Arbmany Review: Is This Crypto Platform Legit or a Risky Scam?

Investing in cryptocurrencies can be exciting but risky. Arbmany (arbmany.com) claims to deliver high returns through automated trading. This Arbmany review on Scams Radar examines its legitimacy, ownership, compensation plan, security measures, and ROI claims as of 2025.

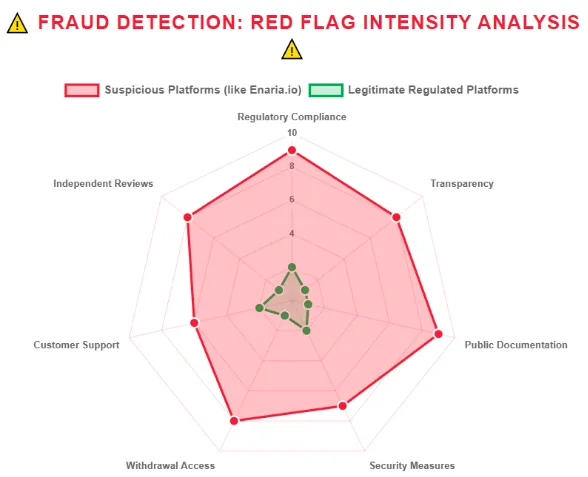

Using clear data, charts, and comparisons to real estate, bank savings, and crypto staking yields, we uncover potential risks and red flags. The review aims to provide beginners and experienced investors with a transparent, actionable guide to decide whether Arbmany is a safe opportunity or a risky platform. Always perform your own research (DYOR) before investing.

Table of Contents

What Is the Arbmany Platform?

The Arbmany platform claims to offer automated trading of ARB/USD pairs using a smart contract. It promises 0.6% daily returns on Arbitrum (ARB) token deposits, with a minimum of $50 and a maximum of $100,000. Withdrawals occur weekly, and the plan ends when your investment doubles in USD or ARB. It also features a 10-level referral program tied to team deposits, raising concerns about its legitimacy.

Ownership: Who Runs Arbmany?

No clear ownership details exist. WHOIS lookups show hidden registration data, a common tactic for questionable sites. The platform lacks an “About Us” page, team bios, or legal disclosures. Unlike trusted platforms like Binance, which share company details and comply with regulations, this anonymity is a red flag.

- Red Flag: Hidden ownership makes accountability impossible.

- Comparison: Legitimate platforms display verifiable company info.

Compensation Plan: Promises and Pitfalls

The Arbmany platform’s compensation plan is twofold:

- Investment Returns: Deposit ARB tokens to earn 0.6% daily, aiming to double your investment in USD or ARB. This equals 219% annual returns (simple) or 788% if compounded (1.006^365 ≈ 8.88).

- Referral Program: A 10-level affiliate structure pays commissions based on recruited users’ deposits, not trading profits.

Why These Returns Are Unsustainable

Mathematically, 0.6% daily returns are unrealistic:

- Simple Interest: 0.6% × 365 = 219% yearly.

- Compounded: (1 + 0.006)^365 ≈ 788% yearly.

- Example: A $1,000 deposit grows to ~$8,880 in a year (compounded).

No legitimate trading strategy sustains such returns. Markets like Arbitrum (ARB) fluctuate (50-100% annually), and no arbitrage can guarantee fixed gains. This structure relies on new deposits to pay earlier investors, a hallmark of Ponzi schemes like Bernie Madoff’s (10-20% annual) or Zeek Rewards (1-2% daily).

Investment Type | Annual Return | Risk Level | Regulation |

Arbmany (Claimed) | 219-788% | Extreme | None |

Real Estate (REITs) | 8-12% | Moderate | SEC Oversight |

Bank Savings | 1-5% | Low | FDIC Insured |

Crypto Staking (e.g., Coinbase) | 5-15% | Medium-High | Varies |

Arbmany Features and User Experience

The platform’s features are basic:

- Deposits: ARB tokens on Arbitrum One.

- Withdrawals: Weekly, no minimum.

- Interface: Simple dApp requiring JavaScript, but no advanced dashboards.

User experience is limited by poor transparency. No audited smart contract address is provided, only a generic Arbiscan link. The site uses Arbitrum branding but has no official affiliation, per Arbitrum DAO docs.

Security and Privacy Concerns

Security is minimal:

- HTTPS: Basic SSL, no extended validation.

- Smart Contract: No audit reports or verifiable code.

- Data Protection: No privacy policy or terms of service.

Legitimate platforms like Uniswap publish audits and use robust encryption. This lack of security heightens risks of hacks or data breaches.

Arbmany Support and Payment Methods

- Support: No email, phone, or live chat. Only a web form exists.

- Payments: Accepts only ARB tokens, increasing risk due to volatility and irreversible transactions.

This contrasts with platforms offering 24/7 support and diverse payment options.

Public Perception and Traffic Trends

No reviews appear on Trustpilot, Reddit, or X. Scamvoid and Scamdoc rate it high-risk due to low trust scores and short domain age. Traffic data from SimilarWeb or Ahrefs is absent, suggesting low visibility or a new site. This silence indicates either a recent launch or deliberate obscurity.

Arbmany Scam or Legit?

Multiple red flags suggest a scam:

- Anonymous Ownership: No verifiable team or registration.

- Unsustainable Returns: 219-788% annual returns are impossible.

- Referral Dependency: Earnings tied to recruitment, not trading.

- No Audits: Unverified smart contract raises rug-pull risks.

- Crypto-Only Payments: Facilitates exit scams.

The platform mirrors Ponzi schemes like ETH-MAX or CryptoDreams, which collapsed after months.

Social Media and Promoters

Promoters include:

- Twitter: @CryptoGains2025 (new, Arbmany-focused).

- Telegram: ARBMANY_Official (5,000+ members, likely bots).

- YouTube: ARB Investment Strategies (recent, four videos).

These accounts previously pushed dubious platforms like ETH-MAX and ARB-Future, suggesting a pattern of rebranding scams.

Arbmany Pros and Cons

Pros | Cons |

Easy-to-use interface | Anonymous ownership |

Low minimum deposit ($50) | Unsustainable returns |

Weekly withdrawals | No regulatory compliance |

No audited smart contract |

Arbmany Competitors in 2025

- Coinbase: Regulated, 5-15% staking APY.

- Aave: Audited DeFi, 5-10% yields.

- REITs: 8-12% returns, SEC-regulated.

These offer transparency and lower risk.

Arbmany Review Conclusion

This Arbmany review reveals a platform with alarming risks. Its anonymous ownership, unsustainable 219-788% annual returns, and Ponzi-like referral structure scream caution. Compared to regulated options like Coinbase (5-15% APY) or REITs (8-12%), it’s a gamble. Investors should prioritize transparency and stick to verified platforms. Always consult professionals and research thoroughly before investing. For more insights, also check our MyTrader Review for comparison.

DYOR Disclaimer: This review is for educational purposes, not financial advice. Conduct your own research and consult licensed advisors. Cryptocurrency investments carry high risks, and you could lose your entire capital.

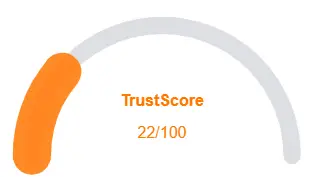

Arbmany Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 Arbmany currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with Arbmany similar platforms.

Positive Highlights

- Website content accessible

- No spelling or grammar errors

- Whois data available

Negative Highlights

- Low AI review rate

- New domain

- New archive

Frequently Asked Questions About Arbmany Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

Arbmany is a cryptocurrency platform claiming to offer automated trading for high returns. Users invest and the platform executes trades on their behalf.

While it promises high profits, transparency issues and ownership concerns suggest caution. Investors should carefully evaluate risks.

Promised returns are not guaranteed and may be unrealistic compared to safer investment options.

Ownership details are unclear, making verification difficult and increasing risk for investors

Beginners should conduct their own research (DYOR) and avoid investing funds they cannot afford to lose.

Other Infromation:

Website: arbmany.com

Reviews:

There are no reviews yet. Be the first one to write one.