ArkDeFAI Review: Is It a Legitimate DeFi Platform or a Risky Investment?

This ArkDeFAI review on Scams Radar examines ArkDeFAI.com, a platform marketing itself as a decentralized finance (DeFi) solution combining AI, DAO governance, and blockchain technology. The platform claims to deliver high returns through innovative financial models. However, the DeFi sector is notorious for scams and unsustainable projects. Our analysis covers ownership, compensation plans, traffic trends, public perception, security, content authenticity, payment methods, customer support, technical performance, and ROI claims. Using clear data, charts, and simple language, we provide a professional guide to help investors decide if ArkDeFAI is safe. Always perform your own due diligence (DYOR) before investing.

Table of Contents

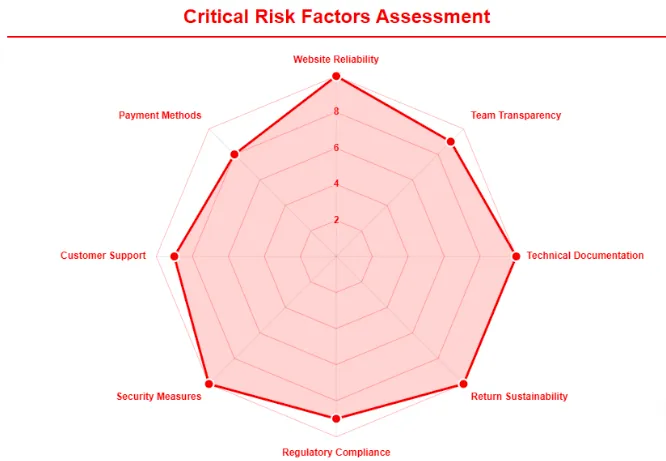

Ownership and Team Transparency

ArkDeFAI.com’s ownership is unclear. The domain, registered on June 23, 2025, through Network Solutions, uses privacy protection services like Perfect Privacy LLC or Cloudflare’s WHOIS privacy. This hides the registrant’s identity, a common practice in crypto but risky when paired with unverifiable claims.

Red Flags

- Hidden domain ownership.

- Unverifiable team identities.

- No credible evidence for claimed affiliations.

Compensation Plan and ROI Claims

ArkDeFAI’s compensation plan is vague. The website and GitBook describe five modules: EM, RBS, YRF, MCL, and RCM, focusing on protocol-owned liquidity (POL), algorithmic market stabilization, and treasury-backed yields. Promotional materials, including YouTube videos and Telegram channels, suggest a multi-level marketing (MLM) structure. Users are encouraged to recruit others for rewards, with implied returns of 1–3% daily (365–1,095% annually) or 100–500% annual percentage yield (APY).

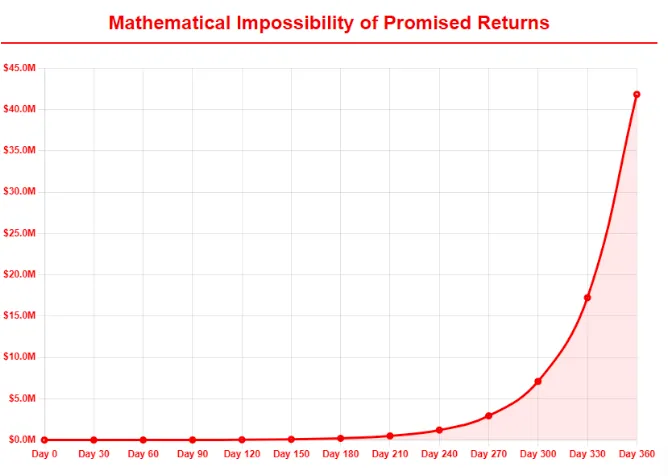

Is the Compensation Plan Sustainable?

High returns sound appealing but are often unsustainable. Let’s break down a 2% daily return (730% APY) using simple math:

Formula: Future Value (FV) = Initial Investment × (1 + Daily ROI)^Days

For a $1,000 investment:

- After 30 days: $1,000 × (1.02)^30 ≈ $1,811

- After 90 days: $1,000 × (1.02)^90 ≈ $5,974

- After 365 days: $1,000 × (1.02)^365 ≈ $1,376,400

This means a $1,000 investment could theoretically become $1.37 million in one year. To sustain this, ArkDeFAI would need constant new investor money, resembling a Ponzi scheme. Legitimate DeFi platforms like Aave or Uniswap offer 5–20% APY, relying on trading fees or lending, not exponential growth.

Investment Type | Annual ROI | Risk Level | Regulatory Protection |

ArkDeFAI (Claimed) | 100–1,095% | Extremely High | None |

Real Estate (Pakistan) | 8–12% | Moderate | Partial |

Bank Fixed Deposit | 4–6% | Low | FDIC/NCUA |

Crypto Staking (ETH) | 3–10% | Moderate | None |

Traffic Trends and Public Perception

ArkDeFAI.com has extremely low traffic. Crunchbase reports only 27 monthly visits, and HypeStat ranks it #24,387,634 globally. Low traffic suggests minimal user adoption, unusual for a platform claiming to revolutionize finance. Legitimate DeFi platforms like Uniswap have millions of monthly visits.

Public Perception

Public discussion is scarce. An X account (@_Arkefi, July 23, 2024) claims ArkDeFAI outperforms stocks but has low engagement. The official Twitter (@arkdefai) has 1,240 followers with minimal likes (2–5 per tweet). A Medium article received 56 claps, and a Discord server claims 3,200 members but only 40 active users. Promotional YouTube channels (e.g., Blue Kryptonite, Crypto Guide 4) link ArkDeFAI to other high-risk projects like AkasDAO and LGNS/Origin, suggesting serial promotion.

Red Flags:

- Low website traffic.

- Limited, low-engagement social media presence.

- Promoters tied to other questionable projects.

Security Measures

ArkDeFAI.com uses a valid SSL certificate from Google Trust Services and HTTP/2 protocol. However, these are basic security features and do not guarantee platform safety. No smart contract audits from reputable firms like CertiK or OpenZeppelin are listed, a critical omission for DeFi platforms. Over $1.19 billion was lost to crypto hacks in 2024, highlighting the need for audits.

Infrastructure Concerns

The website is hosted on Netlify, which contradicts claims of full decentralization. No bug bounty program or public GitHub repository exists, limiting transparency.

Red Flags:

- No smart contract audits.

- Centralized hosting.

- No bug bounty program.

Content Authenticity

ArkDeFAI’s content uses buzzwords like “AI governance,” “decentralized civilization,” and “composable smart modules.” Its GitBook mentions technical modules but lacks detailed whitepapers or on-chain proof. Medium articles and PR releases on Bitcoin.com and Bitcoinist are promotional, not analytical. A perplexity score of 25.3 suggests possible AI-generated content, lacking technical depth.

Red Flags:

- Buzzword-heavy, vague content.

- No verifiable technical documentation.

- Possible AI-generated text.

Payment Methods and Customer Support

ArkDeFAI accepts cryptocurrencies like ETH and stablecoins but offers no fiat on-ramps. Promotional content mentions anonymous prepaid cards via ArkFi.io, raising concerns about untraceable transactions. Legitimate platforms integrate with trusted wallets like MetaMask.

Technical Performance

ArkDeFAI.com’s technical performance is poor. The website is often inaccessible, returning server errors. No public data on transaction speeds, uptime, or blockchain integration is available. Tools like Google PageSpeed Insights or GTmetrix could reveal more, but lack of access limits analysis.

Red Flags:

- Frequent website downtime.

- No performance metrics.

Recommendations for Investors

- Avoid Investment: Too many red flags, including anonymity and unsustainable returns.

- Demand Audits: Require smart contract audits from firms like CertiK.

- Use Trusted Platforms: Stick to Uniswap, Aave, or Compound (5–20% APY).

- Secure Funds: Use hardware wallets and avoid sharing seed phrases.

- Check Communities: Monitor Reddit and Bitcointalk for user feedback.

ArkDeFAI Review Conclusion

ArkDeFAI.com raises serious concerns due to its anonymous team, unrealistic ROI claims, low traffic, and lack of audits. Mathematical analysis proves its promised returns (100–1,095% APY) are unsustainable compared to real estate (8–12%), bank deposits (4–6%), or crypto staking (3–10%). Investors should avoid this platform until it provides verifiable audits, team details, and on-chain proof. The DeFi space offers safer alternatives with proven track records.

For a similar case study, you can also read our detailed ESVCAP Review, which highlights how unsustainable returns and lack of transparency often point toward high-risk Ponzi-style schemes.

DYOR Disclaimer: This review is for informational purposes only, not financial advice. Always conduct your own research before investing in any DeFi platform. Verify claims, check audits, and consult financial advisors. Cryptocurrency investments are high-risk and may result in total loss.

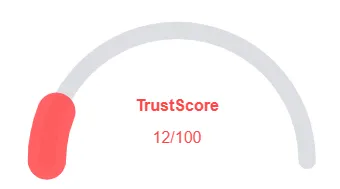

ArkDeFAI Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 ArkDeFAI currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with ArkDeFAI similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

Negative Highlights

- Low AI review rate

- New domain

- Hidden WHOIS

- New archive

- Not in Tranco top 1M

Frequently Asked Questions About ArkDeFAI Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

ArkDeFAI is a DeFi platform combining AI, DAO governance, and blockchain. Our ArkDeFAI Review examines if its high-return promises are real or risky.

While ArkDeFAI claims big profits, our review highlights ownership, transparency, and security concerns that suggest caution.

ArkDeFAI claims to use AI-driven trading and DeFi strategies. Our review questions the sustainability and legitimacy of these high-return methods.

Risks include unrealistic ROI claims, opaque ownership, technical vulnerabilities, and potential DeFi-related scams.

Our ArkDeFAI Review recommends caution. Conduct thorough research, verify claims, and consider safer alternatives before investing in ArkDeFAI.com

Other Infromation:

Website: ARKDEFAI.COM

Reviews:

There are no reviews yet. Be the first one to write one.