AkashX Review: Is This Trading Platform Legit or a Risky MLM?

AkashX (akashx.com) promotes itself as a trading education platform, offering features like Tap to Trade, live sessions, and funded challenges for Forex and crypto markets. This AkashX review on Scams Radar examines its legitimacy, ownership, compensation plan, and risks as of September 2025.

While AkashX promises learning and trading opportunities, our analysis using Trustpilot data, regulatory warnings, and mathematical calculations uncovers potential red flags. By comparing it with safer investment alternatives, we provide clear, actionable insights for beginners and experienced traders. Always perform your own research (DYOR) before investing.

Table of Contents

What Is AkashX Trading Platform?

AkashX positions itself as an educational platform for Forex, crypto, indices, and commodities trading. It offers trade alerts, a trading academy, and prop-style funded challenges. Its “Tap to Trade” feature promises easy trade copying. However, AkashX explicitly states it is not a broker, does not hold funds, and offers no licensed investment advice. Instead, it operates under MyDailyChoice (MDC), a multi-level marketing (MLM) company, raising concerns about its business model.

Ownership and Background

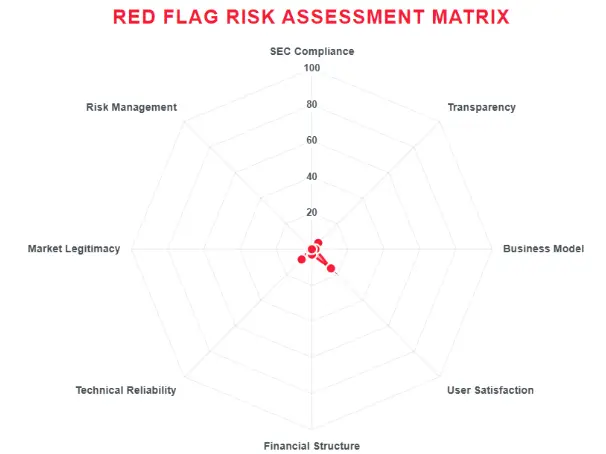

AkashX is run by Akashxchange, LLC, likely based in the U.S. (Texas, per WHOIS data). The domain, registered in 2019, uses privacy protection via Namecheap, hiding ownership details. MDC, founded by Josh and Jenna Zwagil, is the parent company, known for MLM products like supplements and CBD. No leadership bios or regulatory registrations (e.g., SEC, FINRA) are disclosed. Regulatory warnings from New Zealand’s FMA (May 2025) and Malta’s MFSA flag AkashX as unregistered, with false compliance claims.

Key Ownership Red Flags

- No transparent leadership profiles.

- Unregistered with major financial regulators.

- MLM affiliation with MyDailyChoice

AkashX MLM Commission Structure Explained

AkashX operates a subscription model with an initial $299 fee and $149 monthly dues. Users access 135 courses, trade alerts, and a 10k challenge account for simulated trading toward funded accounts (up to 200k). The real income comes from an MLM structure:

- Recruitment Bonuses: Refer three people to waive your monthly fee. Affiliates earn up to 50% commissions on referrals’ fees.

- Binary Structure: Build two “legs” of recruits for residual income. Higher ranks (e.g., Diamond, Super) unlock bigger payouts.

- Funded Challenges: Pass challenges for 80/20 profit splits, but users report failures due to poor signals, requiring repeat purchases.

Rank Tier | Avg. Annual Earnings | % of Affiliates |

Builder | $78 | ~85% |

Director | $95 | ~7% |

Executive | $396 | ~4% |

1K-10K | $5,977-$33,426 | ~3% |

25K-500K | $71,209-$902,876 | ~1% |

Super | $2,362,678 | <0.1% |

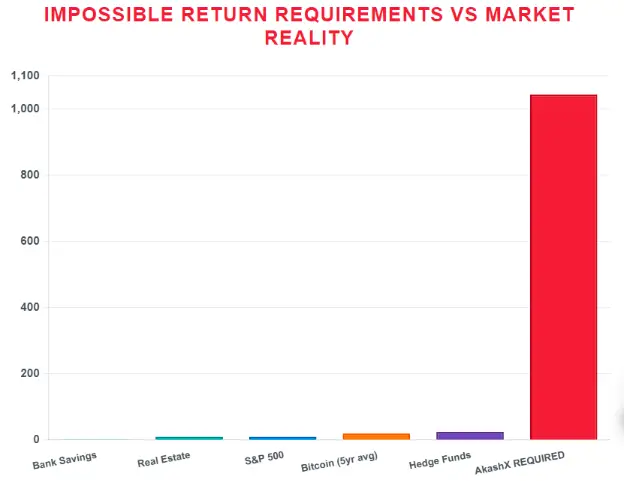

ROI Claims: Why They Don’t Add Up

AkashX implies high returns via funded accounts and trade alerts but avoids explicit promises. Promoters suggest 10% monthly ROI, but user reviews report 40-50% win rates, often leading to losses.

Mathematical Breakdown

Assume a $5,000 account, 5% position size ($250), 5 trades daily, and 0.5% spread ($1.25/trade):

- Daily costs: 10,000 users × 5 trades × $1.25 = $62,500.

- Annual costs: $62,500 × 250 days = $15.6M.

- Break-even requires 1,043.5% annual ROI ($2,087/$200).

Investment Type | Annual ROI | Risk Level | Regulation |

AkashX (Implied) | 50-100%+ | Extremely High | Unregulated |

Real Estate | 7-12% | Moderate | Regulated |

Bank Savings | 4-5% | Very Low | Regulated |

Crypto Staking | 5-15% | Variable | Varies |

S&P 500 | 7-10% | Moderate | Regulated |

AkashX Customer Reviews and Public Perception

Trustpilot rates AkashX 3.2/5 (157 reviews). Positive feedback (23%) praises the user-friendly interface and community. Negative reviews (42%) cite losses from poor signals, MLM pressure, and unprofessional educators like Joel Arias. Reddit (r/Forex, r/antiMLM) calls it a “pyramid scam.” Social media (TikTok, Instagram) shows flashy promotions but growing skepticism.

Positive Aspects | % | Negative Aspects | % |

Interface | 23 | Financial Losses | 42 |

Education | 19 | Poor Signals | 38 |

Community | 15 | MLM Pressure | 32 |

Security and Technical Performance

AkashX uses a basic SSL certificate (Let’s Encrypt) but lacks EV SSL or two-factor authentication. Scans (URLVoid: 0/39 detections; Gridinsoft: flagged for redirects) raise concerns. The site loads fast (<2 seconds) but “Tap to Trade” on MT4/MT5/TradeLocker has delays and glitches.

Payment Methods and Support

Payments include credit cards and bank transfers via BlueSnap/NMI. Users report hard-to-cancel subscriptions and withdrawal delays. Support is via Telegram or Zendesk, with inconsistent responses.

Red Flags

- Unregulated operations and regulatory warnings.

- MLM focus over trading success.

- High fees with unsustainable ROI claims.

- Poor signal accuracy and account losses.

- Opaque ownership and educator credentials.

Social Media Promotion

Promoters like @akashxofficial (Instagram, Facebook) and Telegram’s AkashX Trade Alerts (17k subscribers) push “free” challenges. Influencers (e.g., Francesca Gauci Bonnici) previously promoted Jifu.com and TradexMastery, showing MLM patterns.

Future Outlook

By 2026, AkashX may face SEC scrutiny or lawsuits due to unregistered securities and losses. Traffic (50k-100k monthly visitors, SimilarWeb) may decline as negative reviews grow. Legitimate platforms like eToro will likely outshine it.

Recommendations

Avoid AkashX due to its MLM structure and high risks. Choose regulated brokers (e.g., TD Ameritrade) or free education (Investopedia). Report issues to the SEC or local authorities.

AkashX Review Conclusion

This AkashX review is for information only, based on public data as of September 2025. Verify details with regulators, consult advisors, and never risk funds you can’t lose. Use tools like WHOIS, ScamAdviser, and Trustpilot for research. For more insights, also check our Enaria Review for comparison.

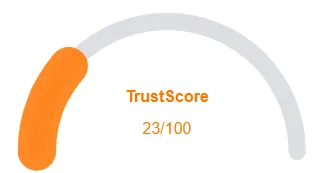

AkashX Review Trust Score

A website’s trust score is a critical indicator of its reliability, and0 AkashX currently holds an alarmingly low rating—raising serious concerns about its legitimacy. Users are strongly advised to proceed with caution.

The platform displays several warning signs, such as low web traffic, negative user feedback, potential phishing risks, undisclosed ownership, unclear hosting details, and inadequate SSL protection.

Given its low trust score, the risk of fraud, data breaches, or other security issues is much higher. It is essential to carefully consider these red flags before engaging with AkashX similar platforms.

Positive Highlights

- Website content accessible

- High AI review rate

- No spelling or grammar errors

- Old domain age

Negative Highlights

- Archive is new

- Whois data hidden

- Domain not in Tranco top 1M

Frequently Asked Questions About AkashX Review

This section answers key questions about , providing clarity, promoting trust, and addressing concerns regarding the platform’s legitimacy.

AkashX is a trading education platform providing tools like Tap to Trade, live sessions, and funded challenges for Forex and crypto trading.

While it offers trading tools, regulatory warnings and transparency issues raise concerns. Users should proceed cautiously.

Promised returns and funded challenge outcomes are not guaranteed and may be exaggerated compared to safer investment options.

Ownership details are not fully transparent, making it difficult to verify legitimacy and accountability.

Beginners should carefully evaluate risks and always conduct their own research (DYOR) before investing in trading or funded challenges.

Other Infromation:

Website: akashx.com

Reviews:

There are no reviews yet. Be the first one to write one.