BAY Miner Review 2025: Cloud Mining Legitimacy, ROI Breakdown, and Investor Risks

Thinking about cloud mining this year? Pick sites with solid proof of payouts and clear rules. BAY Miner Review covers the basics. This app-based service lets you mine crypto from your phone. But is it solid? Let’s walk through it.

Table of Contents

Part 1: What Defines BAY Miner Among Cloud Mining Platforms?

BAY Miner focuses on mobile mining for Bitcoin, Ethereum, Solana, XRP, Litecoin, and Dogecoin. Rent power from remote servers. No gear or setup required. It uses solar and wind for green ops. Launched in 2017, it claims a base in Weybridge, Surrey, UK. User count tops 10 million in 180 countries. Contracts start small and scale up. Rewards hit daily in USD to dodge price swings. Withdraw after $100 to crypto wallets. The app makes it simple. Sign up for a $15 bonus. Check in daily for $0.60 boosts.

Full access needs JavaScript. Live dashboards show progress. Fund with BTC, ETH, or USDT. Support spans languages.

1.1 BAY Miner Review: Ownership and Team Insights

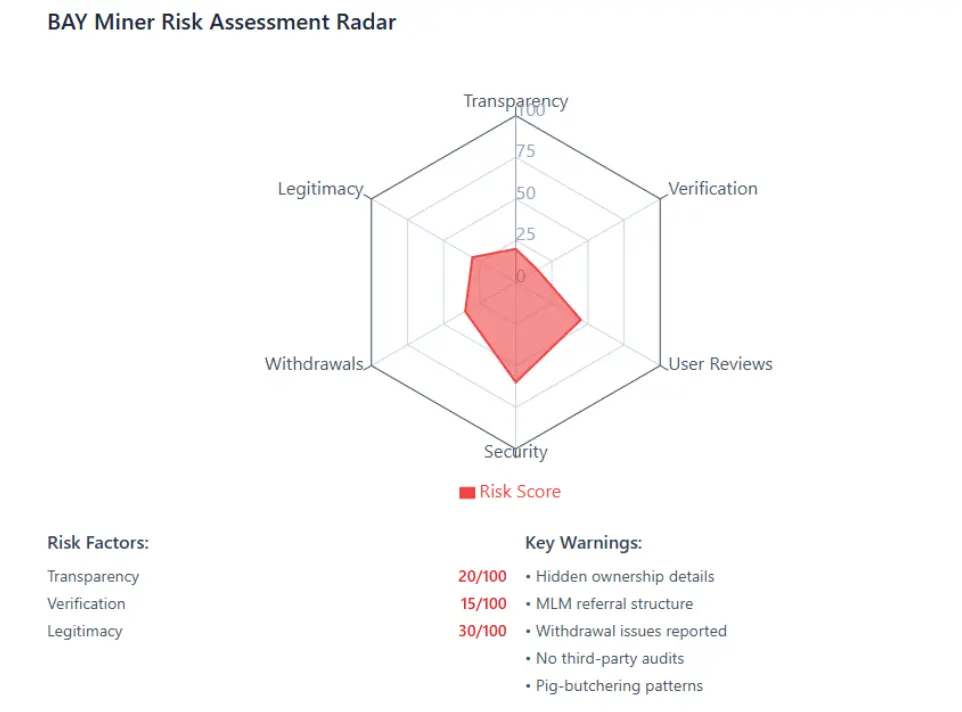

Owner facts run light. BAY Miner gives a UK spot at Egerton House, 68 Baker Street, Weybridge, KT13 8AL. Domain hides behind Gname.com Pte. Ltd. in Singapore. No top names listed. The 2017 start shows in the news drops. But no profiles link to mining vets on LinkedIn. FCA oversight? Claimed but not filed. Bodium Capital links? Firm denies it.

This setup matches iffy crypto spots. Real teams flaunt bios in blockchain or finance. The hush fuels flags. Singapore means lax checks. UK tie? No records back it. By late 2025, such holes point to fronts. Pros call it a key scam marker in mining.

Part 3: Full BAY Miner Compensation Plan: Tiers, Bonuses, and Details

BAY Miner layers plans by cost and span. Stake comes back at the finish. Referrals give 5% on the first tier, down three levels. $15 start bonus helps. Logins net $0.60 each.

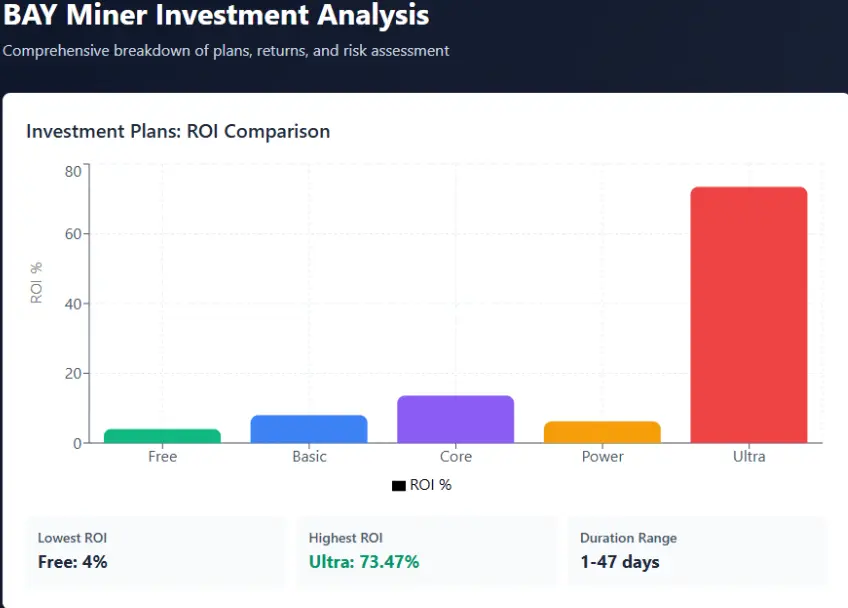

Plans line up so:

Plan Name | Price | Term (Days) | Daily Income | Total Return | ROI % |

Free Hashrate | $15 | 1 | $0.60 | $15.60 | 64.98 |

Basic Trial | $100 | 2 | $4 | $108 | 86.54 |

Core #1214293 | $1,500 | 10 | $20.40 | $1,704 | 87.08 |

Power #1051525 | $150,000 | 47 | $3,390 | $309,330 | 96.89 |

Ultra #1030762 | $350,000 | 31 | $8,295 | $607,145 | 19.07 |

Neat setup. Yet notes warn of “default” traps. These pause cash outs till you pay more. Rules stash the snags. Dig deep.

2.1 BAY Miner Review on Legitimacy: Traffic, Security, and User Input

Hits keep low. Under 50,000 monthly per tool. Ads on social feed it, not steady traffic.

Guards pack CloudFlare SSL, McAfee checks, and cold storage. Two-factor locks in. Army-grade codes shield data. No outer audits. No server snaps or hash proofs.

Input splits. Trustpilot hits 4.5/5 from 58 takes. Some nod to fast small pulls. Others hit snags like locked $67k sums. Scamadviser rates 70% trust, watch level. Reddit eyes Ponzi ties. Chats ping back quickly, Wins? Uneven. One X post calls it bait. Another hypes the app. Blue Stone links raise scam echoes.

Mining cons climb in 2025. BAY Miner fits pig-butchering patterns.

2.2 BAY Miner ROI Math: Flashy Numbers, Real Strains

Core hits 87% in 10 days. Annual push? Over 3,000%. Eye candy. But costs crush.

Power: $0.05-$0.10/kWh. Kits age fast. BTC hash: 600 EH/s. $1,500 grabs output? Fees trimmed to bits.

Part 3 : Key Red Flags in BAY Miner and Social Links

Note:

- Tops stay unseen.

- Referrals tilt multi-level.

- Fixes grab extra cash.

- Takes feel planted.

Social runs quiet. @Bayminer gets scam pings. @andrew_palmor pairs with busts like lunexus. Old ties hit BCHMiner fails. Sparse cheers stick.

DYOR Tools for BAY Miner Scans

Use:

- Scamadviser: Medium alert.

- Trustpilot: New views matter.

- WHOIS: Drops privacy masks.

- Wayback: Tracks tweaks.

Weighing BAY Miner: Smart Steps and Outlook for 2026

BAY Miner pulls with phone ease and green talk. Yet signs lean risky. Go for proven paths on gains. Regs may tighten by 2026 on complaints.

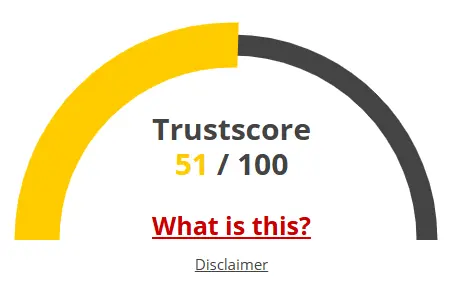

BAY Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. BAY Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the BAY Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About BAY Miner Review

This section answers key questions about the BAY Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

BAY Miner is a mobile cloud mining platform that lets users mine cryptocurrencies like Bitcoin, Ethereum, and Solana using remote servers without any hardware setup.

BAY Miner allows users to rent mining power from remote servers through an app, with daily payouts in USD. It claims eco-friendly operations and offers various investment plans.

BAY Miner raises concerns due to its lack of transparency, unverified ownership, and questionable marketing tactics. These factors make it a risky investment.

Risks include market volatility, withdrawal issues, and unclear terms regarding payouts. Some users report being unable to withdraw their funds or facing unexpected fees.

Given the red flags, including a lack of transparency and potential Ponzi-like features, it’s advisable to approach BAY Miner with caution. Consider more established, transparent platforms.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.