ALR Miner Review: Is This Cloud Mining Platform Worth Your Investment?

In this ALR Miner review, Scams Radar looks at key facts about the platform. It claims to offer easy cryptocurrency mining with high daily returns. But questions about legitimacy arise from ownership details and ROI promises. We cover compensation plans, owners’ backgrounds, risks, and more to help you decide.

Table of Contents

Part 1: Understanding ALR Miner Cloud Mining Basics

ALR Miner positions itself as a top service for cloud mining. Users can start without buying hardware. It supports assets like Bitcoin, Ethereum, Dogecoin, and XRP. The site touts green energy and AI tools for better efficiency. How to start cloud mining on ALR Miner? Sign up for a $12 bonus, pick a plan, and watch earnings grow daily.

The platform says it uses advanced tech for stable income. ALR Miner mining hardware and technology overview shows a focus on sustainable operations. But no clear proof of real farms or power deals exists. This raises doubts in our ALR Miner review.

1.1 Ownership and Corporate Transparency

Who owns ALR Miner? Press materials link it to ALR Financial Services Limited, a UK firm. Records show this as a small outfit with one person, posting losses of about £40,000 yearly. No ties to big mining ops appear. The address given is Singleton Court Business Park, Wonastow Road, Monmouth, UK. Yet, UK Companies House has no “ALR Miner” entry there.

Domain data for ALRminer.com points to a February 2025 registration. Ownership hides behind privacy services. This young setup with hidden details fits scam patterns. Owners’ profiles and backgrounds remain unclear. No named directors or verifiable histories show up. Legit firms share this info openly.

ALR Miner’s sustainability initiatives claim green energy use. But without audits or site details, it’s hard to trust. How transparent is ALR Miner about mining processes? Not much, based on public data.

Part 2: ALR Miner Compensation Plan Details

The ALR Miner investment plans draw attention with fixed terms and high yields. Here’s a breakdown:

- 5-day BTC plan: Invest for a 6.15% total return, about 1.23% daily.

- 15-day DOGE plan: 20.7% total, roughly 1.38% daily.

- 30-day XRP plan: 55.6% total, around 1.85% daily.

Other tiers include $100 for $6.60 net or $5,100 for $2,295 estimated income. ALR Miner minimum deposit and contract details start low, with no fees claimed.

ALR Miner referral program adds appeal. Earn 3-5% commissions on invites, plus partner levels. ALR Miner referral program benefits and commissions encourage growth. Daily earnings and payout schedule promise steady payouts.

ALR Miner mining contracts vary by crypto and length. ALR Miner multi-currency support covers USDT, BTC, ETH, USDC, and more for settlements. Withdrawal limits and method options on ALR Miner seem flexible, but user reports differ.

Plan Type | Duration | Total Return | Daily Rate | Supported Crypto |

Short-term BTC | 5 days | 6.15% | 1.23% | Bitcoin |

Mid-term DOGE | 15 days | 20.7% | 1.38% | Dogecoin |

Longer XRP | 30 days | 55.6% | 1.85% | XRP |

Tiered Investments | Varies | Up to $2,295 net | Varies | Multiple |

ALR Miner fees and commissions explained: Zero for basics, but referrals boost earnings. Mining contract duration on ALR Miner ranges from days to months.

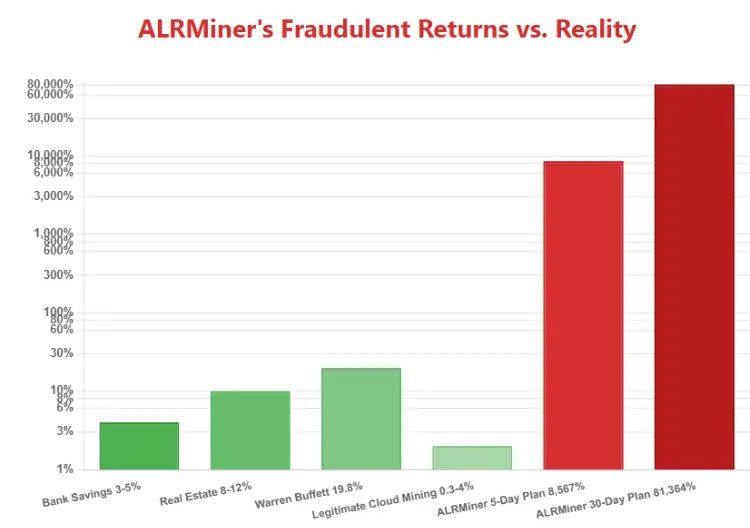

2.1 Why ALR Miner Daily Returns Raise Concerns

ALR Miner daily returns sound great, but the math shows issues. Using compound interest: A = P(1 + r/n)^(nt). For daily compounding, n=365.

Take the 5-day plan at 1.23% daily:

- Annualized: (1 + 0.0123)^365 – 1 ≈ 8,567% APR.

Steps:

- Daily factor: 1.0123.

- Yearly: 1.0123^365 ≈ 86.68.

- APR: 8,567%.

For 30 days at 1.85%:

- (1 + 0.0185)^365 – 1 ≈ 81,364% APR.

Real Bitcoin mining nets 5-15% yearly after costs like power and fees. These claims exceed that hugely, suggesting new funds pay old ones – a Ponzi scheme.

Comparison of ALR Miner with other cloud mining platforms: Legit ones offer 0.3-4% yearly, not thousands. Risks of investing in ALR Miner mining contracts include loss if unsustainable.

Investment Type | Typical Annual Yield | Risk Level |

Bank Savings | 4-5% | Low |

Real Estate | 8-12% | Medium |

Crypto Staking | 3-6% | Medium-High |

ALR Miner Claims | 8,000-80,000% | Extremely High |

Part 3: ALR Miner Security Features and User Experience

ALR Miner’s security and data protection measures include SSL encryption. But the site needs JavaScript to show plans, hiding info from scans. No 2FA or audits mentioned.

The ALR Miner user dashboard offers mining stats. ALR Miner mining statistics dashboard features track earnings. ALR Miner mobile app and platform usability: It pushes APK downloads, not store apps. A past Play Store version tied to a game developer, now gone.

User reviews and testimonials about ALR Miner mix bad and good. Trustpilot scores 3.1/5, with withdrawal blocks common. ALR Miner withdrawal process: Users report freezes and extra deposit demands. Troubleshooting common issues on the ALR Miner platform often points to support delays.

ALR Miner customer support claims 24/7 email help. But reviews say it’s slow or unhelpful. ALR Miner’s AI mining engine and efficiency features sound advanced, yet unproven.

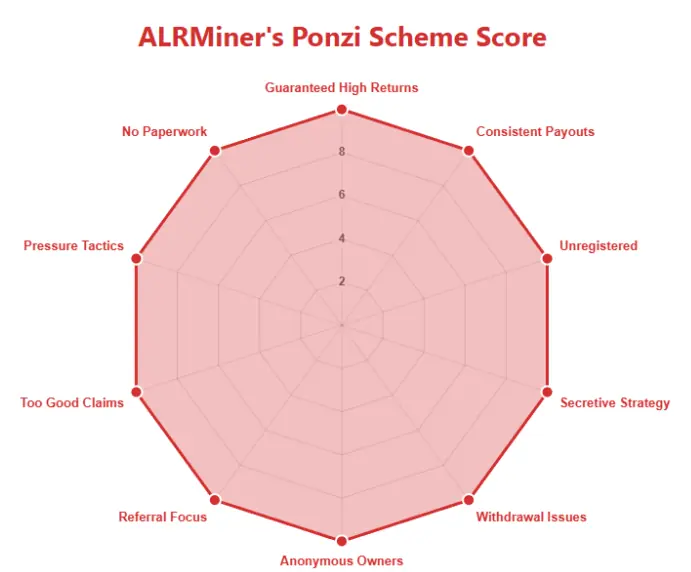

Red Flags and Public Perception

Key concerns:

- Hidden owners, no clear backgrounds.

- Unreal ROIs without mining proof.

- Withdrawal complaints.

- PR-driven hype, not real news.

- Young domain, sideload app risks.

Future Outlook and Recommendations

With tighter crypto rules in 2025-2026, unproven platforms may struggle. If inflows drop, payouts could stop.

Avoid deposits until transparency improves: Show registration, audits, and on-chain proof. Opt for regulated staking or exchanges.

Conclusion

This ALR Miner review shows that big risks outweigh the rewards. Do thorough checks before any move. Crypto carries losses; consult experts. Always verify claims yourself.

ALR Miner Review Trust Score

A website’s trust score is an important indicator of its reliability. ALR Miner currently reflects a worryingly low rating, raising serious concerns about its legitimacy. Users are strongly urged to exercise caution.

Key red flags include low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and weak SSL encryption.

With such a poor trust score, the likelihood of fraud, data breaches, or other security issues is much higher. It is crucial to carefully assess these warning signs before engaging with the ALR Miner or similar platforms.

Positive Highlights

- We found a valid SSL certificate

- The site has been set-up several years ago

- DNSFilter labels this site as safe

Negative Highlights

- The identity of the owner of the website is hidden on WHOIS

- he identity of the owner of the website is hidden on WHOIS

- The Tranco rank (how much traffic) is rather low

- Cryptocurrency services detected, these can be high risk

Frequently Asked Questions About ALR Miner Review

This section answers key questions about the ALR Miner, providing clarity, addressing concerns, and highlighting issues related to the platform’s legitimacy.

ALR Miner presents itself as a cloud mining service, but its high ROI promises and hidden ownership raise major red flags, suggesting it may not be fully legitimate.

ALR Miner offers fixed-term plans with daily returns from 1% to 1.8%, but these unrealistic yields far exceed normal crypto or real-world investments.

Compared to platforms like Everstead Review, ALR Miner provides higher but riskier returns, with little transparency or verified proof of real mining operations.

Many reviews report withdrawal delays and additional deposit demands, making it difficult for users to access their funds smoothly.

Key risks include unverified ownership, unsustainable ROI, lack of audits, and potential Ponzi-style operations. Always do thorough research before investing.

Other Infromation:

Reviews:

There are no reviews yet. Be the first one to write one.