Atlas Funded Review: Legit Prop Firm or High-Risk Challenge?

Atlas Funded review 2025 starts here. This prop firm offers simulated capital up to $400,000. Traders pay fees to pass evaluations. Then they access funded accounts. Scams Radar checks ownership, plans, math, and risks. Read on for clear facts.

Table of Contents

Part 1: Ownership and Company Background

Atlas Funded LTD is based in Saint Lucia. Company number 2025-00597. Address: Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet. Registered in 2025. Saint Lucia has light rules. This is common for prop firms.

A UK company is linked to it. Atlas Vanquish Ltd. Number 15951299. Started September 11, 2024. London-based. No financial filings yet. First due 2025.

Domain atlasfunded.com registered August 20, 2024. Privacy hides owners. No leaders named on site. New setup means short history. No FCA or SEC rules apply. Services bar U.S. users.

Key Takeaway: Legal setup exists. Offshore focus limits protection.

Part 2: Full Compensation Plan Breakdown

Atlas Funded prop firm uses challenge models. Pay the fee. Hit targets. Get a funded account.

Challenge Types

- One-Step: 10% profit target. 5% daily drawdown. 10% overall.

- Two-Step: Phase 1: 10%. Phase 2: 5%.

- Three-Step: Smaller steps. Lower targets.

- Instant Funding: Buy direct access. Higher cost.

- Atlas Access: Pay $5 broker fee first. Pass, then pay full

Account sizes: $10K to $400K. Fees: $40 to $2,500+.

Profit Split Details

Base: 80% to the trader. 20% to the firm. Add-ons rise to 90% or 100%. Need extra pay.

Payout Rules

Weekly or on-demand. Process in 7-10 days. Some claim 12 hours. Refunds after 3-4 payouts. Crypto, PayPal, Rise used.

Scaling Plan

Hit 15% profit in 3 months. 5+ payouts. Capital grows 37.5% quarterly. From $200K to $2M in 24 months. Needs steady wins.

Trading Rules

- Platforms: MT5, TradeLocker.

- No time limits on most.

- News trading allowed.

- EAs okay. No HFT.

- Balance-based drawdown.

- Assets: Forex, indices, commodities.

Fee Structure Table

Account Size | Typical Fee | Profit Target | Daily Drawdown | Overall Drawdown |

$10K | $40-150 | 8-10% | 5% | 10% |

$50K | $200-600 | 8-10% | 5% | 10% |

$100K | $400-1,200 | 8-10% | 5% | 10% |

$200K | $800-2,500 | 8-10% | 5% | 10% |

2.1 Why Returns Look Unsustainable: Simple Math

Industry pass rate: 5-10%. Most fail. Firm keeps fees.

Example Cash Flow

1,000 traders buy $200 fee challenges.

Revenue: $200,000.

7% pass (70 traders).

Each earns $2,000 average profit.

95% split: Trader $1,900. Firm $100.

Total payouts: $133,000.

Firm net: Fees cover, but need growth.

Scaling Math Graph Idea (Text Version)

Start $200K. Need 15% every 3 months.

Month 3: $230K (firm adds).

But real trader ROI yearly: 10-20%. Quarterly, 15% rare. Chance of 8 quarters straight: Under 0.001%.

Expected Value for Trader

Cost: $200.

Success chance: 7%.

Average win: $2,000.

EV = (0.07 × $2,000) – (0.93 × $200) = $140 – $186 = -$46 loss.

Firms profit from fails. Payouts need new fees.

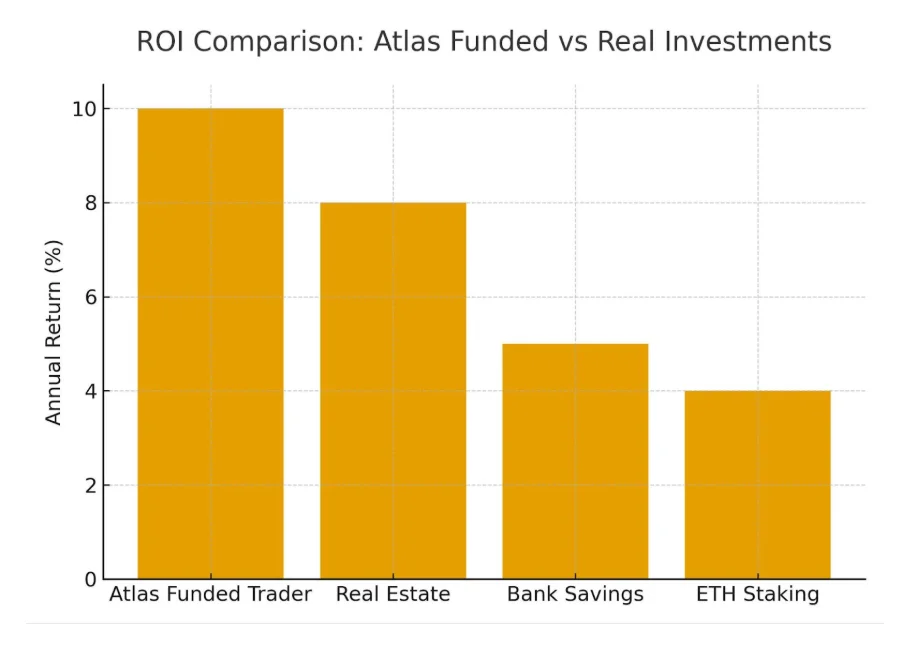

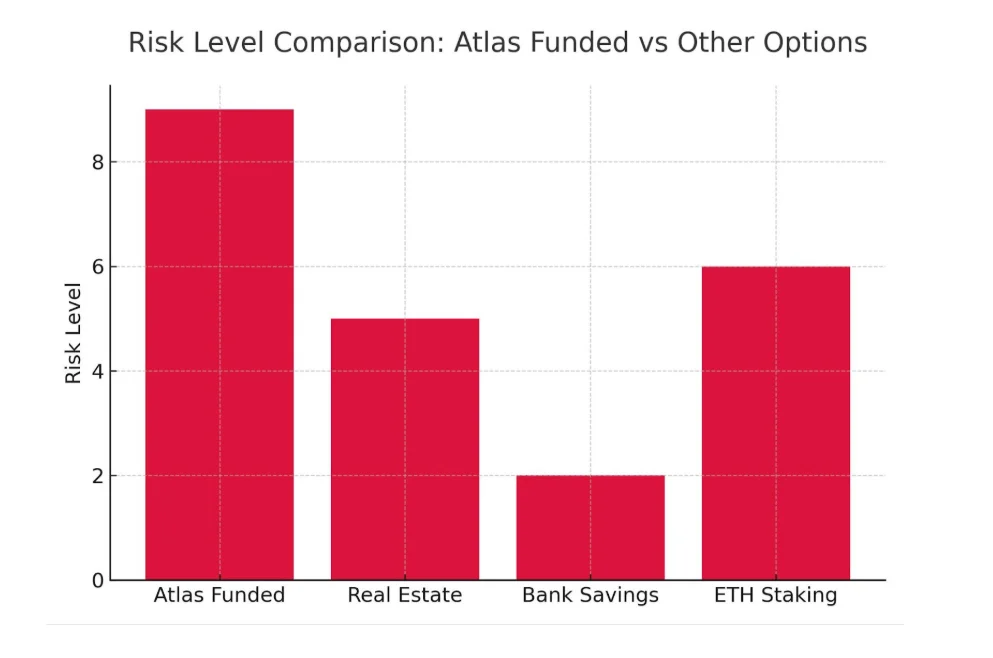

2.2 ROI Comparison Chart (2025 Averages)

Option | Annual Return | Risk | Protection |

Atlas Funded Trader | 5-15% real | Very High | None |

Real Estate Rental | 7-10% | Medium | Legal |

Bank HY Savings | 4-5% APY | Low | FDIC |

ETH Staking | 3-5% | High | None |

Bank beats for safety. Real estate for steady.

Part 3: Public Views and Support

Trustpilot: 4.2-4.8 stars. 400-700 reviews. Praise fast support. Discord active. Some payout wins.

Reddit: Mixed. Delays. Strict rules. Breaches near payout.

Support: 24/7 chat. Discord. Responded early. Slower on issues.

DYOR Tools Summary

- Scamadviser: Low trust. New domain.

- Companies House: UK firm active.

- WHOIS: Hidden owner.

Social Promoters

X: @atlasfundedcom. Giveaways.

Affiliates: @OsmondSabby (30% code). @BirenFx (giveaways). Many push multiple firms. Past: FTMO, FundedNext.

Red Flags List

- New firms (under 15 months).

- Offshore main entity.

- High-failure-rate funds model.

- Rules can end accounts.

- Mixed payout reports.

- Heavy promo discounts.

Tips to Pass the Atlas Funded Trading Challenge

Read the rules fully. Practice demo. Use a balance drawdown. Avoid overtrading. Start Access model.

Final Verdict and Advice

The Atlas Funded trading challenge works for skilled traders. It is legit but high risk. No regulation. Math favors firm. Treat it as a skill test. Not an investment.

Start small. Use Atlas Access. Document all. Check local laws (Pakistan: SBP rules).

Safer: Bank savings. Personal broker.

DYOR Note: This is info only. Not advice. Check yourself. Lose only what you can.

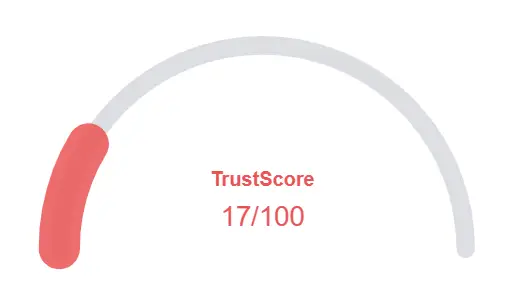

Atlas Funded Review Trust Score

A website’s trust score is an important indicator of its reliability. Atlas Funded currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with Atlas Funded or similar platforms.

Positive Highlights

- According to the SSL check the certificate is valid

- Online shopping features were detected (use our shopping scam checklist)

- v DNSFilter labels this site as safe

- We found a valid SSL certificate

Negative Highlights

- High risk financial services or content seems to be offered

- A risk/high return financial services are offered

- An internal review system is used by this site

- The references on Social Media were negative

- Words were found often used by scammers

Frequently Asked Questions About Atlas Funded Review

This section answers key questions about Atlas Funded, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

Yes, it’s legally registered but unregulated. Treat it as a high-risk trading challenge, not an investment.

Usually 7-10 days, sometimes faster, via crypto, PayPal, or Rise.

Atlas Funded has flexible rules but a higher risk. Everstead offers more compliance but less profit potential.

High fail rate, no regulation, and possible payout delays. Always trade responsibly.

You pay a fee, hit profit targets, and follow drawdown rules to qualify for funded accounts.

Other Infromation:

Website: atlasfunded.com

Reviews:

There are no reviews yet. Be the first one to write one.