Is the Biggest Business Opportunity Legit? Full 2026 Review of BBO MLM Scheme

BiggestBusinessOpportunity.com, often called BBO, attracts people with promises of easy money through a so-called Swarm AI Network. Many individuals search for a Biggest Business Opportunity review to determine whether it is a genuine opportunity or a potential trap. This guide breaks everything down step by step, combining facts and analysis from trusted sources such as BehindMLM, ScamAdviser, and Scams Radar. We examine ownership details, compensation plans, potential risks, and other critical factors. Read on to understand why exercising caution is essential.

Table of Contents

Part 1: What Is BiggestBusinessOpportunity.com?

BBO launched in late 2025. It uses a domain from 2015. The site sells access to a Swarm AI Network. Users install a free browser extension. This shares device power for AI tasks. In return, they get a $550 yearly airdrop. There’s also an MLM setup for commissions on sales.

The core idea sounds new. But details raise doubts. The site claims to boost sales by 500% via traffic redirects. Yet, no clear proof backs this up. Pricing stays hidden. This makes it hard to trust.

1.1 Ownership and Leadership: Who Runs BBO?

Ownership stays hidden. No names of CEOs or founders show up. The site links to “Group Three_e Technology” in London. But UK records show no such firm. Domain WHOIS data hides behind privacy tools from Namecheap. ScamAdviser flags this as a risk. Scammers buy old domains to look real.

No leadership bios exist. Corporate checks in the UK Companies House find nothing. This means no one to hold accountable if things go wrong. Funds could vanish. Data might leak. Compare to firms like Coinbase. They list leaders openly for trust.

Promoters push BBO hard. But their backgrounds matter too. Many hop from one scheme to the next. For example, YouTube channel JTECHCEO touts BBO earnings. They also plug other crypto mining ops. Salvation Crypto Updates shares airdrop videos. Their past includes similar earn-quick plans. CryptoCompass explains nodes. They promoted run-extension deals before.

These promoters focus on hype. They shift when one fades. No criminal ties found in public records. But the pattern warns of unstable ops. Affiliate pages like aamirrahman and bankylanny recruit teams. Their histories stay shallow. They stick to MLM-style pitches.

This lack of clear ownership screams risk. In legit MLMs like Amway, leaders have public tracks. Here, anonymity protects operators, not users.

Part 2: Compensation Plan Breakdown: How BBO Pays

BBO uses a 12-level unilevel plan. This means unlimited direct recruits. Pay goes deep, not wide like binary setups. No fixed spots as in matrix plans. Here’s the full structure from site info and reviews.

Phase 1: Pre-Launch Rewards

- Install extension and run node: $550 yearly airdrop.

- Direct referral who runs node: $25 per year, recurring.

- Overrides on downline: $5 per year per level, up to 12 levels.

Phase 2: Post-Launch Commissions

- Level 1 (your sales): $42 per subscription sale or renewal.

- Levels 2-12: $2 per level per sale or renewal.

Membership costs nothing. But subscriptions drive real pay. Price? Not shared publicly. The site says it’s to guard ideas. This hides if payouts make sense.

Payout rules: Need $10 minimum. Paid in USDT to wallets after 45 days. Crypto only. No bank options. This adds volatility. Disputes get tough.

Why call it unilevel? Unlimited front line. Depth pays small amounts. To earn big, build huge teams. No balance needed like binary. No spillover like a matrix.

2.1 Why BBO Returns Don't Add Up: Math Proof

Promises sound great. But numbers show flaws. Let’s use simple math to explain.

First, commission load per sale. If one sale pays all uplines:

- Level 1: $42

- Levels 2-12: 11 x $2 = $22

- Total: $64

Subscription must top $64 to cover this. Add costs like tech, support, and fraud. No room left. If the price is close, the model fails fast.

Next, growth needs. Assume each recruits 2 (low end).

- Level 12: 2^12 = 4,096 people

- Full network: (2^13 – 1) = 8,191 people

With 3 recruits:

- Level 12: 3^12 = 531,441

- Full: (3^13 – 1)/2 ≈ 797,161

To make $12,000 yearly from overrides ($2 each, levels 2-12): Need 6,000 active subs. All must renew. This demands endless sign-ups. Churn kills it. FTC says 99% in MLMs lose cash.

Airdrop funding? $550 per user. No treasury shown. Likely from new joins. That’s Ponzi style.

Here’s a table showing network size by recruits:

Recruits per Person | Level 12 Size | Total Network Size |

2 | 4,096 | 8,191 |

3 | 531,441 | 797,161 |

4 | 16,777,216 | 22,369,620 |

5 | 244,140,625 | 305,175,781 |

This graph-like table shows an explosion. Real world? Saturation hits quickly. Most end at the bottom with losses.

Compare to real ROIs:

- Banks: 4-5% safe.

- Real estate: 8-12%, needs work.

- Stocks: 7-10% average.

- Crypto staking: 5-15% on trusted sites.

BBO implies infinite ROI on zero input. Matches failed schemes like OneCoin.

Part 3: Security and Tech Risks: Browser Dangers

The site has basic SSL from Google. Data encrypts. But no business check. No 2FA. The extension lacks audits.

Extension “intercepts” searches. This could hijack browsers. Risks: Data theft, ad injects, redirects. Security pros call it unwanted software. Google bans similar extensions.

No code reviews. Permissions unclear. Claims no data sells. But anonymous ops can’t be trusted. Use virtual machines for testing.

Performance: Site loads in 2-3 seconds. No global tweaks. Extension drains devices? Unknown.

3.1 Traffic and Perception: Low Buzz, High Doubt

Global rank: #659,270 per SimilarWeb. Visits are low, from Nigeria and the US. Spike from promos, not organic.

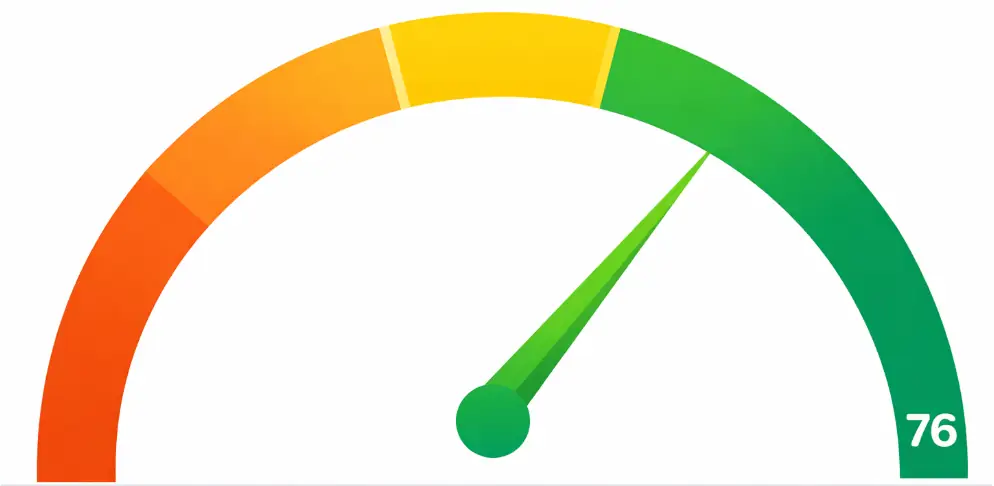

Public view: Skeptical. No Reddit talks. BehindMLM calls it a hijack scheme. Tools vary: ScamAdviser 70/100, warns of hidden data. Scam-Detector 80.9/100, flags risks. Gridinsoft 100/100 on tech. ScamDoc low for similar.

No Trustpilot scores. Suggests evasion.

3.2 Payments and Support: Limited Options

USDT payouts only. Appeals to some, but volatile. No refunds clear. Support: Tickets only. No phone or chat. FAQs basic. Transparency poor.

Red Flags: Key Warnings

- Hidden owners, fake firm.

- Pricing secret, payouts high.

- Extension risks data.

- Recruitment focus, no retail.

- Airdrop lacks funds proof.

- Promoters hop schemes.

Score: All major flags up.

Future Outlook: Likely Fail

By 2027, regs like FTC may hit. Early wins, later losses. 70% collapse chance in 2 years. Pump-dump if token launches. Best: Shift to real tech. But hides suggest the short run.

Final Thoughts and Advice

BBO shows pyramid traits. Anonymous leads, math fails, security gaps. Skip it. Seek proven paths.

Recommendations:

- Ask for audits and leader names.

- Test safe if must.

- Diversify investments.

- Report to FTC.

DYOR: Not advice. Check yourself. Pros help. Markets change.

Biggest Business Opportunity Review Trust Score

A website’s trust score is an important indicator of its reliability. Biggest Business Opportunity currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Biggest Business Opportunity or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- DNSFilter labels this site as safe

Negative Highlights

- The Tranco rank (how much traffic) is rather low.

- The age of this site is (very) young.

Frequently Asked Questions Biggest Business Opportunity Review

This section answers key questions about the Biggest Business Opportunity, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No clear proof of legitimacy due to hidden ownership and unclear revenue sources.

Primarily through subscriptions and recruitment, not verified retail sales.

Most users are unlikely to profit without recruiting large teams.

Safety is questionable due to a lack of audits and broad permissions.

BBO is more opaque and recruitment-driven, while Everstead appears more transparent.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.