ARO Network Review: Is It a Trustworthy Investment?

This ARO Network review on Scams Radar examines the platform’s claims, ownership, rewards system, and potential risks. We analyze dashboard.aro.network, a decentralized edge cloud platform (DePIN) that lets users earn by sharing bandwidth and computing resources. Using clear data, charts, and comparisons, this guide helps beginners understand if ARO Network’s crypto-based model is safe and sustainable.

Table of Contents

Ownership and Team Transparency

ARO Network’s ownership lacks full clarity. The website mentions Cathy Zhu as COO and co-founder and Adam Farhat as Head of Marketing. A July 2025 press release announced a $2.1M pre-seed funding round led by NoLimit Holdings and Dispersion Capital, adding credibility. However, no detailed team bios or legal entity details are available. The domain’s WHOIS data is privacy-protected, a common but opaque practice.

Key Points:

- Named executives: Cathy Zhu (COO), Adam Farhat (Marketing).

- Funding: $2.1M from reputable crypto investors.

- Concern: No public technical team or corporate registration details.

Red Flag: Limited transparency about leadership and legal structure raises accountability concerns.

ARO Network Compensation Plan

ARO Network’s rewards system centers on node operation and referrals, with Jade points earned during the PreviewNet phase (2025) converting to $ARO tokens at Mainnet (2026). Users can participate via:

- ARO Lite: Browser extension for low-effort rewards.

- ARO Client: Software for existing hardware.

- ARO Hardware: Dedicated devices (ARO Pod/Link) for higher earnings.

- Referral Program: 15% commission on referred users’ earnings, plus a $30K USDT prize pool for top referrers.

- Quality Bonuses: Extra rewards for high uptime and performance.

Reward Structure Details

- Node Operation: Earn Jade points by sharing bandwidth for AI compute or content delivery.

- Referral Sprint: Top referrers compete for USDT rewards.

- Early Adopter Bonuses: Incentives for the first 10,000 node operators.

- Payment Methods: Accepts USDC, USDT, ETH, and $1R0R (10% discount).

Concern: The $1R0R token’s value is speculative, and no refund policies are disclosed. Heavy referral focus suggests reliance on recruitment, resembling multi-level marketing.

ROI Sustainability Analysis

ARO Network avoids explicit ROI promises, a positive sign. However, community posts imply high returns. Let’s model a realistic scenario for a $500 ARO Hardware node:

- Assumptions:

- 50 Mbps upload speed.

- 30% utilization at $0.02/GB (competitive CDN rate).

- 50 Mbps upload speed.

- Calculation:

- Monthly data: 50 Mbps = 16,200 GB/month.

- Revenue (30% usage): 4,860 GB × $0.02 = $97.20.

- ARO’s cut (30%): $29.16.

- Net earnings: $68.04/month = $816.48/year.

- ROI: $816.48 ÷ $500 = 163% annually.

- Monthly data: 50 Mbps = 16,200 GB/month.

Investment Type | Annual ROI | Risk Level |

ARO Network | 100-200% | Very High |

Real Estate | 8-12% | Medium |

Bank Savings | 4-5% | Low |

Crypto Staking | 5-20% | High |

Security and Technical Performance

ARO Network uses HTTPS and Cloudflare DNS, ensuring basic security. However, no smart contract audits or privacy policies are public. The platform claims a three-layer architecture (Resource, Network, Application), but no blockchain explorer or performance metrics (e.g., TPS) are available. The dashboard is a single-page app, suggesting minimal backend functionality.

Key Points:

- Security: HTTPS and Cloudflare DNS; no audit reports.

- Performance: No verifiable data on scalability or latency.

- Concern: Lack of technical transparency undermines trust.

Public Perception and Traffic

Traffic data for dashboard.aro.network is limited due to its newness (launched 2025). Social media promotions on X, Telegram, and Reddit drive sign-ups, but discussions lack depth. Accounts like @AroNetwork, @mryptoserviceTH, and @AirdropsBoY focus on referral codes, not organic feedback. ScamAdviser rates aro.network at 71% (medium-low risk), but no TrustPilot reviews exist.

Red Flag: Hype-driven growth with minimal independent user feedback.

Promoter Analysis

- @AroNetwork: Official account pushing referral sprints.

- @mryptoserviceTH, @AirdropsBoY: Share referral links, also promote airdrops like GSPartners.

- Telegram (t.me/ARO_Network): 18k+ members, referral-focused.

Concern: Promoters’ history with high-risk projects (e.g., YieldNodes) suggests coordinated marketing.

DYOR Tool Insights

- ScamAdviser: 71% trust score (medium-low risk).

- Cloudflare Radar: Confirms new domain (May 2025) with GitHub Pages hosting.

- VirusTotal/urlscan: No malware detected; investors can submit scans.

- Wayback Machine: First snapshot in 2023, limited content.

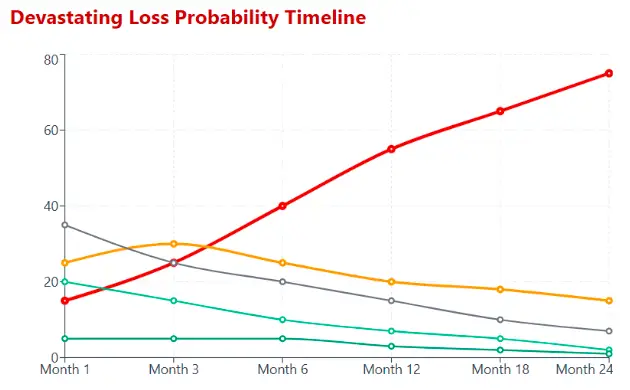

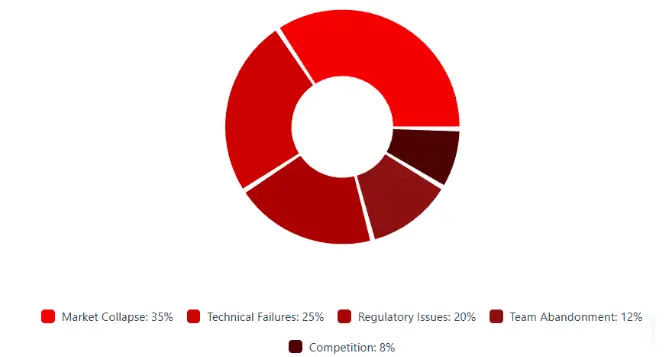

Future Outlook

- Positive (30%): ARO Network grows with DePIN adoption, securing AI partnerships.

- Neutral (50%): Stable but limited user base, tied to crypto market trends.

- Negative (20%): Fails to deliver Mainnet, faces regulatory scrutiny.

Recommendations for Investors

- Avoid Large Investments: Only risk what you can lose.

- Verify Claims: Check whitepapers, audits, and team LinkedIn profiles.

- Use Secure Wallets: Protect funds with hardware wallets.

- Monitor Updates: Track Mainnet progress and $ARO token listings.

- Diversify: Balance with stable investments like real estate or crypto staking.

ARO Network Review Conclusion

This ARO Network review finds a promising but risky DePIN project. Its $2.1M funding and technical foundation are positive, but unclear ownership, speculative $1R0R tokens, and referral-heavy growth raise concerns. Compared to real estate (8-12% ROI) or bank savings (4-5% APY), ARO’s projected 100-200% ROI is unsustainable. Investors should approach cautiously, conduct thorough research, and avoid hype-driven decisions. For more context, also read our Cryptex Review to see how similar platforms operate and the risks they pose.

DYOR Disclaimer: This review is informational, not financial advice. Crypto investments are volatile and may result in total loss. Verify claims using tools like Etherscan, ScamAdviser, and Reddit. Consult financial advisors before investing.

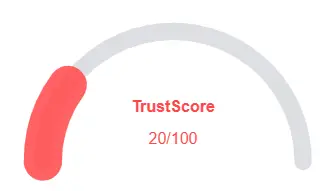

ARO Network Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 ARO Network currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ARO Network similar platforms.

Positive Highlights

- Content accessible

- No spelling/grammar errors

- Old archive age

- Domain in Tranco top 1M

Negative Highlights

- Low AI review rate

- Hidden Whois data

Frequently Asked Questions About ARO Network Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

ARO Network is a decentralized edge cloud platform (DePIN) allowing users to earn by sharing unused internet bandwidth and computing resources.

Our Scams Radar review highlights concerns about transparency and sustainability, though the platform operates publicly on dashboard.aro.network.

Users earn crypto-based rewards by sharing bandwidth and computing resources for AI computation and peer-to-peer content delivery.

As a crypto-based model, returns are tied to network adoption and usage. Risks include market volatility and potential operational issues.

Yes, but understanding the DePIN model and crypto risks is essential before participating.

Other Infromation:

Website: dashboard.aro.network

Reviews:

There are no reviews yet. Be the first one to write one.