Bit Graph Review: Is This Trading Platform Legitimate?

Bit Graph Review: A detailed look at the Bit Graph platform reveals serious concerns for investors. With no clear ownership, vague promises, and minimal online presence, caution is advised. This analysis covers ownership, compensation plans, security, and more to assess its legitimacy. For an in-depth scam analysis, visit Scams Radar for a detailed review of bitgraphplatform.com.

Table of Contents

What Is the Bit Graph Platform?

The Bit Graph trading platform claims to offer cryptocurrency, forex, and stock trading with high returns. However, its website lacks transparency, raising doubts about its credibility. This Bit Graph review examines key aspects like ownership, compensation, and security to help investors make informed decisions.

Ownership and Transparency Concerns

The Bit Graph platform provides little information about its ownership. The website mentions a founder, Mobarok Hossain, but offers no verifiable details, such as a LinkedIn profile or professional background. WHOIS data shows the domain uses privacy protection through Namecheap, hiding the registrant’s identity. Legitimate platforms like Binance or Coinbase disclose their leadership and regulatory status. This anonymity is a major red flag for Bit Graph legitimacy.

- Key Issue: No identifiable owners or corporate entity.

- Comparison: Regulated exchanges provide clear company details and registrations.

- Risk: Hidden ownership suggests potential lack of accountability.

Compensation Plan and ROI Claims

The Bit Graph trading platform does not clearly outline a compensation plan. It uses vague phrases like “unbeatable pricing” and “flat fees” without detailing commission rates or profit-sharing models. Implied high returns, such as a hypothetical upto 200% ROI in six months, are unsustainable. Let’s break it down mathematically:

For a $10,000 investment expecting a 200% return in six months ($30,000):

[ A = P \times (1 + r)^t ]

- ( A = 30,000 ), ( P = 10,000 ), ( t = 6 ) months

- ( 30,000 = 10,000 \times (1 + r)^6 )

- ( 3 = (1 + r)^6 )

- ( r \approx 20.09% \text{ monthly, or } 773.5% \text{ annually} )

This exceeds legitimate returns:

- Real Estate: 5-12% annually

- Bank Savings: 0.5-5% APY

- Crypto Staking: 2-10% APY (e.g., Binance)

Such returns suggest a Ponzi scheme, where new investor funds pay earlier investors, collapsing when deposits slow.

- Red Flag: No clear Bit Graph fees or compensation structure.

- Risk: Unrealistic returns indicate potential fraud.

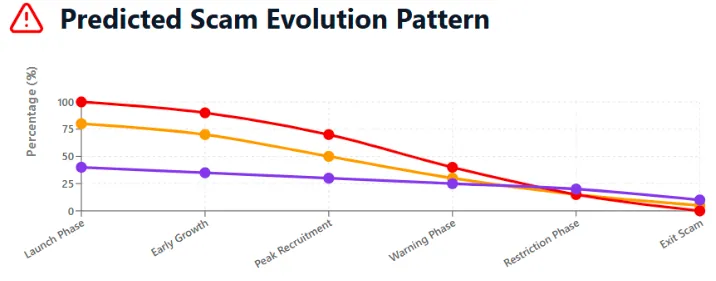

Traffic Trends and Public Perception

The Bit Graph platform shows minimal traffic on tools like SimilarWeb or Alexa, indicating low user engagement. No user reviews exist on Trustpilot, SiteJabber, or Reddit, and there’s no significant discussion on forums like Bitcointalk. This lack of Bit Graph user experience feedback is unusual for a trading platform.

- Issue: No verifiable traffic or community presence.

- Comparison: Legitimate platforms have active user bases and reviews.

- Risk: Low visibility suggests limited trust or deliberate obscurity.

Security and Technical Performance

Bit Graph claims “robust security” but provides no specifics on encryption, two-factor authentication (2FA), or cold storage. A standard SSL certificate (Let’s Encrypt) is present, but this is insufficient for a financial platform. The website, likely built on a WordPress template, lacks advanced trading tools or API integration, unlike platforms like Kraken.

- Concern: Vague Bit Graph security measures.

- Technical Issue: Basic website design, not optimized for trading.

- Risk: Weak security increases vulnerability to hacks or data breaches.

Content Authenticity and Services

The website’s content is generic, using buzzwords like “game-changing” without explaining trading mechanisms. A testimonial about “Martha Chumo” is plagiarized from Codecademy, undermining Bit Graph’s credibility. Services like “Strategy Consulting” lack detail, unlike transparent platforms.

- Red Flag: Plagiarized content and vague service descriptions.

- Risk: Inauthentic content erodes trust.

Payment Methods and Customer Support

Bit Graph does not list payment methods, raising concerns about deposit and withdrawal processes. Reports suggest crypto-only payments and blocked withdrawals unless “security fees” are paid, a common scam tactic. Customer support is limited to a generic email with no live chat or phone options.

- Issue: Unclear Bit Graph withdrawal and deposit processes.

- Support Concern: Minimal Bit Graph customer support channels.

- Risk: Potential for trapped funds or unresponsive support.

Social Media and Promotional Analysis

No verified social media accounts promote the Bit Graph platform on X, Twitter, or YouTube. This lack of Bit Graph user trust score or promotional activity is unusual, as even scams often use fake accounts for buzz. No links to other scam sites were found, but the absence of presence is concerning.

- Concern: No social media engagement.

- Risk: Suggests low adoption or intentional obscurity.

ROI Comparison

Investment Type | Annual ROI | Risk Level | Time to Triple Investment |

Real Estate (Pakistan) | 8-12% | Medium | ~36 months |

Bank Savings | 0.5-5% | Low | ~50+ months |

Binance Staking (ETH) | 2-10% | High | ~40 months |

Bit Graph (Hypothetical) | 773.5% | Extreme | ~6 months |

Red Flags Summary

- Hidden ownership and no regulatory compliance.

- Vague compensation plan and unsustainable ROI claims.

- Minimal traffic and no public reviews.

- Weak security and basic website design.

- Plagiarized content and unclear payment methods.

- Limited customer support and no social media presence.

Recommendations for Investors

- Avoid Investment: The Bit Graph platform shows multiple scam indicators. Do not deposit funds.

- Use Regulated Platforms: Choose exchanges like Coinbase or Binance with clear licensing.

- Verify Credentials: Check ownership and regulatory status via FINRA or FCA.

- Research Thoroughly: Use ScamAdviser or Trustpilot for user feedback.

- Secure Funds: Store crypto in hardware wallets to avoid risks.

Bit Graph Review Conclusion

This Bit Graph review highlights significant risks. Hidden ownership, unsustainable returns, and lack of transparency make the platform highly questionable. Similar concerns were found in our OLYONE DAO Review, which exposed comparable red flags. Investors should prioritize regulated platforms with proven track records. Always verify claims independently to protect your funds.

DYOR Disclaimer: This Bit Graph review is for informational purposes only and not financial advice. Conduct your own research using trusted tools like ScamAdviser or regulatory websites. Cryptocurrency investments carry high risks, and funds sent to unverified platforms may be lost. Consult a financial advisor before investing.

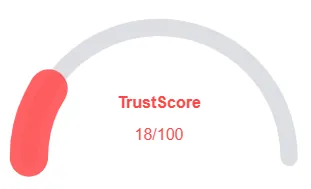

Bit Graph Review Trust Score

A website’s trust score plays a vital role in evaluating its credibility, and Bit Graph a dangerously low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform presents several warning signs, including low traffic, poor user reviews, potential phishing threats, hidden ownership, unclear hosting information, and weak SSL security.

Given this low trust score, the chances of fraud, data breaches, or other harmful activity increase significantly. It’s essential to assess these red flags carefully before engaging with Bit Graph or similar platforms.

Let me know the next company name whenever you want a swap.

Positive Highlights

- Website content is accessible

- No grammar or spelling issues detected

Negative Highlights

- Low AI review count

- Newly registered domain

- Fresh archive data

- Whois info is hidden

Frequently Asked Questions About Bit Graph Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

No, Bit Graph raises significant concerns about its legitimacy due to unclear ownership, vague promises, and an absence of transparency.

Investing in Bit Graph carries high risks, including unrealistic returns, lack of regulation, and potential fraud. The platform’s vague compensation plan adds to the uncertainty.

Bit Graph claims to generate returns through investments, but there is no clear evidence of its trading or investment activities, making its returns questionable.

No, Bit Graph is not regulated by any known financial authority. The lack of regulation is a red flag for potential investors.

It is advisable to avoid investing in Bit Graph due to its lack of transparency, vague promises, and absence of verifiable ownership. Always conduct thorough research before investing.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.