BBD Review: Is This Cryptocurrency Platform Legit or a High-Risk Venture?

In this BBD review, Scams Radar examines the cryptocurrency platform BBD, known as Blockchain-Based Decentralized. It claims to offer tools for digital asset management. Yet, key details raise questions about its safety and value. We draw from site data, public records, and math models to help you decide.

Table of Contents

Part 1: Understanding the BBD Cryptocurrency Platform

BBD positions itself as a Web3 ecosystem on Polygon. It promises stablecoin deposits, investments, and payments without middlemen. Users get a dashboard for smart contracts. The site lists a team but lacks depth. James Carter serves as CEO. Jenifar Lorany handles marketing. Michel Ramos leads HR. Lorence Katie designs. No backgrounds or LinkedIn links exist. Searches yield nothing. This opacity signals risk in crypto.

The platform mentions a business plan download. It ties to a token called XPEED. Pre-sale dates conflict, from 2018 to 2019. Roadmap starts in 2025. These mismatches suggest copied content. No whitepaper or audits appear. Polygon integration claims lack proof. No contract addresses on PolygonScan.

1.1 BBD Compensation Plan Breakdown

Materials linked to BBD describe an MLM-style setup. Registration bonuses range from $7 to $40. Level income spans 20 levels. Star ranks offer promotions based on teams. Deposits split: 90% to main contract, 5% marketing, 3% creators, 2% leaders. A 5% security fund from withdrawals goes to a hidden wallet.

This relies on recruitment. Direct business bonuses reward sign-ups. Team building qualifies for higher tiers. Up to five-star levels bring payouts. Yet, no on-site details confirm this. It mirrors pyramid schemes. Regulatory bodies flag such models.

- Registration Bonus: $7 for basic, up to $40 for premium.

- Level Income: Earnings from recruits down 20 levels.

- Star Ranks: Advance by meeting team goals.

- Referral Rewards: Mainly focus on bringing in new users.

This structure needs constant growth. Math shows why it fails.

1.2 ROI Claims and Mathematical Proof

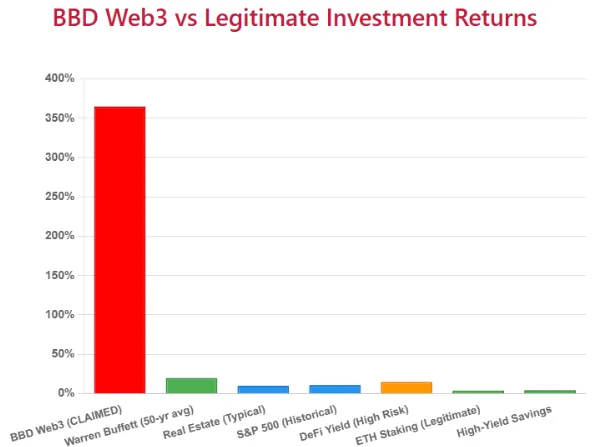

BBD promises 1% daily ROI, or 30% monthly. Let’s calculate sustainability.

Daily 1% compounds to (1 + 0.01)^365 ≈ 37.78 times your investment yearly. That’s 3,678% annual return.

For $1,000 invested:

- After 30 days: ≈ $1,348.

- After 180 days: ≈ $5,995.

- After 365 days: ≈ $37,783.

No real revenue backs this. Returns come from new deposits. In MLM, assume each user recruits two. By level 20, you need 2^20 = 1,048,576 users. World population limits this. Collapse follows when recruitment slows.

Investment Type | Typical Annual ROI (%) | Monthly Equivalent (%) |

BBD Claimed | 3,678 | 30 |

Real Estate | 8-12 | 0.67-1 |

Bank Savings | 4-5 | 0.33-0.42 |

Crypto Staking | 3-20 | 0.25-1.67 |

BBD exceeds real estate ROI by factors. Banks offer FDIC safety at low yields. Crypto like Ethereum staking gives 3-7%. Platforms like Coinbase cap at 16% with risks. BBD’s guarantees ignore market realities.

Part 2: Ownership Profiles and Backgrounds

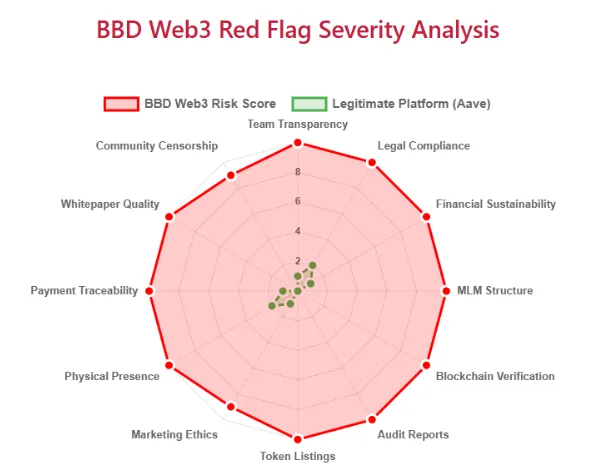

Ownership hides behind privacy. Registrant ties to NeuraEdge GmbH in Zurich. No blockchain links. No company filings. Team lacks credentials. James Carter has no public history in crypto. Jenifar Lorany shows no marketing roles. Michel Ramos and Lorence Katie appear to have invented. No GitHub or past projects.

In contrast, legit platforms like Aave list founders like Stani Kulechov. Transparent teams build trust. BBD’s anonymity fits scam patterns.

2.1 Security Measures and Technical Performance

Site uses CloudFlare and basic SSL. Dashboard needs Wallet Connect. No 2FA or audits. Security fund lacks wallet proof. Content has typos like “Blockcain.” Crypto tables show fake prices, all at $1,097,201.

Payment methods: Crypto-only, likely MATIC. No fiat. Withdrawals deduct 5% unverified. Support is absent; no emails or chats.

Traffic is low. No Tranco rank data. Public perception: Zero reviews on Trustpilot or Reddit. X searches show unrelated posts. No promoters found. Accounts like @BNBCapitalorg push similar yields, but not BBD.

Part 3: Red Flags in This BBD Review

- Young domain: Registered May 2025.

- No audits: Unverified contracts.

- MLM focus: Recruitment over value.

- Inconsistencies: Old ICO dates, placeholder content.

- No listings: Absent from CoinMarketCap, DeFiLlama.

- Phishing alerts: Flagged by scanners.

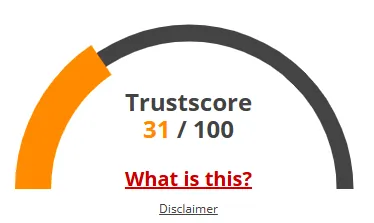

DYOR tools: Scamadviser gives it a low trust rating. VirusTotal and URLVoid suggest checks. No academic mentions.

3.1 Comparing BBD to Other Platforms

BBD vs. Uniswap: No referrals, audited code. BBD lacks both.

BBD crypto futures? Site mentions derivatives but no details. Perpetual futures contracts are absent. Non-custodial wallet implied but unproven.

For business strategy, BBD echoes online entrepreneurship. Yet, no training like BBD online course or James Wedmore’s BBD. No team building beyond MLM. Marketing by design seems generic.

Part 4: Benefits and Critiques

Benefits claimed: Autonomy, low fees. But risks outweigh. Common critiques: Unsustainable yields, no recourse.

Success rates? Historical MLMs show 99% lose money.

4.1 How to Trade on BBD

No guide exists. Registration at app.bbdweb3.com. Connect wallet. Risks high.

BBD vs. others: Lacks leverage like the BBOD trading platform.

Part 5: Final Thoughts in This BBD Review

BBD tempts with high returns. But math and opacity point to collapse. Avoid unless audited. Opt for proven options like bank APY or real crypto staking. DYOR always. This BBD review uses public data from October 2025. Consult experts. Invest wisely. Now Visit Universal-Miners Review.

BBD ReviewTrust Score

A website’s trust score is an important indicator of its reliability. BBD currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, possible phishing risks, undisclosed ownership, vague hosting details, and weak SSL protection.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with BBD or similar platforms.

Positive Highlights

- Valid SSL certificate found

- Site marked safe by DNSFilter

Negative Highlights

- Low Tranco traffic rank

- High-risk crypto services detected

- Very young website age

- iQ Abuse Scan flagged phishing alert

Frequently Asked Questions About BBD Review

This section answers key questions about BlockDAG Review, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

BBD is a Web3 platform claiming stablecoin deposits, investments, and payments on the Polygon network, but it lacks verified audits.

BBD shows high-risk signs such as MLM-style payouts, 1 % daily ROI promises, and no transparent team, making it unsafe for investors.

BBD advertises about 1 % daily (≈30 % monthly) returns, far higher than real estate or bank savings, which is financially unsustainable.

While both raise concerns, BBD’s extreme ROI claims and anonymous owners make it riskier than Everstead’s comparatively moderate offerings.

Key warning signs include fake price tables, missing whitepapers, inconsistent roadmap dates, and reliance on constant recruitment.

Other Infromation:

Website: bbdweb3.com

Reviews:

There are no reviews yet. Be the first one to write one.