Betronomy Review: Is This AI Betting Platform Legitimate or a Hidden Ponzi Scheme?

Betronomy Review: The search term is bringing thousands of people here right now.

If you landed on this page, you are probably asking the same question everyone else is asking: Is Betronomy a genuine AI-powered sports betting investment opportunity, or is it just another cleverly disguised crypto Ponzi scheme?

After digging through every available public source, regulatory filings, blockchain data, and independent expert analyses, Scams Radar examined the entire operation, and the verdict is clear: Betronomy shows every classic hallmark of a Ponzi scheme wrapped in modern AI and sports-arbitrage marketing.

Below is the most complete, up-to-date breakdown you will not find anywhere.

Table of Contents

Part 1: Company Background and Ownership: Who Actually Runs Betronomy?

Betronomy operates under “Betronomy Limited,” a Hong Kong shell company incorporated in June 2025. Hong Kong shells cost less than $200 and require zero real identity disclosure; they are the go-to choice for anonymous scam operators worldwide.

The domain betronomy.com was privately registered on 22 May 2025. That makes the platform only six months old at the time of writing.

The supposed CEO, Kristian Farber, appears exclusively in Betronomy’s own videos, blog posts, and YouTube channel. Outside their controlled channels, no LinkedIn profile, no previous employer records, no media interviews, no industry history, nothing exists. Independent searches return zero verifiable traces of this person in finance, technology, or betting before 2025.

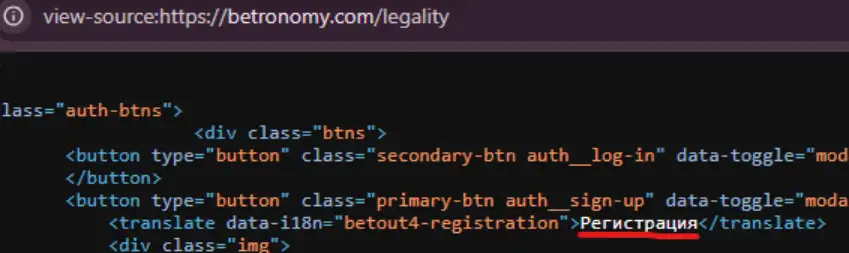

Multiple investigators (BehindMLM, Decripto, Millionaire Drive) conclude the real operators are likely a Russian-Asian scam network, based on:

- Default Russian language in source code

- Staged events in Moscow, Vietnam, and Manila

- Identical patterns to the collapsed UEFA Football Fund scam

Verdict: Completely anonymous ownership is the biggest red flag in any investment platform.

Part 2: Promised Returns: Why the Math Simply Cannot Work

Plan | Minimum Deposit | Duration (days) | Daily Return | Simple Total Return | Compounded (approx.) |

Brick | $25 | 5 | 0.5-1% | 102.5-105% | – |

Bronze | $200 | 40 | 0.75-1.25% | 130-150% | – |

Silver | $1,000 | 120 | 1-1.5% | 220-280% | ~6× at 1.5% |

Gold | $5,000 | 180 | 1.5-2% | 370-460% | ~35× at 2% |

Platinum | $10,000 | 280 | 2-2.5% | 660-800% | ~1,000× at 2.5% |

Diamond | Higher | 200 | 3% fixed | 700% | ~370× |

Titanium | Higher | 300 | 3.5% fixed | 1,150% | ~30,000× |

Even at the lowest realistic rate (1.5% daily compounded for 120 days), $1,000 becomes roughly $6,000. At the highest advertised rates, $1,000 can theoretically become tens of millions within a year.

Professional sports arbitrage in the real world rarely exceeds 1-3% per opportunity (not per day), and bookmakers aggressively limit or ban successful accounts. No legitimate operation can guarantee these returns to thousands of users simultaneously without massive losing periods.

The only way these payouts are possible is by using new deposits to pay earlier investors, which is the exact definition of a Ponzi scheme.

2.1 Compensation Plan Classic Unilevel MLM Pyramid

Betronomy uses a ranked unilevel structure paying up to 12 levels deep (some marketing claims 20 levels):

- Level 1 (your direct recruits): up to 10% of their deposit

- Level 2: up to 6%

- Levels 3-12: up to 5% each

Maximum immediate commission on a single deposit can reach 66%. Commissions are paid instantly and withdrawable.

There are 13 ranks requiring escalating personal investments and downline volume (up to $100 million team turnover for the top rank). Higher ranks unlock deeper levels, higher percentages, and cash bonuses up to $1,000,000.

Additional incentives:

- Activity Program pays $2-50 USDT for TikTok, Instagram, YouTube, and story posts containing your referral link

- Recruit 10 active members with $2,000+ total deposits → get +0.5% extra daily on your own investment

This structure forces constant recruitment. The business model depends far more on bringing in new money than on any real betting profits.

2.2 Real-World Comparison Table

Investment Type | Realistic Annual Return | Betronomy Equivalent (mid-range) |

S&P 500 long-term average | 7-10% | 365%-1,277% |

Rental real estate (net) | 6-10% | 365%-1,277% |

High-yield savings/CDs 2025 | 4-5.5% | 365%-1,277% |

Ethereum staking | 3-6% | 365%-1,277% |

Top hedge funds | 12-20% | 365%-1,277% |

Professional sports betting | 2-5% (most lose money) | 365%-1,277% |

Betronomy promises 30-400 times higher returns than legitimate options, with zero risk presented. That is mathematically impossible without new money constantly flowing in.

Regulatory Status Already Blacklisted

On 1 December 2025, the Bank of Lithuania officially added betronomy.com to its public warning list of unauthorized financial service providers.

No securities licence, no gambling licence, and no financial services authorization exists in any major jurisdiction. The platform operates completely unregulated while soliciting investments worldwide.

Promoters and Social Proof Manipulation

Visible top promoters include:

- Liqin Gao (Asia), a heavy recruiter on X/Twitter and YouTube

- Thomas Schmidt (@thomas_sch11), European event leader

- Alfredo Rebenito, the Philippines’ respectability face, is tied to charity posts

- Various Telegram and Facebook mentors are pushing “daily income” screenshots

All positive Trustpilot reviews (currently ~4.3/5) must be viewed in light of the Activity Program that literally pays users to post promotional content and reviews.

Conclusion Stay Away

Betronomy is not a legitimate investment platform. It is a sophisticated Ponzi scheme using AI sports-betting as a cover story, anonymous operators, unsustainable returns, aggressive MLM recruitment, and paid shilling to keep new money flowing in.

The scheme is still paying early participants (classic Ponzi behaviour), but history shows these platforms collapse within 12-24 months once recruitment slows. When that happens, the anonymous owners disappear with the remaining funds.

If you have money in Betronomy right now, withdraw everything you can immediately and do not reinvest.

If you are considering joining, do not deposit a single dollar.

There are no safe “mid-yield” corners in this platform. The math does not work, the owners are hidden, and a European regulator has already declared it illegal.

Always remember: legitimate high returns never need multi-level referral commissions to survive.

Do your own research, but the evidence is overwhelming. Betronomy is extremely high risk

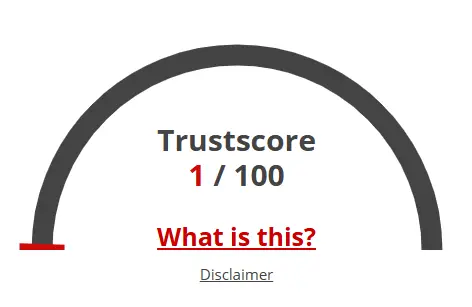

Betronomy Review Trust Score

A website’s trust score is an important indicator of its reliability. Betronomy currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the Betronomy or similar platforms.

Positive Highlights

- We found a valid SSL certificate.

- DNSFilter labels this site as safe.

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS.

- The Tranco rank (how much traffic) is rather low.

- Cryptocurrency services detected, these can be high risk.

- A risk/high return financial services are offered.

- MLM references were found which may be Multilevel Marketing Scams.

- The age of this site is (very) young.

Frequently Asked Questions About Betronomy Review

This section answers key questions about Betronomy, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

No. Betronomy shows classic Ponzi traits like hidden owners, unrealistic ROI, and MLM-based funding.

It claims AI betting, but no real proof exists. Returns mainly depend on new deposits.

Anonymous founders, extreme daily ROI, no license, and heavy recruitment incentives.

No. It’s unregulated, extremely risky, and has already been warned by a European regulator.

Like the Everstead Review cases, Betronomy also shows unrealistic returns and hidden ownership.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.