidden owners, no audits.

Conclusion

After diving deep into the BitNasdaq review, it’s clear that the platform offers some appealing features like low trading fees, P2P options, and a VIP system for users. Tools such as express trading and mobile app integration make it accessible for Bitcoin trading, Ethereum exchange, and altcoin trading. However, the red flags outweigh these perks. Hidden ownership, lack of regulation, and unsustainable ROI claims signal high risks. Compared to established spots like Binance, BitNasdaq falls short in transparency and security protocols. For beginners, stick to proven exchanges to protect your funds. In a volatile crypto market, informed choices matter most. BitNasdaq may suit risk-takers, but caution is key.

DYOR Disclaimer

Our BitNasdaq review is based only on public data and user feedback. It does not offer financial advice, investment tips, or endorsement. Cryptocurrency trading involves significant risks, including the potential for total capital loss due to market fluctuations and platform issues. Always do your own research by checking official sources, regulatory bodies, and independent reviews. Consult a licensed financial advisor before making any decisions. We hold no responsibility for actions taken based on this content. Past performance does not predict future results, and crypto regulations can change. Verify all details yourself to ensure your safety. Now Visit TMX Global Review.

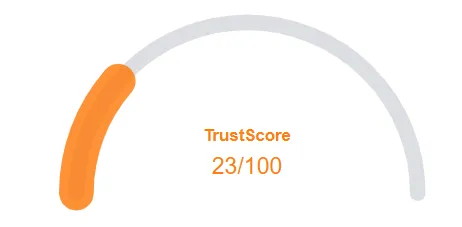

BitNasdaq Review Trust Score

A website’s trust score is an important indicator of its reliability. BitNasdaq currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with BitNasdaq or similar platforms.

Positive Highlights

- Website content is accessible

- No spelling or grammatical errors

- Domain age: Old

- Archive age: Old

Negative Highlights

- Low AI review rating

- Whois data hidden

- Domain not in top 1M on Tranco list

Frequently Asked Questions About BitNasdaq Review

This section answers key questions about Aarman, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

BitNasdaq shows red flags like hidden ownership and no regulation, so it’s high-risk and not fully trustworthy.

BNQ mining rewards depend on your hashrate, but the high ROI claims (over 100% yearly) are unsustainable.

Key risks include lack of regulation, unclear ownership, unsustainable ROI promises, and slow withdrawals.

Binance is safer due to licenses, proof-of-reserves, and insurance, unlike BitNasdaq’s unverified operations.

Both highlight transparency and security concerns, urging users to research deeply before investing.

Other Infromation:

Website: bitnasdaq.com

Reviews:

There are no reviews yet. Be the first one to write one.