BitcapitalX Review: Is It a Legitimate Investment Platform?

This BitcapitalX review examines the platform’s legitimacy, ownership, compensation plan, and risks. For an in-depth scam analysis, visit Scams Radar for a detailed review.

BitcapitalX, accessible at bitcapitalx.com, targets investors seeking high returns through AI-driven crypto trading. However, limited transparency, unsustainable ROI claims, and hidden ownership raise concerns. Read on to explore whether bitcapitalx.com is safe, covering features, compensation, security, and more, with clear insights and comparisons to real-world investments.

Table of Contents

What Is BitcapitalX?

BitcapitalX markets itself as an AI-powered cryptocurrency trading platform. It claims to offer high returns through proprietary algorithms and liquidity management. However, its recent domain registration and lack of verifiable details spark doubts about its credibility.

Ownership and Background

The platform is linked to BIT CAPITALX TRADE LIMITED, incorporated in the UK on April 15, 2025. Its registered address is 12 The Casemates, Tower of London, EC3N 4AB, a location often used by shell companies. Named individuals include William Klien (director) and Freddy Kennedy (CEO), holding significant shares. No LinkedIn profiles or professional backgrounds are verifiable, raising red flags. Legitimate platforms like Coinbase list team credentials and regulatory licenses, which BitcapitalX lacks.

- Red Flags: Hidden WHOIS data, unverified team, and a virtual office address.

- Recommendation: Verify ownership via Companies House or SEC/FCA databases.

Compensation Plan and ROI Claims

BitcapitalX promotes returns of 0.25%–0.35% daily (weekdays) or 8%–13% monthly, implying 91%–148% annually. Some materials claim up to 180% returns. These figures are tied to a referral-based, multi-level marketing (MLM) structure requiring a Referral ID for sign-up. A $300 minimum deposit is high for new platforms.

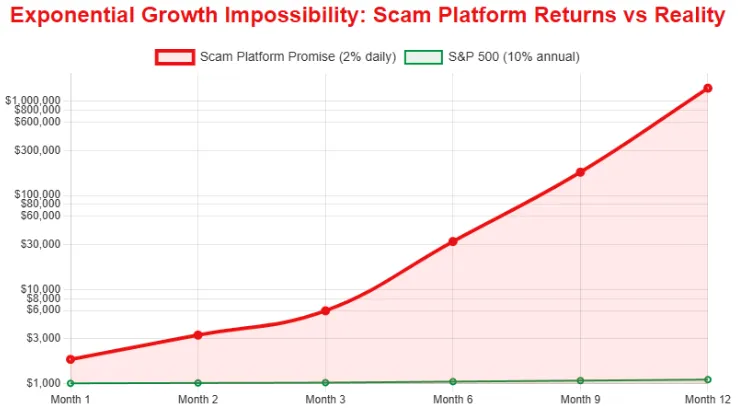

Mathematical Analysis

Let’s assess a 13% monthly ROI:

- Formula: ( A = P(1 + r/n)^{nt} ), where ( P = $1,000 ), ( r = 1.56 ) (156% annual), ( n = 12 ), ( t = 1 ).

- Calculation: ( A = 1000(1 + 1.56/12)^{12} \approx 1000 \times 4.33 = $4,330 ).

- Result: A $1,000 investment grows to $4,330 in one year, far exceeding realistic benchmarks.

Comparison to Legitimate Investments

Investment Type | Annual ROI |

Bank Savings (US) | 0.5%–5% |

Real Estate (Global) | 3%–7% |

Crypto Staking (Binance) | 5%–20% |

BitcapitalX (Claimed) | 91%–148% |

High returns suggest a Ponzi-like model, where new investor funds pay earlier ones. The SEC’s BitConnect case, involving 325,000 BTC, shows such schemes collapse when inflows slow.

- Red Flag: Unrealistic ROIs and MLM structure.

- Recommendation: Compare to regulated platforms like Binance or Kraken.

Traffic and Public Perception

The platform ranks low globally (~1,544,512), with traffic driven by referral links and YouTube promotions. No significant reviews exist on Trustpilot or Reddit, unlike established exchanges. ScamAdviser gives a 91/100 trust score but flags the young domain (April 2025). Gridinsoft notes a 71/100 score, citing AI-generated content.

- Red Flag: Limited online presence and mixed trust scores.

- Recommendation: Check ScamAdviser and Gridinsoft for updates.

Security and Content Authenticity

The site uses Cloudflare’s Domain Validated (DV) SSL, offering basic encryption but no business verification. Claims of “bank-grade security” and AML/KYC compliance lack evidence. No audits or certifications (e.g., CertiK) are provided. Content uses vague buzzwords like “AI-driven trading” without technical details or whitepapers.

- Red Flag: Unverified security and generic content.

- Recommendation: Use SSL Labs to verify encryption.

Payment Methods and Customer Support

BitcapitalX accepts crypto deposits (BTC, ETH), with no fiat options. A $300 minimum deposit limits accessibility. Support is email-only (support@bitcapitalx.com), with no live chat or phone. Promotional materials redirect to Telegram/WhatsApp, a common scam tactic.

- Red Flag: Crypto-only payments and unresponsive support.

- Recommendation: Test support responsiveness before investing.

Technical Performance

Hosted on Cloudflare, the site offers fast load times and basic DDoS protection. However, no mobile app or API exists, limiting usability. Claims of “enterprise-level infrastructure” are unverified.

Red Flags Summary

- Young domain (April 2025).

- Unverified ownership and no regulatory licenses.

- High, unsustainable ROI claims.

- Referral-only sign-up and MLM structure.

- Limited customer support and crypto-only payments.

- Typo in legal documents (“bitcapitalx.com”).

Social Media Promotions

Promoters include @bitcapitalx (Twitter/Instagram), “Bit CapitalX Warriors” (Facebook), and Binance Square users like Sajid Malik Vehari, who also push tokens like $DOGETO. These accounts often promote other questionable platforms.

- Recommendation: Cross-check promoter histories on X and Binance Square.

DYOR Tools

- ScamAdviser: Flags young domain and hidden WHOIS.

- Gridinsoft: Notes low traffic and AI content.

- Companies House: Confirms UK incorporation but not licensing.

- Wayback Machine: Tracks site changes.

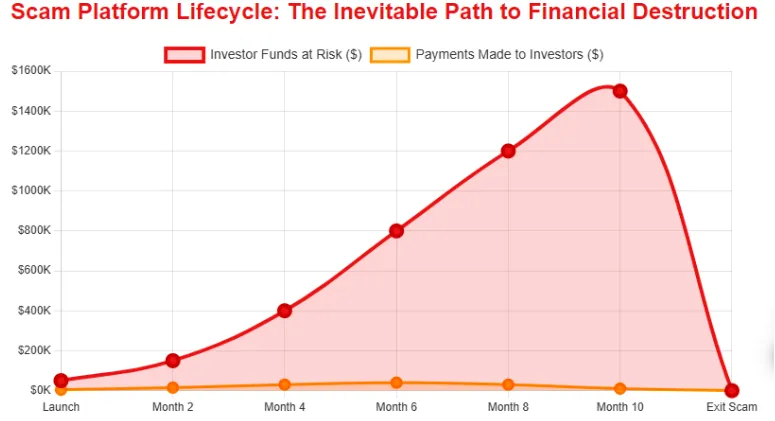

Future Outlook

Without transparency, BitcapitalX risks regulatory action or an exit scam within 6–18 months. Legitimate platforms must provide audited financials and licenses by Q1 2026 to build trust.

BitcapitalX review Conclusion

This BitcapitalX review highlights significant risks. Its high ROI claims, lack of transparency, and MLM structure suggest a potential scam. Investors should avoid depositing funds until verifiable credentials are provided. Stick to regulated platforms like Coinbase or Binance for safer crypto investments. For more information on similar platforms, check out the Broadscom Review.

BitcapitalX Review Trust Score

A website’s trust score is a crucial measure of its credibility, and BitcapitalX currently has an alarmingly low rating—raising serious doubts about its legitimacy. Users are strongly urged to exercise caution.

The platform exhibits numerous warning signs, such as low web traffic, negative user reviews, potential phishing risks, undisclosed ownership, vague hosting information, and inadequate SSL protection.

Given its low trust score, the likelihood of fraud, data breaches, or other security threats is significantly higher. It is vital to carefully evaluate these red flags before engaging with BitcapitalX or similar platforms.

Positive Highlights

- Website content is available

- No spelling or grammar issues found.

Negative Highlights

- AI review rating is low.

- Domain is newly registered.

- Archive is recent.

- Whois data is private.

- Domain ranks outside the top 1M on the Tranco list.

Frequently Asked Questions About BitcapitalX Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No. BitcapitalX raises concerns due to limited transparency, hidden ownership, and unverified ROI claims.

The platform claims high returns through AI-driven cryptocurrency trading, but there is no verifiable evidence of its trading activities or profits.

No. BitcapitalX is not licensed or registered with any recognized financial regulator, which increases the risk for investors.

Risks include potential financial loss, lack of investor protection, hidden ownership, and unsustainable ROI promises.

It is not recommended. The platform’s lack of transparency, regulation, and verifiable performance makes it a high-risk investment.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.